14 Jun 2018

Updated on December 28th, 2022

How To Choose A Perfect Payment Gateway For Your E-Commerce Mobile App

Ankit Singh

The biggest fear I had when I initiated my e-commerce app, whether users would come to buy from this app portal, then Techugo- a leading mobile app development company in USA helped me sail through this difficulty and I was more than happy.

This was one of the reviews which we received at one of the listing websites from one of our prestigious clients, and indeed it was the moment of happiness and joy for us, but deep down within we knew that what all it took to make a successful e-commerce app platform for our client.

I know it doesn’t sound so different for any of the developers out there, but for a client it must, since there is a common myth amongst the clients that an e-commerce mobile app is not many efforts requiring…(Sorry if I hit the wrong chord there J), but this is the fact every client feels about the development of the e-commerce mobile app.

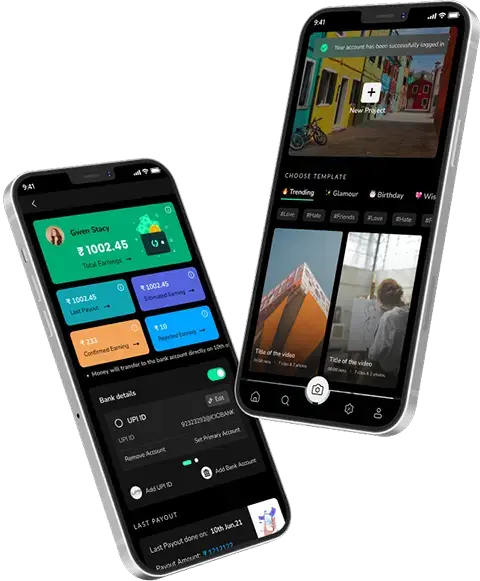

But you would be surprised to know that an e-commerce mobile app requires the number of efforts and the challenges has to be maintained within the e-commerce mobile app platform, and biggest of all is the selection of the right payment gateway for your mobile app.

Don’t get shocked, the selection of the right payment gateway for your mobile app, holds the maximum worth, and it cannot be avoided at any given cost.

With this blog today I am going to give you the ways through which you can pick the right and the best payment gateway for your e-commerce mobile app.

So just to give you a full-fledged view of the payment gateway integration from the scratch I am here to help you in identifying every bit involved with the payment gateway integration so a seamless experience for your users can be crafted…

So let’s begin the journey…

Calling the selection of payment gateway, is no less than selecting your partner (accept my intentional pun hereJ), but the biggest question which bangs on our door is that why do we need to choose the right payment provider for the mobile app…and the answer is simple, a right choice will withdraw the interest from the right resources, which would influence your revenues, conversions and user satisfaction.

And last but not the least it changes the life of your business for something better and much productive.

As I promised that I will start from the scratch, then I would start from the very basic concept and that is

WHAT IS A PAYMENT GATEWAY?

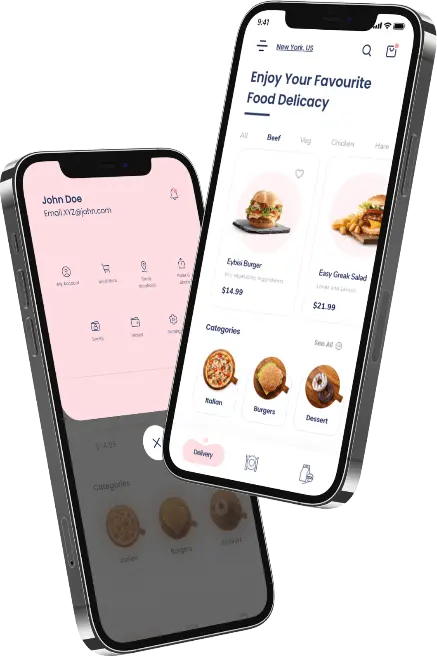

If I have to explain in a laymen’s vernacular, then payment gateway is nothing but a substitute for the card swiping device, wherein the process of accepting payments through the online mode is done with the payment gateway.

It allows the different businesses to accept the payments from the customers through the mode of Net Banking, Credit / Debit Cards, and online Wallets.

Now since the very concept of payment gateway integration is clear, now you must be thinking that there are plenty of fishes in the sea and you can pick any.

I know it sounds alluring enough to have a good number of payment processing companies in the market, but actually, this is what makes the competition tougher.

And you actually get the tension raised that which portal to pick.

Don’t worry, considering the situation, we have brought the solution with this post…so you can consider a few of the aspects before picking a right payment provider for your mobile app development agency.

Check The Flexibility

Flexibility which might sound to you an irrelevant part of the payment gateway integration is actually a very much relevant part.

You need to understand the flexibility of your payment gateway from the perspective of whether…

- Your payment gateway adapt to specific needs of your business?

- Would it adapt to the programming language?

- Would it respond well to the global currencies?

Apart from these, you need to ensure that this payment platform would help you create the business model and the payment scenario as per your business demands.

- Compliance Should Be Considered

In the payment gateway compliance usually takes time to integrate, thus you must ask your provider about the estimated time it would take to obtain your new merchant account and when it shall start processing transactions.

- What Will Be The Processing Options

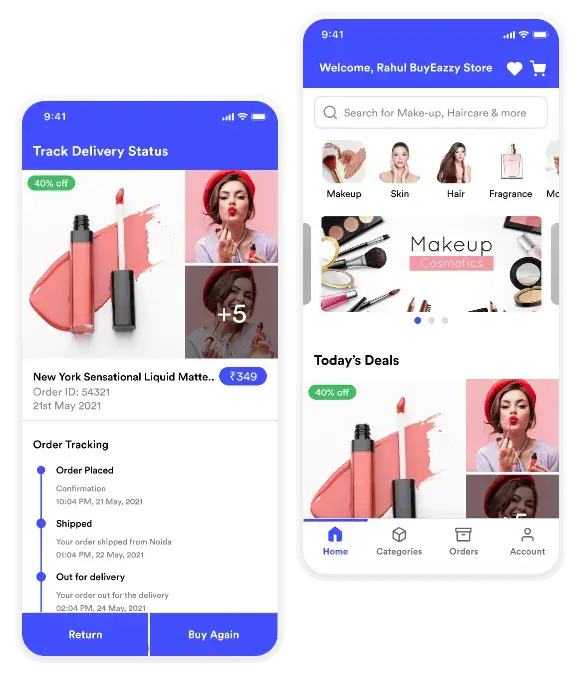

The look of your payment gateway either attracts or distracts the users to handle it further.

The form your provider gives you, help your buyers to place the trust on you.

If your provider offers you an embedded custom form to keep your users always on your app platform, this will surely result in higher conversions, since it turns out to be more safe and trustworthy.

The checkout option must be easier and simplified if your payment gateway offers the multi-language checkout, one clicks upsells, or “Remember me” kind of functions then it would certainly help your business to receive the maximum business boost.

- Don’t Miss The Fees Factor

Do you know what is most frustrating, when there is enough space for surprises to pop up your money is involved?

Don’t get fooled by the marketing propaganda of the payment providers, which might sound less, but you would certainly end up paying more than your budget with the hidden cost factor.

So you must keep the pricing policy as transparent as possible. Don’t hesitate to ask your doubts from your payment provider and ask them to give full-stack up of the fee structure…

You must be aware of

- set up fee

- monthly fee

- registration fee

- processing fee

- transaction fee (successful and declined)

- refund fee

- chargeback fee

- reserve

- any other fee based on different conditions

- Understand The Payment Process

Yes, this is what you must not forget to ask your payment provider, and you must make sure that get paid fast. The flow of cash is highly significant in the payment process of your mobile app’s payment gateway.

If you are getting paid with long intervals, then this is not the payment provider for you.

Check the entire payout schedule and make sure that it compliments with payment requirements related to paying to your suppliers.

- Security Is The Need of The Hour

Don’t miss out largely on the data encryption, VeriSign SSL certificates and CVV2 verification and any other additional encryption algorithms to be a part of the protected security of users’ data.

In this way, you create a safety path not just for your merchant account also for the safety of your clients and their financial information.

Your payment gateway must support the fraud protection and your payment provider must offer the anti-fraud system and active chargeback management system.

- Customer Support

If your payment gateway provider lacks in offering the 24/7 support, then it is nothing but an expensive and futile gateway for your mobile app.

Facing the technical hiccups during the payment process is nothing exceptional, you shall be receiving it, but expecting the response to come for your raised query is indeed a bugging process you don’t want to face at any given cost.

An efficient payment gateway always assigns an account manager for your account, who offers the help through any possible means at the earliest possible, and you don’t need to sit and get baked on the problem for the next 24 to 48 hours.

Your aim with these few questions should be to look for a payment gateway partner, not just the payment gateway provider, and this would help your dream of a successful mobile app to come into reality.

Get in touch.

Write Us

sales@techugo.comOr fill this form

SA

SA  KW

KW  IE

IE AU

AU UAE

UAE UK

UK USA

USA  CA

CA DE

DE  QA

QA ZA

ZA  BH

BH NL

NL  MU

MU FR

FR