Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

The FinTech industry is on the rise, driven by digital transformation that goes far beyond simple improvements to existing offerings. It’s about changing how we manage finances for the digital age, using modern technologies like blockchain, which enables payments without needing an intermediary, and artificial intelligence, which provides personalized investment recommendations.

The market for digital transformation is expected to grow to $3.3 trillion by 2025, with a compound annual growth rate (CAGR) of 23%. With such a vast market, the FinTech sector is emerging as a key player set to transform the traditional financial industry and change how consumers manage their money, invest, and trade.

As rapidly evolving technology reshapes the world of finance, FinTech is revolutionizing accessibility, delivery, and mobile banking by redefining the boundaries of physical bank access and creating new banking systems. FinTech is also leading a new generation of financial services that offer unmatched connectivity, accessibility, and adaptability.

The FinTech industry embraces modern technologies that streamline processes, improve customer experience, and foster innovation. Positioned at the forefront of this transformational journey, it is driving unprecedented growth and changing the global finance industry.

In this blog, we’ll explore the impact of digital transformation within the FinTech industry and what it means for technological innovation in the financial sector.

FinTech, short for financial technology, refers to the application of software and innovations designed to revolutionize traditional processes in the financial sector. It’s a relatively simple concept: FinTech offers more efficient, flexible, and personalized services for consumers compared to the existing systems. This requires a wide array of options.

FinTech innovations have been driving the digital transformation of the finance industry. For example, some businesses aim to replace traditional payment methods with digital wallets, cryptocurrency, or even short-term loans. Crowdfunding platforms allow consumers to obtain credit without going through banks. Robo-advisors and other trading apps offer personalized recommendations and portfolio management. The key point is that if something can be improved, there’s likely an app to help.

FinTech’s emphasis on digital-first thinking could eliminate the traditional banking and finance model, driving these institutions’ modernization. Banks worldwide are now seeking FinTech partners rather than developing technologies in-house. This allows them to quickly lower operating costs while adopting digital technology to stay competitive.

Cloud computing, AI, and big data analytics have led to significant advances in the banking sector. The technology allows financial institutions to make data-driven decisions and automate processes to offer personalized service to customers. Efficiency gains and cost reductions that come with digital

Transformation has transformed the fintech industry’s competitive landscape. Outsourcing software development, specifically FinTech software, has become essential in the digital age. By collaborating with FinTech experts and service providers, companies in the FinTech industry can access a wealth of knowledge to speed up innovations, grow their businesses effectively, and master the challenges of new technology.

Digital transformation integrates technology to transform how companies conduct business, offer services, operate, and engage with clients. For the fintech industry, digital transformation is about increasing efficiency and enabling new possibilities for innovation and growth. Below are a few of the key advantages of digital transformation in fintech.

One significant advantage of digital transformation is enhancing operational efficiency. By replacing manual, time-consuming procedures with automated ones, Fintech firms can cut operating costs and speed up service delivery.

For instance, when it comes to lending online, technology allows the automated verification of data about the borrower, like identities and credit histories, as it would have to be manually handled by employees. This means that fintech firms can provide better and faster solutions to their customers, increasing their ability to compete well in the market.

The customer experience is crucial to the success of every business, not just fintech firms. Fintech firms’ digital transformation allows them to use data and analytics to understand their clients’ requirements and preferences.

For example, fintech firms can analyze transaction data to understand customer preferences and provide more personalized and appropriate products or services. Simple and user-friendly mobile applications can also enhance customers’ experiences using Fintech-related services. Fintech firms can establish lasting customer relationships and improve customer satisfaction by providing better customer service.

Digital transformation offers customers a broader range of banking services. Using mobile apps and digital platforms, FinTech companies enable their clients to access various financial services anytime, anywhere. This is vital in developing countries, where most people lack access to traditional branch banks.

Thanks to digital technology, FinTech offers more efficient and timely services like transactions, fund transfers, loans, and investments. This increased accessibility enhances customer convenience and creates opportunities for financial inclusion for previously underserved people.

Digital transformation allows fintech firms to innovate by developing superior financial products and services. Technologies like artificial intelligence (AI), big data, and blockchain provide significant opportunities for FinTech firms to create new and more sophisticated products and services.

Specifically, AI can be used to develop better algorithms for credit risk assessments and fraud detection in financial transactions. Additionally, blockchain technology can provide safer and more transparent solutions for recording transactions and managing data. By integrating these technologies, FinTech companies can offer their clients greater efficiency, innovation, and secure services.

Data can be a powerful asset for fintech businesses. Digital transformation, done with the help of a fintech app development company, allows FinTech businesses to gather and analyse data more effectively, which leads to better decision-making. By utilizing big data and analytics, FinTech companies can identify market trends, understand customer behavior, and forecast potential business risks and growth.

Analytics also help improve risk management, such as during loan approval and investment assessments, by providing more profound and reliable insights. With better data management, FinTech firms can make faster and more accurate decisions, boosting performance and increasing efficiency.

One of the issues facing many fintech businesses is handling rapidly growing numbers, especially when the number of customers or transactions increases quickly. Digital transformation, through scalable cloud computing and digital infrastructure, helps fintech companies handle this growth more effectively.

With cloud-based solutions, FinTech businesses can quickly expand their storage and computing capacity as needed without investing in costly infrastructure. This enables them to quickly adapt to shifts in market trends and expand their services into new regions or markets without facing significant barriers.

Digital transformation enables FinTech firms to collaborate more closely with other players in the tech ecosystem, including cloud-based service providers and payment platforms. This collaboration allows FinTech companies to benefit from the latest technologies and innovations, enhancing their offerings.

For example, partnering with blockchain technology providers can offer more reliable and secure solutions for cashless transactions, while collaborating with AI development company can help FinTech companies develop advanced analytics to assess customer needs and potential risks.

Secure data and transactions are paramount in fintech due to the vast amount of financial and personal information that must be protected. Digital transformation enables fintech firms to deploy more robust security options, such as end-to-end encryption, two-factor authentication (2FA), and biometric technologies, to protect customer data from cyberattacks.

Faced with increasing cyberattacks and cybercrime, financial institutions must continuously enhance their security solutions to safeguard their customers. By transforming their digital systems, fintech companies can integrate modern security tools to protect information and transactions, boost customer trust, and ensure compliance with applicable security regulations.

Technology is changing customer expectations and market dynamics. Banks must embrace technological innovation to stay competitive and remain relevant. The following are the reasons why digital transformation is crucial for banks:

Banks not embracing the new norm will see their customers move to more modern, technologically advanced banks ready to join the game. The digitalization of banking provides established banks with the seamless, omnichannel customer experience needed to meet customers’ evolving needs.

Customers no longer interact with businesses as they used to, and their behavior toward businesses has changed. There’s a growing demand for technology that enables access to financial accounts anytime, anywhere. Customers now expect customized, efficient solutions. The time and manner in which customers wish to access something must be honored; any additional stress is no longer acceptable.

Looking around, you’ll see many banks competing with emerging fintech businesses and tech companies looking to expand into the financial services sector. Banks must develop new offerings or differentiate existing ones to maintain market share and remain relevant. Digital transformation allows banks to digitize new products, improve existing ones, and create new value-added products to stay ahead of the competition.

The regulatory landscape is more challenging than ever before. Digital transformation helps ensure compliance with evolving regulations by automating compliance processes and improving access to data. Additionally, since security and privacy remain significant concerns, the banking industry needs improved digital systems to protect customer information. By embracing digital transformation, banks can mitigate the risk of losing sensitive information and reduce the threat of cyberattacks.

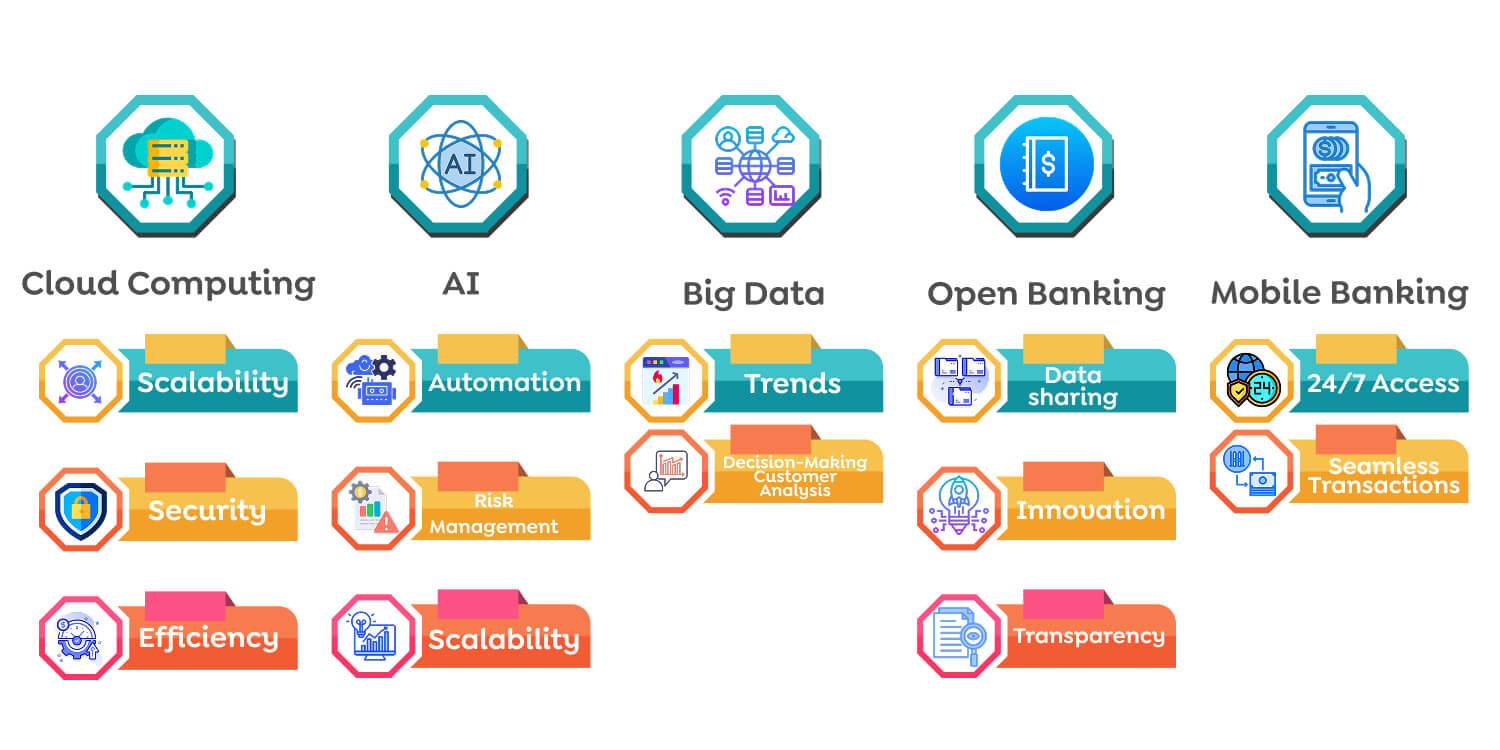

The key technology drivers of digital banking include various advancements that promote expansion and improve service to potential customers. These technologies are essential for modern banking to meet operational and transactional requirements.

Financial institutions are turning to cloud computing to improve processes and reduce costs. Cloud computing solutions offer scalability, agility, and enhanced security. They also enable smooth collaboration and more efficient procedures.

AI is revolutionizing the finance industry by automating manual tasks, improving risk management practices, and enhancing customer service. Machine Learning algorithms can analyze vast amounts of data to provide valuable insight, personalized recommendations, and fraud detection.

Analyzing and extracting actionable insights from large amounts of data has become essential in the fintech sector. Big data analytics enables financial institutions to understand customer behavior, forecast market trends, and improve decision-making processes.

“Open banking” means that banks can access customer data through their systems and other banks and third-party providers. This creates a collaborative network and fosters innovation. With APIs, data access is no longer an issue. Open banking gives customers complete control over their personal information through APIs, and the ability to access data-driven services enhances transparency, builds confidence, and offers additional benefits that banks can provide.

Banking apps for mobile devices offer users access at any time. These options cater to customer needs and fit into their busy lifestyles. Bank apps typically provide more user-friendly interfaces, improving customer interaction and overall user satisfaction.

Various services, including mobile payments, are available online, enabling clients to perform almost all transactions within a unified platform. These services are secure and comprehensive, with regular patches and software updates to ensure they remain current.

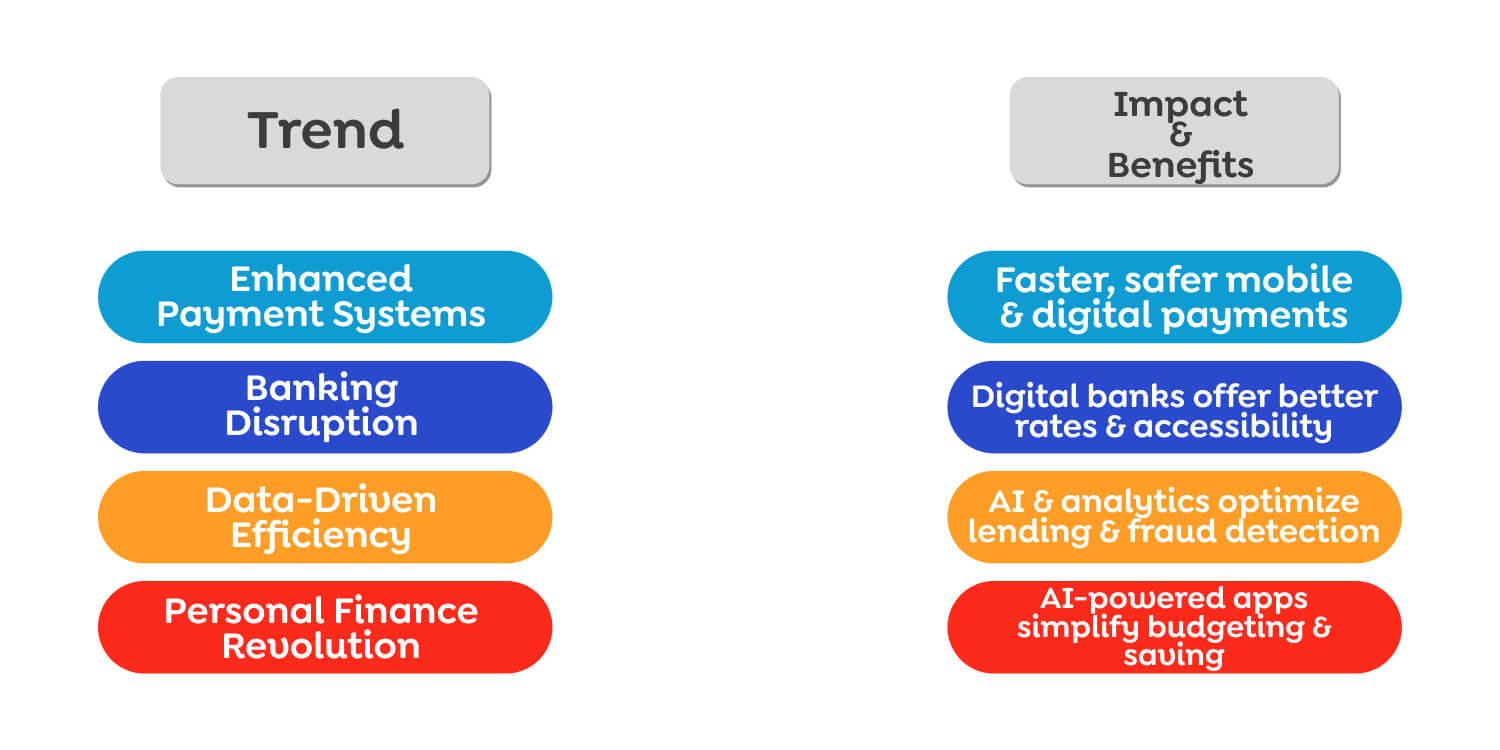

Digital transformation is changing how we use tools and redefining financial services to make them faster, more secure, more reliable, and more accessible to users.

The way we make payments is being upgraded. Mobile payments, digital wallets, and cryptocurrency make transactions faster, more straightforward, and safer. There’s no need to search for cash or wait to transfer money from a bank account. Payments can be as simple as pressing your phone. Today, 53% of Americans use digital wallets more frequently than traditional payment methods. The most popular mobile wallet options for payment include Google Pay (56%), Apple Pay (53%), and Samsung Pay (52%).

Digital banks disrupt the traditional banking system. The worldwide market for digital banks is expected to expand by 9.67% between now and 2028. Online banks can offer anything from a more favorable interest rate to lower charges without visiting branches.

Banks are now challenged to develop new ideas or be lost, which means higher quality services and increased consumer alternatives. The digital era is here, and FinTech is at the forefront of transforming financial services entirely from scratch, providing them with greater accessibility and personalisation and safety for all.

As lending platforms become digitally equipped with cutting-edge features like video-based, social personal identification, and security, financial advisors can quickly access customer information and obtain their consent, ensuring better performance.

Outsourcing Data Analytics services can help improve the understanding of customer portfolios, facilitating improved credit processing. Data could also be utilized to detect fraud, where customer behavior is documented and used to identify the possibility of fraudulent activity.

Financial management used to involve spreadsheets, guesswork, and stress. Nowadays, apps developed by a mobile app development company in the USA and AI have transformed personal finances into manageable tasks. The tools can analyze spending habits, provide suggestions on how to save money, and predict future expenditures, budgeting and saving an activity you can complete at night.

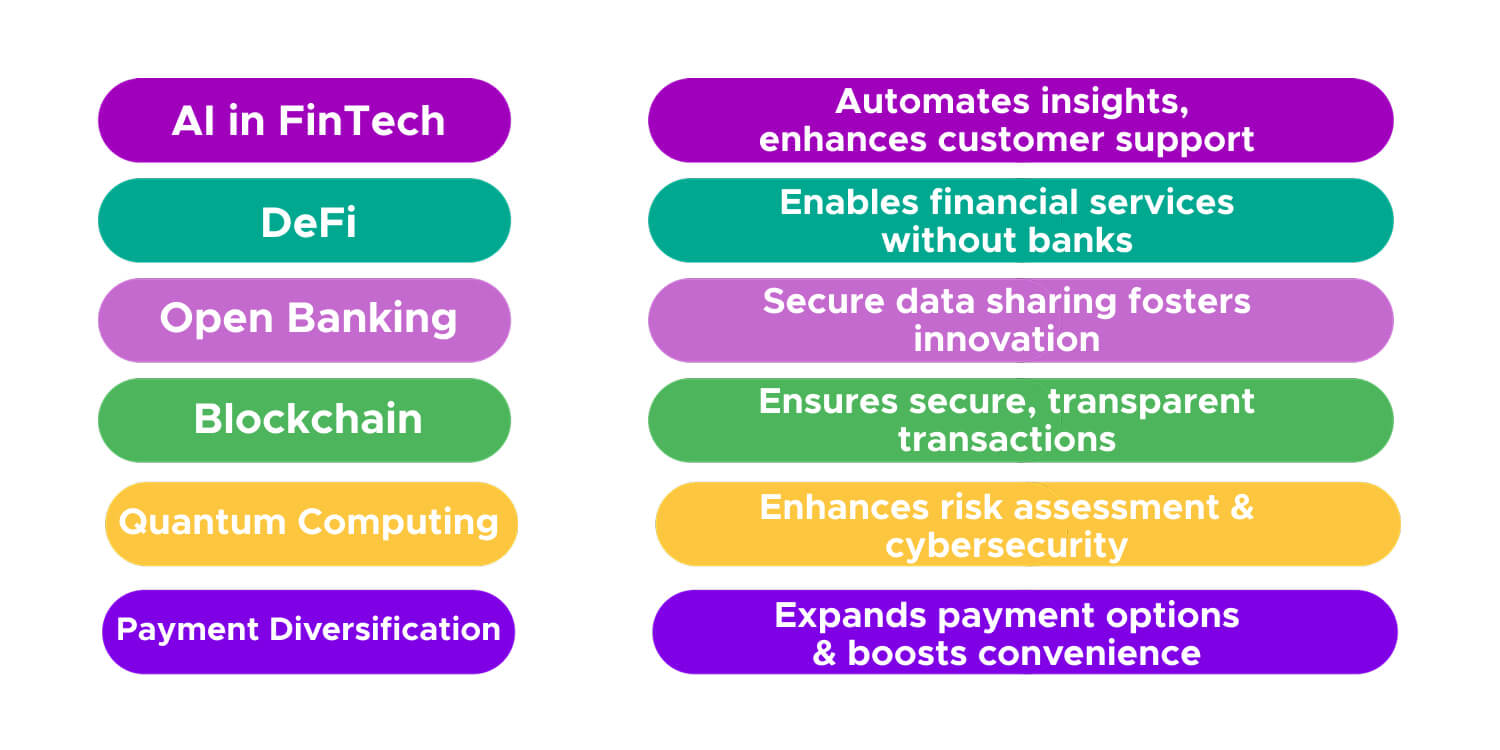

The fintech sector is constantly evolving, and to stay competitive, stakeholders must monitor trends and the latest patterns. Key areas like decentralized finance (DeFi), AI, blockchain technology, and open banking will likely soon influence fintech’s growth.

One major trend in fintech is the integration of AI into financial services. AI-powered software and algorithms can analyze vast amounts of information and provide valuable insights for decision-making. Virtual assistants and chatbots have become increasingly sophisticated, offering personalized help and improving customer experience by assisting with financial issues and customer support.

Decentralized finance, also known as DeFi, is a rapidly expanding trend that aims to transform traditional financial systems using blockchain technology. DeFi platforms allow people to access financial services without relying on banks or intermediaries. This decentralized and open approach can enhance access to financial services and provide greater financial accessibility for people across the globe.

The Open Banking initiative is a government program that encourages sharing financial information between third-party service providers and banks using secure application programming interfaces (APIs). Allowing access to customer data fosters innovation and promotes competition in the financial sector. Customers can seamlessly manage their finances across different platforms and receive customized services tailored to their needs.

Blockchain technology, the foundation of cryptocurrencies like Bitcoin, presents a significant opportunity for various applications in the digital financial sector. Due to its decentralized and immutable nature, it enables secure and transparent transactions, reducing the need for intermediaries and increasing efficiency. In addition to cryptocurrency, blockchain technology can be used for smart contracts, supply chain management, identity verification, and many other applications.

Although still in its infancy, quantum computing can perform complex financial calculations at unimaginable speeds. Researchers are studying quantum computing’s potential to improve solutions in the financial industry.

Quantum computing has the potential to dramatically enhance risk management, fraud detection, and trading strategies. It could provide FinTech firms with unimaginable processing power, and its ability to protect transactions and strengthen encryption could revolutionize cybersecurity standards in finance.

The increased use of technology and various forms of currency has led to rapid innovation in payment systems. The idea is that offering a broad range of payment options can influence and improve consumer buying behavior. Thanks to FinTech, consumers now have access to apps that accept not only traditional debit and credit cards but also crypto and blockchain solutions, digital wallets, peer-to-peer transfer methods, tokenized credit card transactions, and more.

Digital transformation is the main driver behind the changes in FinTech, altering how we handle, invest, and manage our money. It opens the door to unprecedented accessibility, personalization, and efficiency, making the financial sector more accessible.

Even at its growth stage, the fintech sector has enormous potential to change financial institutions’ operations. Many fintech companies have made their mark, putting the financial industry in a desperate race to stay ahead. This once-in-a-lifetime conflict between banks and fintech has evolved into a symbiotic partnership that allows both to grow and prosper in a world defined by unprecedented innovation.

The transformation of the digital world from traditional finance to modern Fintech-based solutions shows the power of technology within banking and financial services. One thing is sure: the banking sector’s future looks promising, and FinTech is shaping it and propelling it forward.

Stay ahead in the FinTech revolution. Partner with Techugo, a leading FinTech app development company, to build cutting-edge financial solutions.

Write Us

sales@techugo.comOr fill this form