14 Nov 2016

Updated on July 22nd, 2019

Successfully Developing A Mobile Banking App

Ankit Singh

I have to go to the bank tomorrow, I have to transfer some amount, I have to open an account….we all have gone through this and there was a time when such statements did never spark the air. Banks received maximum customers, visiting their premises to get their required job done. But now technology has turned these statements into the period and dated. Everything is changed and the way different now. The current era is all about technology and how to make the life more convenient and comfortable; customers have turned more tech-savvy than ever before and opt for a mobile banking app before making a move to the bank. A bigger chunk of customers is embracing digital technologies to ease down the stress of their daily chores.

Why Mobile Apps for Bank

The technology has evolved to a larger extent and the simplest tasks are not even left to experience the digital revolution. Banks are among the most heavily regulated industries in the world, so indulging into the mobile apps is challenging and risky and may cause security and data breach issues. Although banking apps can benefit in various ways, but the most useful support banking apps can provide is better security practices and prevent hackers from invading the users’ secure banking details. Mobile banking offers many advantages to the consumers, such as security, easy access and the biggest benefit of a control on your money.

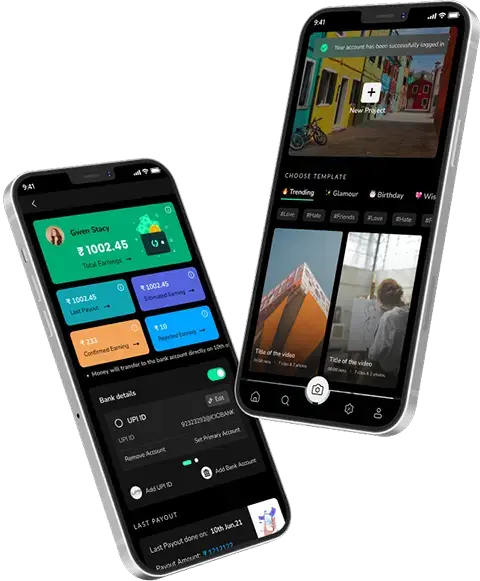

Mobile Banking Experience

The banking industry is developing mobile banking apps that are faster, more secure and more contextual. But the mobile banking, which makes it possible to perform practically any banking function from a smartphone, with a variety of benefits, the security issue is ever-present. Banks offer a mobile wallet function to customers and many other features as well, can take the following tips to provide customers a successful mobile banking experience.

Make It Stupid Simple

To get a mobile app for your banking need is not so troublesome, but making your mobile banking app easy to use, is indeed tough. Mobile banking apps are featured with various exciting features but have been challenging to use, such as ; server error, login problems or page expire, this all make the customer pick either your competitor or never use your app again. Once you have a rough design ready, ask any of the most non-technical friend or family member to check the basic functionalities of the mobile app, from a customer’s point of view. You must look for a few points, whether the app is intuitive, buttons are easy-to-read and many other factors which you think can be in the favor of customer, after reviewing the issues, take notes and work on the actionable areas to make the app easy to be used.

Security Should Be Your Top Priority

When it comes to mobile banking apps, customers fear most of the security invasion, related to their accounts. Even if your mobile app has got numerous features and easy navigation, but if it fails to provide security, then it will be destined to doom. Your foremost priority should be highest levels of security possible within the app, and you must provide safety tips to the customers. Security ought to be a conspicuous design element for mobile app security. The users opt-out from using the mobile banking app due to the uneasiness they receive with the security feature. Technology has led to some unhealthy options as well like SIM card cloning and Trojan horse-like viruses, which can track IMEI from account holders. So the app developers must monitor the security features within the mobile app to provide a stress-free app usage experience to the customers.

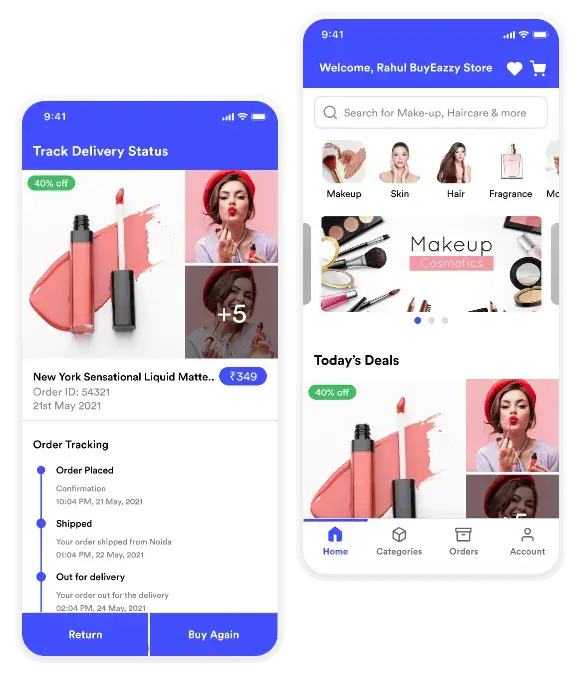

A Personalize App Experience

A mobile app is designed for the smartphone and must deliver the content that’s personalized for the user. The app must contain relevant content that would create brand recognition for you and users should receive the preferred version of notifications, as per their choice. A personalized app experience lets the users stick to your brand for the longer period. Don’t opt for a mobile app just for the sake of making a pace with the current technology, but your mobile app must speak the need of your customers. Include number of important banking features, surveys, and offers, and as a consequence customers would stick to your mobile app for a long time.

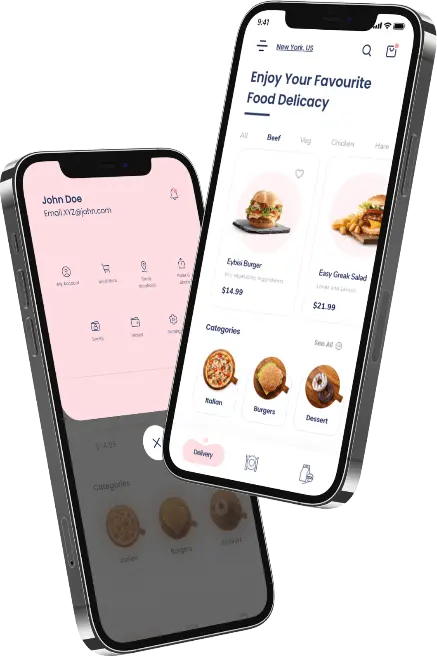

Don’t Stick To One Platform

Technology has much to offer these days, users have the access to desktop, web, smartphone and tablet. There are many devices and platform are available in the market, which let the users pick from the vast options, as per their needs and choices. If you are making a mobile banking app, then don’t limit your mobile app to a particular platform or a device make sure your mobile banking app is available, functional and attractive across as many devices and platforms as possible.

According to a report by Gartner, 25% of Global banks will have their banking apps available to its customers by 2016 and serve 1.75 Billion users worldwide by 2019. The heavy and ever increasing usage of smartphones has raised the expectations for banks to retain customers through technology in a competitive market. Banks are no more dependent on mere advertisement to connect with their customers; rather they are putting their efforts to provide a positive customer experience by making their services more convenient and accessible. The customer engagement created through the technology of mobile apps can be much more successful if designed to engage users appropriately not from the banker’s point of view but from the point of customers.

“You can get in touch with our team to discuss further your mobile banking app concept to bring into reality. The discussion would help you to gain a better insight of your mobile app requirement.”

You can reach us at:

sales@techugo.com

Skype: aks141

Skype: ankit.techugo

Get in touch.

Write Us

sales@techugo.comOr fill this form

SA

SA  KW

KW  IE

IE AU

AU UAE

UAE UK

UK USA

USA  CA

CA DE

DE  QA

QA ZA

ZA  BH

BH NL

NL  MU

MU FR

FR