10 Sep 2020

Updated on December 28th, 2022

Cost And Features Required To Make An Incredible P2P Payment App

Ankit Singh

Mobile payment is no more a fantasy that people crave for, but it is a beautiful reality, letting people across the globe to choose it for various reasons.

It is the popular option for users to stay card-free, encourage a cashless economy, relish buy-in-one-click technology, and most importantly it supports #socialdistancing amid COVID fear.

The Peer-to-Peer payment apps are here to give a boost and optimize mobile payment for different means.

Are you willing to get a P2P app for your business?

Then you must read this post reflecting core features and cost to build a successful P2P payment app.

What is a P2P payment app?

P2P stands for Peer to Peer or Person to Person. And as the name suggest this type of app helps users to transfer funds from their bank account to the bank account of another person.

Global mobile wallet market value set to reach $1 trillion in 2020

Image and data courtesy- payment cards and mobile

The constant evolution in the app technology has even led different apps to pay rent installments, cab services, utility bills, and bill splitting, and much more, from P2P apps.

How does the P2P payment app work?

Well, no rocket science runs behind this system, and it is the SIMPLEST process possible. Every user needs to follow a few simple steps to set up P2P payment accounts.

- Sign up for an account;

- Link bank account or card to the service account;

- Add personal information, security question, and passwords;

- To send or receive money, choose a recipient, the amount of money, add the purpose of payment or any special message (an optional feature)

- App confirms the transfer process;

- Click on the send button and receive notification through SMS, app notification when funds are deducted from your account.

That’s it!

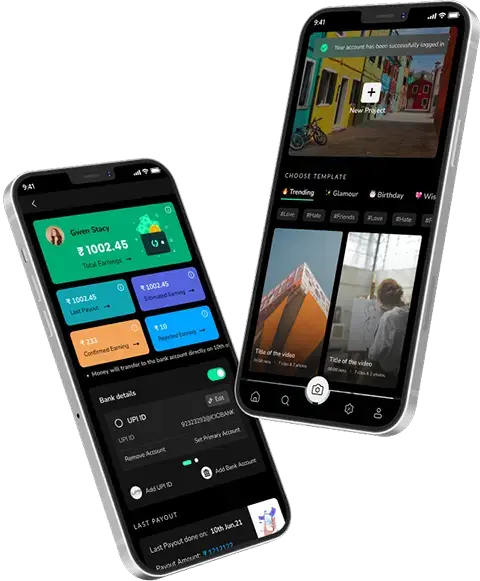

Must-Have features for your P2P payment app

A P2P payment app features!

Yeah, you cannot think of skipping this section at any given cost, to create a reliable P2P payment app. Let’s find out the features that help your app to stand long-lasting in the market.

Sign in/Sign up

though it is a very simple and much-required step for any app, but in this type of app, you need to keep it as simple as possible, where users can log in through a security pin or other verification methods.

Adding a card or bank account

Your P2P app must allow users to send a payment using a card or bank account. Here users need to verify their information to tackle the security process.

Real-time notification

Most payment apps have the push messages, but with P2P you need to provide real-time information to the users, so they won’t be hassled by the wrong information. Your app needs to provides information about every activity on the app. Also, give users a free-will to receive or decline this service, and helps them to get the information as per their convenience.

Face ID and Touch ID security

App security is the major concern in this type of app, as it deals with the money, and other vital credentials and bank details. Here, integrating the biometric app protection, that involves the use of fingerprint and facial recognition, is a significant feature to be included, and helps in reducing the global transaction fraud.

Transaction History

Transaction history helps your users to get an instant summary of their spending and helps them cross-check any aspect that could lead to some misuse.

Unique ID or OTP

A unique ID or OTP is required for users to verify a transaction before a deduction is made. This helps users to increase the security on the P2P payment app and its offered features.

Bank Transfer

You must ensure that your P2P payment app is flexible enough to allow the transfer of money to a bank account from the app.

Buy & Sell Cryptocurrency

Cryptocurrency is leading the world of financial transactions, and letting your P2P app not to use it would be a futile decision. You must let your users to efficiently and seamlessly buy and sell cryptocurrency from the app, however the security compliance, your app must adhere to.

What would be the cost of developing a P2P app?

This is the question that creates many fears and doubts in the mind, and you are left scratching your head to get one perfect answer.

So the answer is there is NO perfect answer fr this question.

Feeling bad?

Well, you must be, but our job is to give you the real picture and not set your expectations high with wrong stats and information. App development companies claiming to give the sure-shot figure for this, are just completing their sales target.

Because the fact is not a single app development company in the world, can give you that exact numerical figure without knowing and assessing your app concept.

A mobile app cost is a result of multiple factors; features, type of technology, Oss, functionalities, location of developer among many other facts. Developing a P2P app can be an expensive journey, as it requires a lot of skill and experience of high-end technologies. Hence to give you a rough estimation, the cost for a P2P payment app can be from $20,000 to $100,000 or even beyond depending on the features to be included in the app.

To get one specific numerical figure for your concept you need to share your app concept with a team of experienced technocrats to assess and provide you cost for your project.

The bottom line

All of the above seems rather complicated… you’re unlikely to know where to start, right?

No reason to worry, because we’re here to help you.

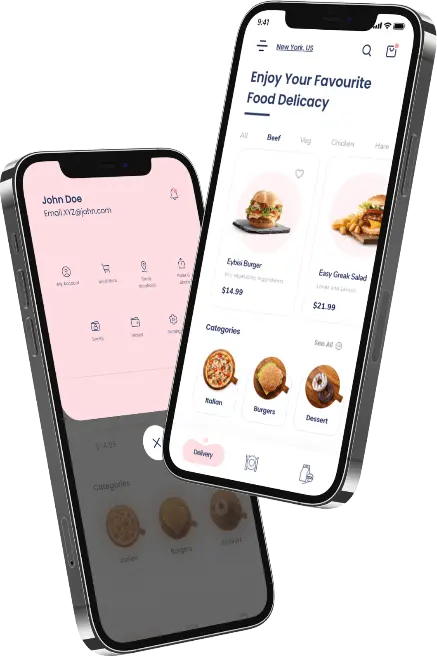

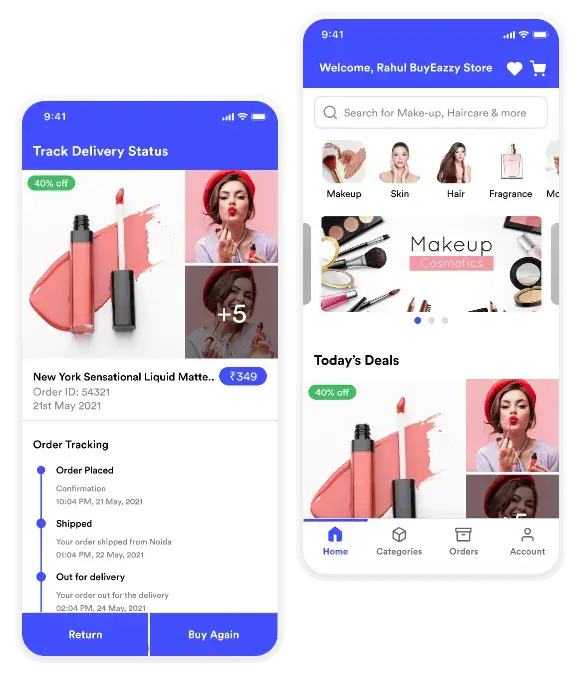

Techugo is your trusted partner in FinTech app development

Techugo is a hub of technology and innovation, and our creative team has addressed the FinTech development as well. We can ensure to build a custom P2P money transfer app meeting all your requirements, as our development team is skilled, to bring your concept into reality. If you have got any questions related to P2P development, get in touch with us NOW!

Get in touch.

Write Us

sales@techugo.comOr fill this form

SA

SA  KW

KW  IE

IE AU

AU UAE

UAE UK

UK USA

USA  CA

CA DE

DE  QA

QA ZA

ZA  BH

BH NL

NL  MU

MU FR

FR