25 Jul 2020

Updated on August 13th, 2020

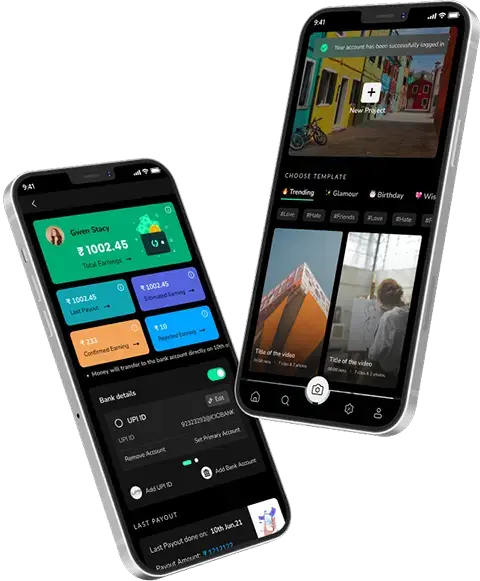

How To Create A Money Transfer App?

The integration of online payment apps has transformed the way we all carry out the financial operations in our day to day basis. Whether it is a personal or professional space, a mobile app makes the banking process as simple as possible.

The age-old method of visiting banks, standing in the queue to deposit or withdraw money is a PERIOD!

Now, the payment ecosystem has taken a revolutionary curve with the help of a mobile app, meeting the needs of Millenials. Here, there is no need of paper, filling slops, or waiting endlessly. This chaotic process is simply replaced by a few taps on the users’ smartphone, and every required detail, information, or transaction process proceeds effortlessly.

If you are curious to know how a simple app interface has met the needs of GEN-X, you need to scroll further and read this post to unleash the process involved in crafting a sizzling mobile payment application.

Let’s get on the boat and sail ahead…

Benefits of money transfer app

- Reduces transfer fees;

- Transfer can be done in a jiffy of a moment, without any hassle involved;

- Makes it easy to conduct money transactions through any device;

- Users can check their transaction history;

- Customer support is available 24/7.

Critical features required to create a money transfer app

Sign In/Sign up

This is the basic but most significant feature that needs to be included within your app. You need to keep it as simple as possible, but must integrate the vital information without the app platform, wherein the app must authenticate the details with the SMS or call on the number.

E-wallets

The digital wallet or eWallet is the best option to try out the payment method through the digital mode. This evades any type of cash or credit or debit card in the users’ pockets. And helps them to pay easily and manage their budget effectively.

Face ID and Touch ID security

In this feature, there is biometric app protection, consisting of fingerprint and facial recognition. This helps in reducing the level of global transaction fraud.

24/7 chat support

Your app must provide round-the-clock customer support to the users, as a money app, it needs to offer unconditional support to the users. This will help them to get instant access to their queries.

Notifications and alerts

Push messages and SMS alerts let the users get updated information about the recent transactions, important payments, and any other information related to money transactions.

Cross-border transfer and currency exchange

Your app must offer a platform for the users to access the hassle-free international money transfers with least or no fee involved and get the real-time currency exchange rate.

Data protection

A money transfer app is nothing without security and protection of data. To make this an indelible aspect of your app, you need to provide your users with the highest level of data protection. You can achieve this by making your app compliant with legal requirements, confidentiality, secure system logs, different options for user authentication, and more.

Advanced features to create your own money transfer app

It takes a LOT to build a successful money transfer app, and it is not sufficed to just coding only, but there is much more that runs behind the curtain and completes the show. Here. We have brought you a quick glance at different steps that are needed to help you craft an app solution.

Integration of CRM module

A money transfer app comes with different interfaces within the app system, such as admin, auditor, cashier, and many others. These features help in monitoring activities on account and even help the financial bodies to run their marketing activities on the app.

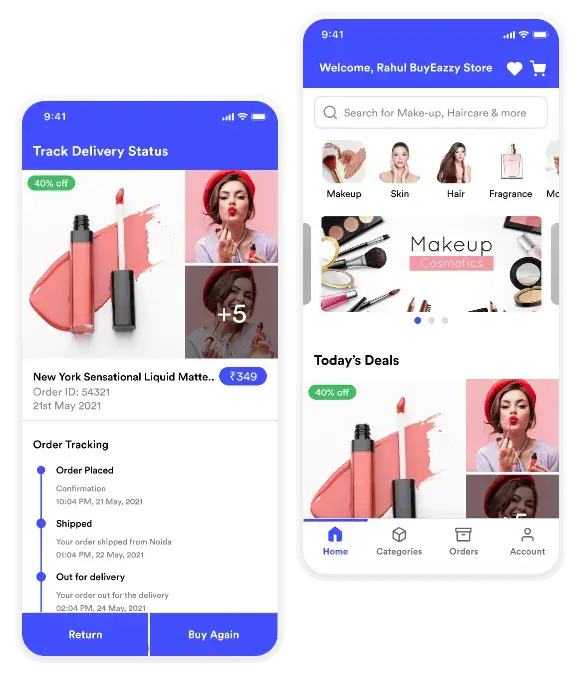

Real-time reporting

Real-time tracking is the essential element for the online payment app, and it must have a feature to monitor the real-time data of the available balance, evaluate profits and losses, and set general limits to transfer the money.

Strict compliance & security

Every country has certain rules and regulations related to payment functionality. And here different data encryption, backups and recovery, limited access to session time limits, and many other features. You need to take a note of KYC, AML, and other counter-terrorism financing compliance related to financial apps.

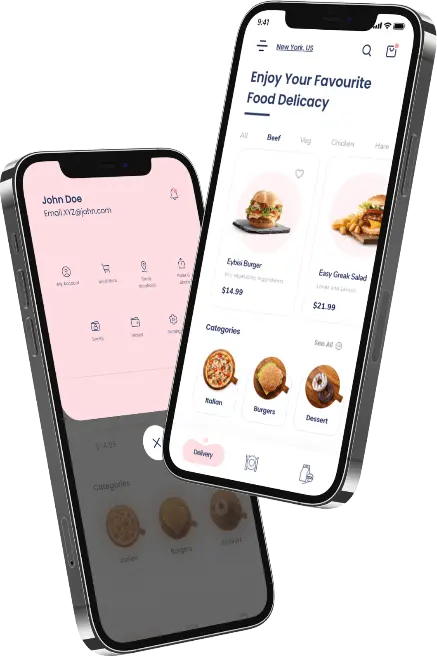

A user-friendly UI/UX

When a user lands on your app, they need to be welcomed with seamless user experience. During the development process, you need to ensure that your app is offering a glitch-free and easy to use app interface. Your app design needs to be creative but simple enough so it doesn’t confuse the users. Hence pay attention to what your users are looking for and try to integrate everything as per their VISION.

Final thoughts

The money transfer app concept is a game-changer for many out there, however, there are few essentials which must be taken into consideration.

Apart from the above-mentioned features and facts, you must ensure to get associated with a skilled app developer in the market.

This is where Techugo, comes as a savior and helps you get a scalable money transfer app solution.

Grab your phone and give us a call today and receive a no-obligation quote for your app concept!

Get in touch.

Write Us

sales@techugo.comOr fill this form

SA

SA  KW

KW  IE

IE AU

AU UAE

UAE UK

UK USA

USA  CA

CA DE

DE  QA

QA ZA

ZA  BH

BH NL

NL  MU

MU FR

FR