17 Aug 2023

How to Create a Money Lending App: Funding the Future By Making Lending Easy!

Surbhi Bhatia

It was a clumsy activity to apply for a loan a decade ago; however, the digital age has led to transformation for good. Today’s customers have dynamic requirements and are looking for convenience from the comfort of their couch.

Now that most of our lives are impacted by technology and innovation, the financial market has been an attractive option for digital transformation. Thus, it led to a rise in money lending mobile apps.

This blog focuses on providing insights into how to create a money lending app for entrepreneurs and startup owners since it is the need of the hour!

Now that mobile app development has become easier with the help of experts, long gone are the days when applicants had to wait in long queues to apply for their loan applications.

So, if you want to learn how P2P apps have simplified everyone’s lives, let’s dive deep into the pool of information to explore the unexplored.

A Sneak Peek Into Money Lending App Market

We are all familiar with the rise in mobile banking patterns before the pandemic. However, the demand for remote financial services gradually increased. According to a survey, more than 40% of people between the age group of 18-34 years began using mobile banking during the lockdown period. What’s more? About 78% of US citizens prefer transacting via mobile apps, reflecting the digital banking industry boom.

Talking about the money lending market, the transactional value will likely surpass US $8.2 billion by the end of 2028.

How intrigued are you by applying for loans without even stepping out?

Also Read – Want to Create Your Own Money-Making App? Take These Drastic Measures

Introduction to Money Lending Apps

A loan lending app forms a bridge between the lenders and the customers to fulfill the requirement for business loans, personal loans, car loans, etc. It can work as a shared platform where two parties can hassle-free meet each other’s needs.

Additionally, these apps provide customers with 24/7 access to money-borrowing options without submitting a physical application. Not to forget, it is significant for both borrowers and lenders to be available on this app to agree on the same lending conditions and proceed with the procedure.

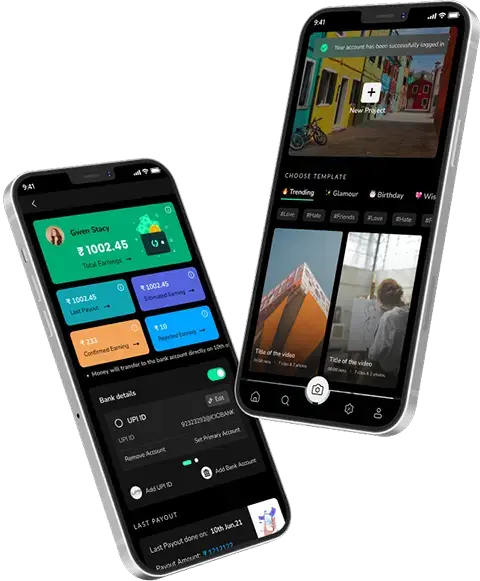

No wonder the fintech industry is excelling at its operations, and there’s no stopping anytime soon! How about working on your fintech or loan lending app development?

The Working Mechanism of Loan Lending Apps

Businesses closely working with the fintech industry are keen to develop loan lending apps. However, both borrowers and lenders must keep its working mechanism in mind. The instructions are as follows:

– Both parties must register on the app before using the software.

– Both parties must verify their profile by adding personal information and linking a bank account.

– Borrowers can check and opt for the best lending option by submitting a request and justifying the reason.

– Once the lender goes through the application, he can accept or decline the request.

– However, if both parties agree to the terms and conditions, the lender can transfer the funds.

For more assistance on the app idea, connect with the best fintech app development company and discuss any unique elements you would want to offer your customers.

The Motivation Behind Loan Lending App Development

Loan lending app development is equivalent to providing an opportunity for your customers to carry a bank in their pocket and transactions at their fingertips. Indeed, it has become much easier to borrow money and make deposits; however, it comes with a range of additional benefits. Take a look:

1. Loan Alternatives

The loans offered by lending apps may come in categories, including payday loans, personal loans, etc. Many people want to seek loans; however, the purpose might differ for every individual. Fortunately, loan lending apps fulfill these requirements by lending money as per one’s needs.

2. Accelerated Security

The mobile apps fabricated for money lending are integrated with utmost security and an encrypted network to keep the customer information secure. Additionally, the app prompts its users to set up a strong password for safer access.

3. Confidentiality

While many people tend to apply for home or car loans, others may need loans for covert purposes. Therefore, the best thing about loan lending apps is that they keep the secrecy of reasons, making them ideal for customers.

4. Boosted Logs

You must have seen the transaction records recorded in the entirety of a commercial bank. Similarly, transaction records are also kept by money lending applications that can be easily accessed. Notably, record management motivates customers to make their payments on time. Not only this but they are reminded via alerts and notifications for better response.

How to Create a Money Lending App?

Finally, it is time to answer one of the most asked questions by tech enthusiasts: “How to create a money lending app?”

Take a closer look at the following steps to obtain insights into how a loan lending app development is carried out.

1. Market Inspection

It always works if you inspect your competitors and weigh the pros and cons of their services. You may also download some of these apps to acquire a first-hand experience, or else you may also go through the reviews and feedback of an application. Don’t worry; the research won’t go down the drain! You’ll be preparing for the bigger picture before making a debut in the market.

2. Pick Out an App Type

Once the market research is concluded, make a list of the significant attributes to include in your mobile app. Not only this, but you must decide the type of money lending app that you want to build, such as:

– For personal loans

– For business loans

– For cash advances

You must also consider a number of features, including app development cost, team, and more, before picking out an app type for your business.

3. Partner with a Reliable Team

Once you have a plan, it’s time to rope in a top-notch mobile app development company like Techugo. Collaborate with the team and build strategic plans to enable your business to skyrocket.

What do you think?

4. Pick a Tech Stack

Now is the time to shift to the technical stage that requires deciding the incorporation of technologies and tech stack. Some of the general pointers to keep in mind include:

– Backend and frontend development

– App infrastructure

– Database infrastructure

Notably, it all comes down to having a professional development team to take care of each and every step during the loan lending app development journey!

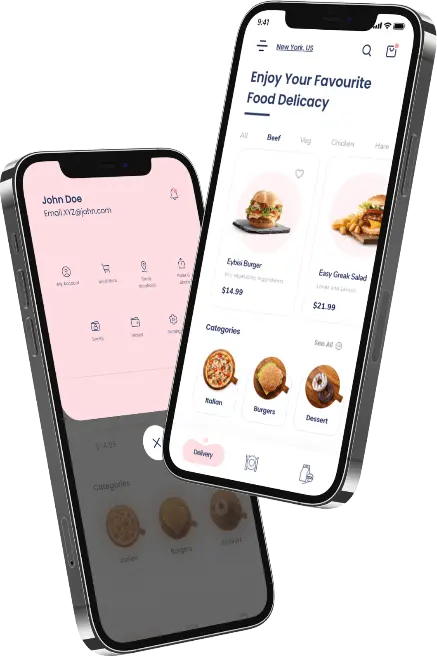

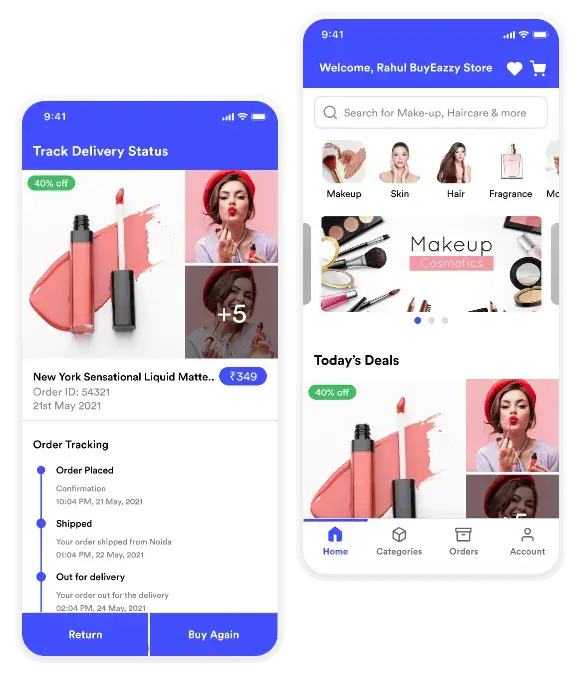

5. App Designing

A roughly designed mobile app can cost you your customers, which is why, it is one of the crucial stages of app development. You don’t want to be the buzzkill for your customers, right? So, prioritize the app design stage to intrigue a solid customer base.

6. The Development Stage

This stage comes with a number of development tasks, such as:

– Front-End Development: It emphasizes creating the user interface, which comes with a whole set of designing and developing the app’s layout, buttons, menus, and whatnot. The front-end team is also responsible for developing an app’s web pages using CSS, HTML, etc.

– Back-End Development: It is concerned with the app’s server-side that is closely related to the data and logic of the app.

7. Integration with Third Parties

The incorporation of loan lending app development with third-party tools or software is vital, and the best example includes the payment gateways like PayPal, Stripe, etc.

The app development team must amalgamate the app with essential tools using APIs, which will have a direct impact on an app’s functionality.

8. Test and Launch!

Now that an app is developed, it is time to make it available to customers for added convenience. But before that, don’t forget to thoroughly test your loan lending app to keep it away from any bugs or issues.

Key Features of a Loan Lending Mobile App

Here are some of the best loan lending app features to incorporate into your business model for accelerated attention:

1. Dynamic Requirement Gathering

The loan app must be able to spawn document requirements once the loan characteristics are examined. Thus, it simplifies the loan application and approval, which saves time and money.

2. CIBIL Analysis

To apply for business or personal loans, you must have a CIBIL score of around 900 points. Therefore, the closer your points will be, the higher will be the approval chances.

3. Chatbot Integration

The AI-integrated chatbot feature enables the two parties to communicate via an in-app messaging feature without sharing personal contact details.

4. Reward Points and Ratings

If both parties pay the interest amount without delay, additional points will be awarded to them. Doing so will lead to customer retention and loyalty.

5. Loan Calculation

Your money lending app must come integrated with a loan calculator to enable users to calculate their loans accurately. It would be best not to leave the loan calculation activity to customers and instead provide them with a mechanism to do the same.

6. Document Management

By incorporating loan document management software, you can make it much simpler for users to manage their documents within the app. Additionally, allow them to eliminate or upload documents as needed.

7. Cloud Storage

Indeed, a loan lending app will benefit exceptionally from cloud technology as user data privacy can not be compromised. Thus, the incorporation of this feature will prove to be highly beneficial in terms of security.

Loan Lending App Development: Roadblocks That May Encounter!

While loan lending app development comes with a plethora of advantages, it may set some challenges for you. To learn more about these challenges and begin preparing for the same, continue reading:

1. Legal Regulations

It is essential to meet the legal regulations of the country or region for which you will launch the loan lending app. Notably, security standards may differ, and you must keep a check on the same.

2. Acquire Assistance from a Finance Specialist

You may hire a financial advisor to help you make accurate decisions regarding the best marketing strategies and more for your business.

3. Look for a Bank Partner

Collaborate with an investor or a banking institution to initiate the growth of your business. Keep in mind that when dealing with banks, you’ll need to adhere to specific regulations and undergo a series of financial protocols before gaining access to the funds. On the other hand, opting for investor funding avoids certain legal complexities, although it may entail a potential reduction in ownership, authority, or control over your business.

Cost to Build a Loan Lending App: Here’s What the Investment Takes!

The cost to build a fintech app may vary from $40,000 to $4,00,000 depending on a number of factors. Therefore, here are some of the most important factors to consider for cost estimation of a loan lending app development.

– Choice of the platform

– Complexity of the project

– UI/UX design

– Developer’s cost

– Tech stack used

– Number of features

etc!

Wrapping Up!

No wonder fintech in investment banking can be a complex activity. However, at Techugo- we have already created more than 900 successful mobile apps and are all set to add another feather in the hat!

So, if you plan to invest your money into money lending apps, we have your back! Get in touch with the best money-lending app development company to learn everything you need to know before getting started.

Happy innovation!

Get in touch.

Write Us

sales@techugo.comOr fill this form