Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Have you ever pressured your mind on how apps like Al Ansari Exchange make money transfers feel… almost too easy?

People in the UAE now prefer mobile banking over traditional counters, and a fast, secure e-wallet app often becomes their go-to for daily transactions.

If you’re thinking to build a digital wallet or a similar money transfer app, you’re in the right place.

The global digital remittance market is growing rapidly; therefore, more businesses are exploring how to build a digital wallet like Al Ansari Exchange, and want to know the overall cost of development, so that they can make a substantial profit from the investment.

This guide keeps things simple. You’ll learn the key steps, essential features, and costs to consider before starting your digital wallet app development journey.

Let’s get into it.

👉Must Read: FinTech Innovation in MENA: Digital Banking Trends 2026

Before you plan to build a digital wallet like Al Ansari Exchange, it’s useful to know why this app is so successful in the first place. The platform is now a source of funds transfer in the UAE because it simplifies the process; easy registration, speedy transfers, various payment methods, and consistently competitive exchange rates. No clutter. No confusion.

Users can send money anytime, anywhere, without stepping into a branch, and that convenience is exactly what sets the Al Ansari Exchange digital wallet apart. It’s secure. It’s fast. And for many people, it’s easier than traditional banking. That’s why it has achieved a 4.7-star rating and 1M+ people have downloaded it till now.

But…apps like this don’t succeed by accident. They require smart product thinking, compliance alignment, and a solid mobile wallet app development team behind the scenes. With the right e-wallet app development company in UAE guiding the process, businesses can actually compete in this space and launch a money transfer app that stands out in the UAE market.

You might be asking yourself – “Is there any potential for a digital wallet in UAE market?”

So…YES. The main reason is that over 50% of UAE residents now use digital wallets (Source: Checkout.com survey).

If we talk about the market, then the UAE mobile wallet space is valued at USD 4.18 billion in 2024. And now it is projected to become almost double by 2030, reaching USD 8.28 billion (Source: Techsci Research).

Now the question is, what is driving this boom?

That’s why connecting with a top e-wallet app development company in UAE, and building a digital wallet app feels less like a gamble and more like stepping into the future.

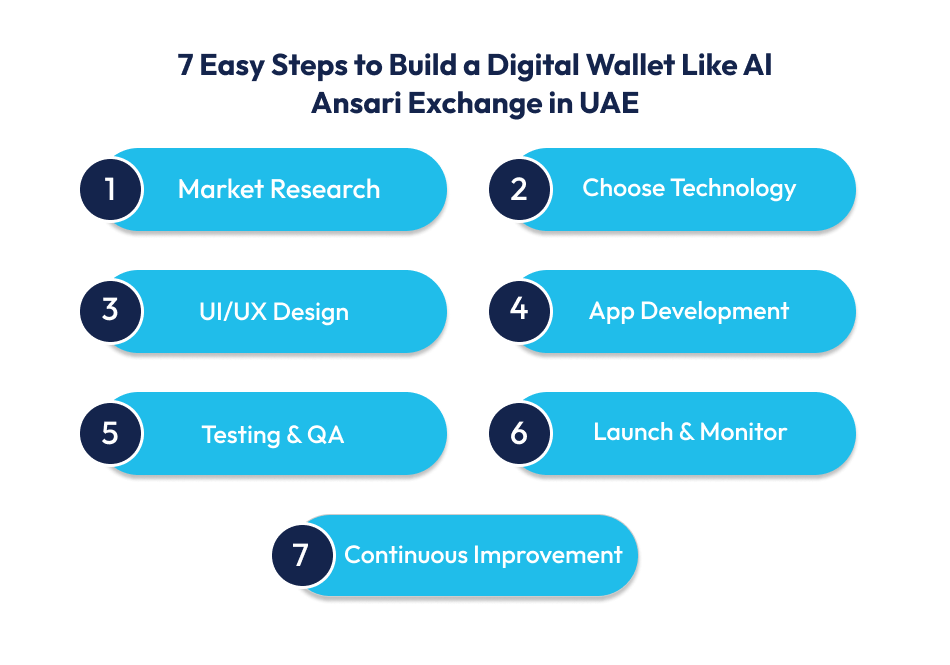

It’s obvious that you want to know how to build a digital wallet app. Building a digital wallet app development project isn’t complicated when you break it down into simple, practical steps. Here’s the clearest way to get started.

Understand who you’re building for. Study user behavior, competitor apps, and UAE payment trends. This helps you shape a p2p payment app that actually solves real problems instead of guessing what people want.

Choose secure and scalable technologies early. Decide between native Android/iOS or cross-platform development based on budget and timelines. If needed, hire Android or iOS app developers to guide you.

Your app should feel effortless. Wireframe. Prototype. Test quickly. Refine navigation until even first-time users know exactly what to do. A top mobile app development company in UAE can speed this up.

This is where the real product takes shape. Code the interfaces, APIs, and payment flows. Keep testing as you build to catch issues before they snowball.

Security tests, performance tests, device compatibility…all of it matters for a money transfer app like Al Ansari Exchange. Fix bugs instantly to ensure the app feels stable from day one.

Publish the app, watch user behavior, analyze conversion drop-offs, and keep an eye on transactions. Real-time monitoring helps you plan early improvements.

Update features, enhance UI, tighten security, and respond to user feedback. For long-term success, partner with a fintech app development company that can maintain and scale your app as the market evolves.

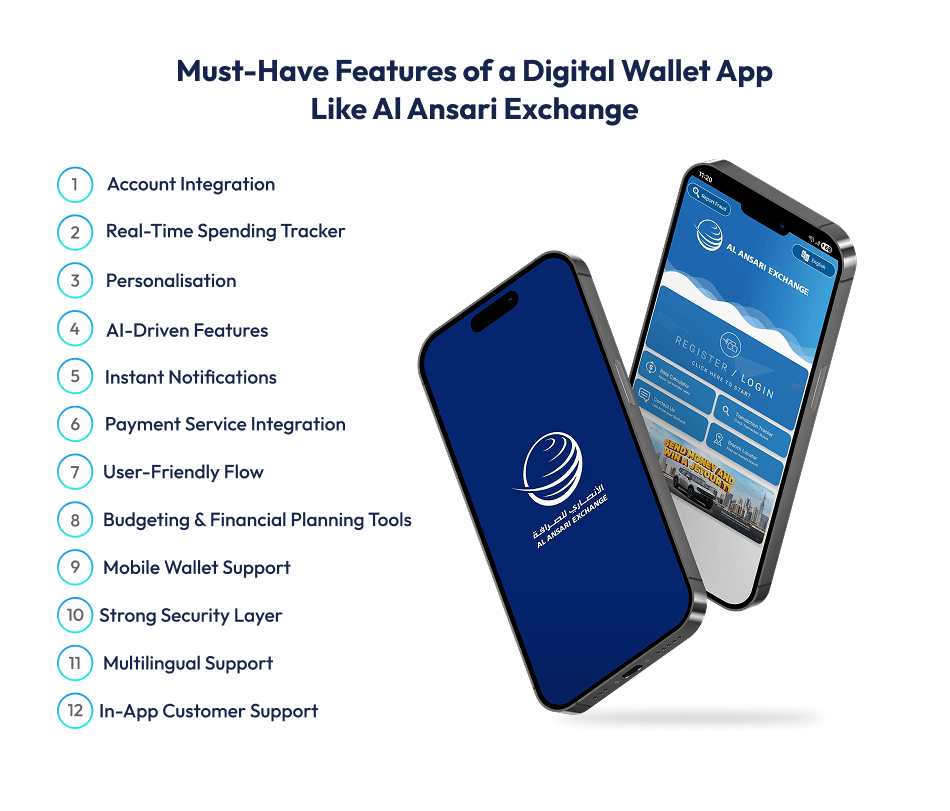

If you’re aiming to build a digital wallet like Al Ansari Exchange, the features you choose will decide whether users trust your app… or delete it after one try. Great fintech apps don’t overload users. They keep things simple, secure, and truly helpful. Here’s what your money transfer app must include.

👉Must Read: AI in Fintech: Driving Innovation in Digital Financial Solutions

Your app should pull together bank accounts, cards, loans, and investment details so users can manage everything from one place.

People want instant visibility. A live expense tracker helps users understand where their money goes…without digging through statements.

Tailor the experience. Show relevant insights, spending patterns, and smart suggestions, just like modern e-wallet apps in the UAE.

Use AI for fraud alerts, forecasting, spending insights, and 24/7 support. It’s a huge differentiator in digital wallet app development.

Whether it’s a transfer, bill payment, or login attempt, users want updates right away. It builds trust.

Smooth payments are the heart of a money transfer app like Al Ansari Exchange. Integrate multiple payment rails for fast, secure, friction-free transactions.

Clean screens. Predictable navigation. Zero confusion. A digital wallet app succeeds only when it feels easy from the first tap.

Give users control. Smart budgets, savings goals, and spending insights make your app more valuable than a basic transfer tool.

Enable quick payments through QR codes, NFC, and in-store options. This is where convenience turns into habit.

Biometric login, encryption, 2FA, anti-fraud systems, these are all non-negotiable for a secure e-wallet app.

UAE users speak many languages. Offering at least English + Arabic increases adoption instantly.

Chat support, FAQs, and quick help options make users feel safe, especially when money is involved.

To be honest, every business that thinks about digital wallet app development eventually hits the same question: “Okay, but how much will it cost?”

And the truth is… the cost isn’t fixed. It shifts based on how simple or complex you want your e-wallet app to be.

Here’s a quick snapshot so you don’t have to guess:

| Based On Complexity | Estimated Cost in | Estimated Cost in USD |

| Simple digital wallet (essential features) | AED 33,000 – 59,000 | $9,000 – $16,000 |

| Moderate to complex fintech app | AED 59,000 – 73,500 | $16,000 – $20,000 |

| High-end, highly complex app | AED 91,750+ | $25,000+ |

These ranges depend on your platform of choice (Android, iOS, or cross-platform), how complex the design is, integrations, and the size development team you engage. One of the convenient ways to get an exact estimate of your own app development cost is to get in touch with a trusted fintech app development company.

Once your app goes live, the work doesn’t stop. You’ll still need updates, security patches, server monitoring, and analytics tracking.

Maintenance typically falls around 15–20% of your total development cost per year.

So if your digital wallet costs AED 36,700 ($10,000) to build, expect around AED 5,500 – AED 11,000 ($1,500–$3,000) annually for maintenance.

And just like development, the final maintenance cost depends on your app’s complexity, user load, OS updates, and how often you release new features.

Techugo helped turn Bajaj Finserv into a digital-first fintech powerhouse. As a Forbes Asia Fab 50-listed company, Bajaj Finserv came to us looking to modernize their legacy systems and scale securely. They also wanted to deliver a sleek, AI-enabled financial experience.

Here’s what we did:

The result?

Bajaj Finserv emerged as a true fintech innovator…modern, secure, and ready to compete with digital-native startups.

This is the kind of transformation Techugo offers: not just a product, but a future-ready digital platform.

Great products rarely happen by accident. They happen when strategy, tech, and execution sit at the same table…and that’s exactly where Techugo operates.

When you’re building something as sensitive and high-stakes as a digital wallet, you don’t just need developers. You need a team that understands the UAE fintech ecosystem, compliance layers, transaction security, and how users actually move money on mobile. Techugo has already shaped financial experiences that millions use daily.

Think of us as your end-to-end fintech partner…not just a vendor. We’re a trusted fintech mobile app development company in UAE. We’ve years of experience in building enterprise-grade digital wallets, cross-border remittance apps, KYC/AML platforms, and secure payment systems as well. We know what it takes to match the reliability of fintech apps like Al Ansari Exchange.

While other app development companies highlight broad fintech expertise, Techugo brings something sharper to the table:

If you’re imagining a digital wallet that feels as seamless as Al Ansari Exchange, but sharper, smarter, and built for the next decade, Techugo can get you there. Avail our e-wallet mobile app development services at affordable prices.

For a closer look at our fintech work, features we’ve built, and how we approach high-scale apps, visit Techugo.

The pricing greatly depends on the functional characteristics of your application.

Users do expect basic functionality like account links and transfers, budgeting tools, and a clean mobile app wallet experience. Real-time spending tracking is second most valued feature. Customers expect the security of biometrics and encryption as a standard verification feature. UAE users specifically love multi-currency options, remittance payments, and AI-based insights. Notifications, bill payment capabilities, and fraud detection logs make for a great registration and budget experience; you can also add rewards or investment functionalities if you want the app to be special.

Yes, it’s legal. But the UAE’s fintech industry is very regulated. To start or operate any business, you need the licenses from the Central Bank of UAE (CBUAE), and sometimes ADGM or DIFC depending on the business model you are pursuing. You will also need to comply with KYC, AML, PCI DSS, and data protection laws. If your application has remittances, currency exchange, and/or stored value in the model, you will need additional licensing as well. Compliance is a huge part of the licensing process.

Developing a simple eWallet generally takes about 3 to 4 months. A mid-range eWallet with some artificial intelligence functionality, a dashboard, and a user interface might take 6 to 9 months. Applications that require an elaborate and complex backend system or that need to adhere to high regulatory compliance standards will take longer to design and develop. Other factors that will likely contribute to the duration are the testing, approvals, and integrations.

Typical dedicated e-wallet app developers charge from about $15 to $25 an hour, depending on their experience and skill set and/or the complexity of your project. If you are looking for fintech skills or experience with regulatory compliance for UAE, expect a higher rate.

Write Us

sales@techugo.comOr fill this form