Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

In the financial world, the difference between millions of dollars in profit and loss can be a matter of mere microseconds. By the end of 2026, high-frequency trading software development will become a necessity, not a luxury, for all proprietary trading firms and hedge funds. This has completely changed how CTOs and founders view technology: they no longer ask, “How fast can I go?” but rather, “What will it cost me to get to that speed?”

Want to build a trading platform, but not sure where to start?

With 90% of market volume being produced through algorithms, continuing to rely on manual processes to trade is nothing but an outmoded methodology. At Techugo, we’ve had the opportunity to see this paradigm shift firsthand so that enterprises that were engaged in traditional execution methods can implement ultra-low-latency trading systems.

This guide breaks down high-frequency trading software development, the infrastructure required for speed, and how AI trading app development boosts ROI. Whether you are an enterprise in New York or a fintech startup in Dubai, this report helps you calculate the cost to develop a mobile app and choose the right trading software development company to make informed business decisions.

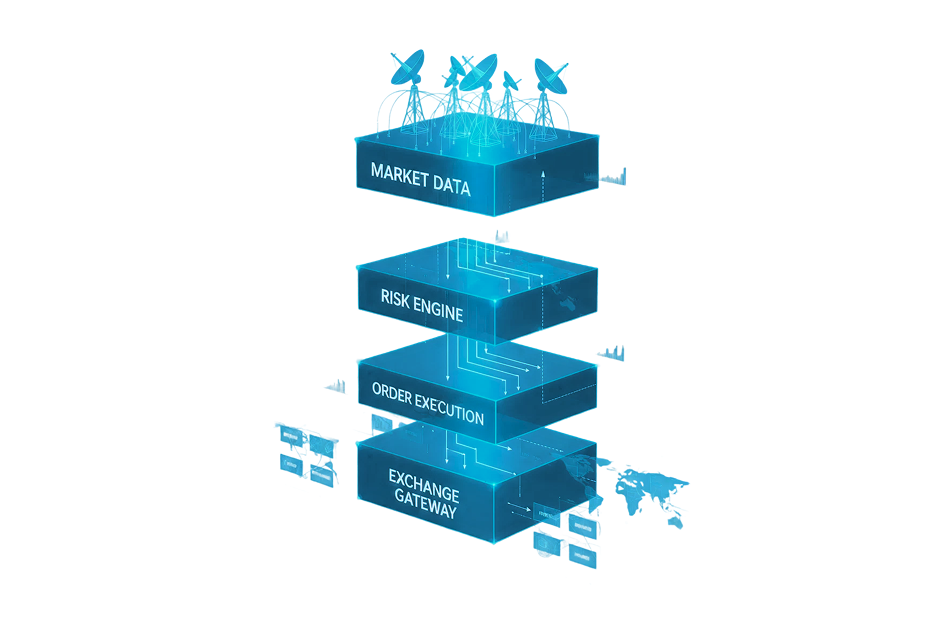

Before we get into cash, we need to talk about basic concepts of high frequency trading. First thing to remember: high frequency trading software is NOT like your normal retail broker app. It’s a specialized type of algorithmic trading that executes thousands/millions of orders at sub-microsecond (10^(-6) second) or nanosecond (10^(-9) second) speeds.

The Execution Engine is the core of this technology and it is typically written in either C+ -rust/ ) language; it provides deterministic performance, manages order placement/cancellation, and serves as the heart of these systems.

Ultra fast data pipelines reading “tick by tick” exchange data via decoding.

Pre-trade risk gates designed to prevent algorithms from going rogue and potentially bankrupting the company in seconds.

A standard mobile application development company focuses mainly on UI/UX aspects, while a trading software development company will focus mainly on latency budgets. In HFT, every single line of code has been reviewed thoroughly to make certain that it does not cause any additional delay whatsoever when executing the “tick to trade” lifecycle.

| Feature | Standard Mobile App | HFT Trading Software |

| Primary Metric | User Engagement & Retention | Latency (Microseconds/Nanoseconds) |

| Tech Stack | React Native, Flutter, Swift, Kotlin | C++, Rust, FPGA (VHDL/Verilog) |

| Data Processing | Request-Response (REST/GraphQL) | Streaming (Binary Protocol/FIX/SBE) |

| Performance | Human-perceptible speed (<200ms) | Machine-level speed (<10 microseconds) |

| Infrastructure | Standard Cloud (AWS/Azure) | Co-location & Microwave Links |

| Error Handling | Graceful UI messages | Pre-trade risk gates & kill-switches |

More countries are asking for faster execution and with the growth rate almost doubling from last year, it’s expected that both MENA and Asia will grow very quickly, due to digital transformation initiatives occurring there.

Market statistics and market dynamics include:

The total algorithmic trading market is expected to exceed $30 billion by 2027.

HFT has overtaken 50% of all equity trading volume, and HFT is also rapidly growing on crypto exchanges.

Retail trading customers now also want “instant” execution and will continue to force developers to increase their costs in order to integrate more advanced predictive capabilities into their AI trading apps.

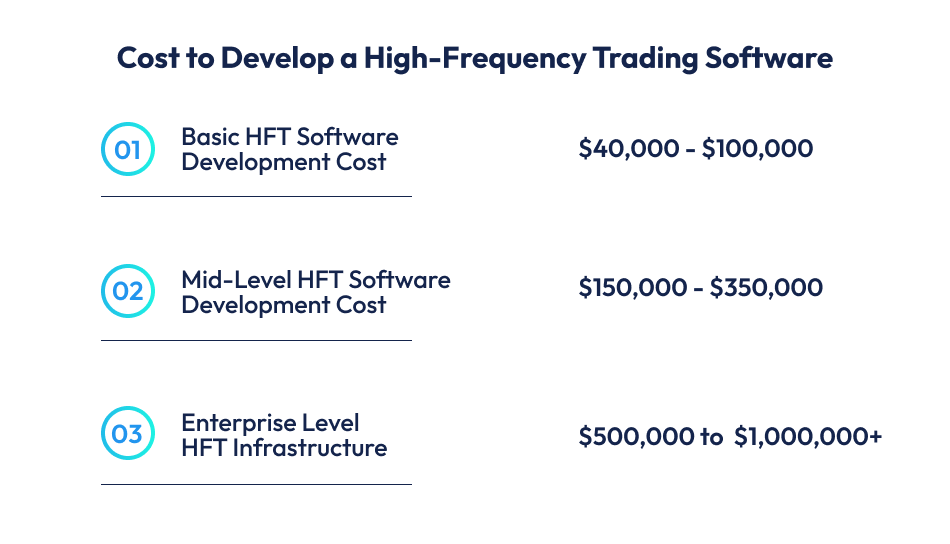

The cost of developing HFT software is very flexible based on what you are trying to build. If you are creating just a simple MVP, the investment will be a lot less than if you plan on creating a full institutional-level product.

This is the general range for startups testing one arbitrage strategy against one exchange. Costs are primarily limited to:

This is typically the space where most firms land. This includes:

Using machine learning to support strategy analysis, signal generation, and decision support.

Your application’s front end (e.g., monitoring dashboards) can be accessed via web or mobile for easy oversight.

Comprehensive tools that can enforce position limits, stop trading in the event of errors, and help meet regulatory or internal compliance standards.

If you plan to compete with leading firms in this space, software is only part of your overall HFT budget. As a minimum, you should expect to spend on the following:

Moving critical parts of your trading logic to hardware to speed up execution.

Fees paid to the exchanges to keep your servers physically as close as possible to theirs.

Specialized networking stacks designed to help reduce the time it takes from receiving to executing a trade by nanoseconds.

| Component | Estimated Cost (2026) | Complexity |

| Matching Engine | $50,000 – $120,000 | Very High |

| Market Data Feed Integration | $20,000 – $50,000 | High |

| Pre-Trade Risk Suite | $30,000 – $70,000 | Medium-High |

| Mobile Monitoring Dashboard | $25,000 – $45,000 | Medium |

| Maintenance (Annual) | 15-20% of Build | Ongoing |

The journey to develop high-frequency trading (HFT) software is a series of successful projects. As a top mobile application development company, we employ strict lifecycle protocols to deliver reliable and quick-to-market products.

We’ve taken much care to understand your application needs, including the amount of time you want it to take to return to the last executed transaction (latency). Is it 500 µs or 5 µs? This decision will be the gateway to determining your entire technology stack.

Even though trade execution occurs in an unknown timeframe, the humans involved must have access to a clean and valid stock trading application development interface. Our software engineers develop high-density dashboards visually representing tens of millions of data points without delay.

Our software engineers utilize low-level programming languages and FPGA (Field Programmable Gate Array) devices as necessary to guarantee that code runs as quickly as possible in a trading system.

Prior to executing a trade in live markets, we must ensure our trading program’s strategy will generate profitability while producing bug-free code. To accomplish this, we analyze years of empirical “tick data” in order to validate our assumptions.

In the world of high-frequency trading, your software is either an asset or a liability. Don’t settle for a generic build when your capital is on the line. At Techugo, we combine ultra-low-latency engineering with institutional-grade security to ensure your platform stays ahead of the curve.

Several factors can impact your final HFT software development cost when you request a quote from software developers.

When developing an application or software for the Stock Exchanges (NYSE/NASDAQ), you need to have access to certain types of compliance requirements and data feeds, which vary from those needed for Forex or Cryptocurrency; therefore, developing on a multi-asset platform generally will be more expensive to build a mobile application.

The cost of subscribing to Direct Market Access (DMA) feeds is very high, and a subscription to real-time high-quality data can be in the thousands of dollars/month, and is not included in your development costs.

You must comply with regulations like MiFID II (European regulations) and SEC (USA) regulations, and you must log and report certain events. These features will increase the cost of high-frequency trading software, as the automatic compliance with these regulations will need to be included in your development costs.

One example is when we assisted a boutique firm operating out of the UAE that had previously been trading cryptocurrency by hand and was incurring excessive “slippage” as a result; this led us to build a custom HFT trading bot that was then paired with an AI-generated sentiment analysis tool.

Through the application of principles regarding equity trading application development, even in the cryptocurrency vertical, we were able to help reduce execution time by 85%. After implementation, they went from having an incredibly minimal amount of sales (zero) during the month of implementation to being able to show a return on investment (ROI) of 12% in less than 3 months.

We aren’t simply developing software and applications but creating engines to deliver your organization’s competitive edge. We’re a leading mobile application development agency with a global approach to each and every one of our projects.

Our team at Techugo, as a part of an experienced HFT software development company, helps with end to end process, from strategy to deployment and post-launch support because we believe in long-term partnerships that lead to success and growth. Don’t wait anymore, reach out to us today.

If you’re serious about increasing your trading capabilities in the future, it is essential to invest in high-frequency trading software. We are continuing to see an accelerated pace of development and adoption of mobile applications for trading; therefore, investing in this type of trading infrastructure will be vital if you want to continue participating in the financial markets through 2026.

The cost to develop a mobile application for trading can vary widely depending upon what type of environment the application will be used in and how many users will access the app. That being said, most low-latency strategies that have been implemented properly will return roughly their development cost within a few months based on transaction volumes alone.

Rather than allowing technical difficulties to impede your ability to become a market leader, we can help you either find a trading software developer to create a custom trading engine or get a more thorough understanding of the costs associated with developing an AI-enabled trading application. Contact us today if you are ready to take charge of your success by dominating the marketplace.

Python is an ideal language for strategy research and testing your strategies, but for the execution engine, we typically recommend C++ or Rust to avoid Python’s “garbage collection” pauses.

Typically, it takes about 3 to 4 months to build a working MVP. Development of a full HFT system that has co-location and hardware acceleration typically takes 8 to 12 months to complete.

In general, most AI Trading Application development costs include developing data collection, cleaning, and the time-consuming process of training the models based on historical market data.

Co-location is an additional operational cost. It does not affect the cost of developing the trading application; however, the trading software must be compatible with the exchange’s hardware, resulting in additional engineering costs that are specific to your application.

Write Us

sales@techugo.comOr fill this form