Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Shopping has changed in the GCC. People no longer wait to buy the things they want. They look for flexible options. And here’s when Buy Now Pay Later in GCC says hello. The idea sounds simple. Pay a small part now, and split the rest into easy instalments. No heavy interest. No complicated process. Just smooth digital payments.

But why is this trend booming? Because the region is moving fast toward being digital. E-commerce is everywhere. Young consumers want speed. They don’t want old banking delays. They want freedom and control.

This is where Tabby gets the spotlight. You must have already heard about the Tabby app in UAE or maybe seen it while shopping online. It lets you buy today and handle payments tomorrow, or later. And it does it with trust and style.

Still, BNPL is not only about consumers. It’s about merchants too, like retailers and fintech startups. Everyone in the ecosystem benefits. Gets higher sales, more loyal customers, and smarter data.

So the big question is, why is BNPL winning in the GCC? And why is Tabby at the center of this fintech revolution? That’s what we’re about to explore. Keep reading…

First, let’s understand BNPL business model.

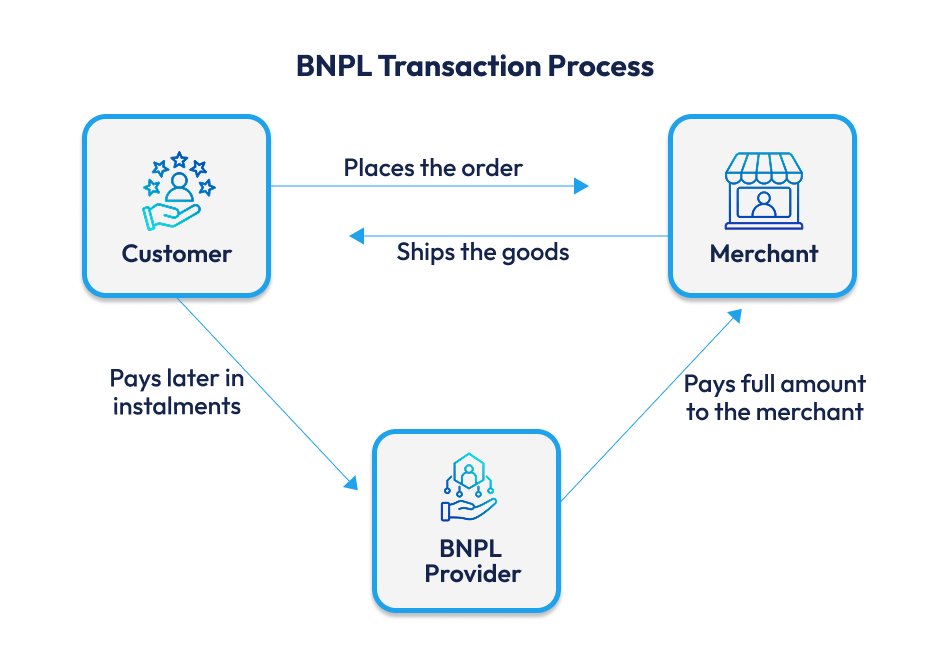

At its core, Buy Now Pay Later in GCC is a simple short-term financing tool. You pick a product. You pay a part upfront or 25% of the total purchase amount. The rest amount gets split into smaller payments spread over weeks or months, with zero interest charges. That’s it. No credit card interest drama. No waiting for bank approvals. Faster, smarter, and digital-first.

BNPL apps, like the Tabby app in UAE, sit right inside your favorite online store or point of sale. You click “Pay with Tabby.” Your purchase goes through. The merchant gets paid. And you, the customer, get flexible time.

Here’s the flow in steps:

And yes, it feels effortless. That’s the charm why Buy Now Pay Later apps in GCC are spreading so fast.

But BNPL is more than just payments. It’s a business model that builds trust and drives sales. It connects FinTech startups in GCC with customers in a new, exciting way.

If you’ve a business idea around Buy Now Pay Later in GCC, don’t wait anymore. Capture the thriving market in the UAE, Saudi Arabia, Dubai, and the entire Middle East.

If really interested, book a free app consultation call with Techugo, a leading fintech app development company in Middle East, and launch your app as soon as possible.

The Gulf region is buzzing with digital payments, digital banking, and digital shopping. Everything is shifting online. And people are quick to adopt what feels convenient.

E-commerce in UAE, Saudi Arabia, and other GCC nations has exploded. Almost every hand has a smartphone with fast internet. And a young population, especially, hungry for smarter options. This is the perfect recipe for Buy Now Pay Later in GCC to grow.

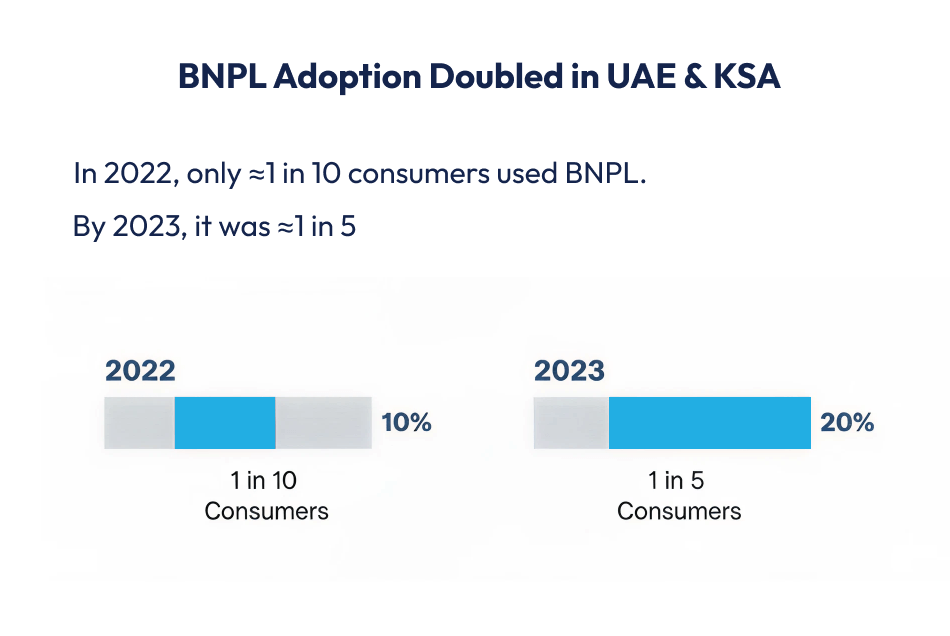

Here’s some proof:

FinTech startups are popping up everywhere. They’re solving problems banks often overlook. Speed. Flexibility. Simple apps. That’s why BNPL adoption in UAE is so high already.

But it’s not just about consumers. Retailers are seeing the difference. With BNPL, customers don’t hesitate to add more items to their cart. Average order value jumps. Conversion rates climb. Businesses grow.

And investors? They are watching closely. Tabby investors in GCC are betting big because they see the shift. Traditional credit cards are losing charm. People prefer small, controlled payments over large debt traps.

This is where FinTech disruption in the Middle East is loudest. Payments. Finance. Customer experience. Everything is being rewritten by BNPL apps like Tabby.

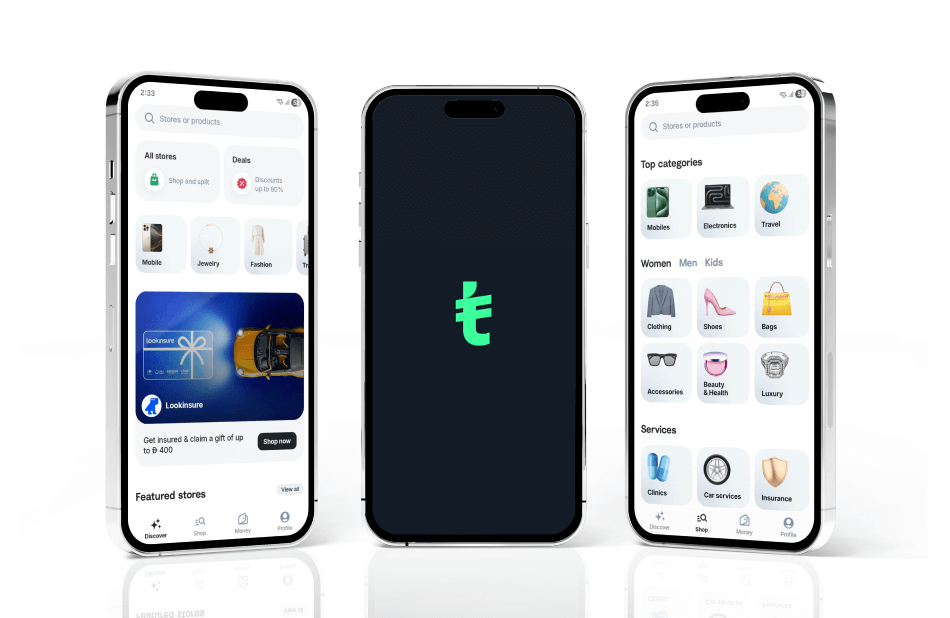

So, what’s Tabby really? Founded by Hosam Arab (CEO) and Daniil Barkalov (COO) in 2019, Tabby is a fintech BNPL solution in GCC that lets you shop now and pay later. Simple. But behind that simplicity, there’s a smart system built for speed and trust.

The Tabby app in UAE is everywhere – online stores, fashion brands, electronics, and even home goods. You pick Tabby at checkout, pay a small part, and split the rest into easy, interest-free installments. No hidden charges. No late-night panic about credit card bills.

Here’s how it usually flows:

For merchants, it’s even smoother. Tabby payment solutions in GCC integrate with POS systems and e-commerce platforms. Orders update automatically. Customers stay happy. Sales go up.

And here’s the interesting part – Tabby isn’t only about payments. It’s about trust. It’s about consumer freedom. And honestly, it’s also about showing how AI-driven fintech apps can make finance less scary, more human.

Buy Now Pay Later apps like Tabby isn’t just a theory. It’s already everywhere in the GCC. Let’s look at a few real-life examples:

And it’s not only businesses. Investors are backing Tabby hard. In 2023, the company raised $350 million in debt financing to fuel its regional growth. That’s not a small change. That’s the belief in the BNPL future in Middle East.

These stories show the point clearly. BNPL isn’t hype. It’s practical. It’s working. And Tabby is the name most people see first when they think “Buy Now Pay Later in GCC.”

So, why is Tabby leading the BNPL market, and not the others?

Simple. Tabby nailed because of…

“Timing + Execution + Credibility”

And finally, investor backing. With hundreds of millions pouring in from Tabby investors in GCC and beyond, the company has the resources to scale. Competitors may try, but scaling without strong financial muscle is tough.

All of this explains why Tabby isn’t just another BNPL app. It’s leading the charge in a growing market. And shaping the way people shop.

Your Tabby-like fintech app isn’t a dream. It’s a launch away. Talk to BNPL app experts now at Techugo, a trusted fintech app development company in Middle East.

The rise of Buy Now Pay Later in GCC isn’t just a passing trend. It is changing how people shop and how businesses drive sales. Tabby stands out because it balances both sides of the retail equation: shoppers get more financial flexibility, while merchants unlock higher revenue streams.

In short, Tabby helps consumers buy smarter and merchants sell better, which is exactly why BNPL adoption is accelerating across the Middle East.

What sets Tabby apart from a traditional credit card installment system is how it takes the advantage of artificial intelligence to power smarter, faster, and safer transactions.

AI algorithms assess spending behavior, transaction history, and repayment trends in real time. Instead of outdated credit scores, Tabby can predict repayment capacity with higher accuracy, ensuring responsible lending.

AI tailors offers, discounts, and payment flexibility to each user. For instance, repeat customers with good repayment history may get higher spending limits instantly, boosting both satisfaction and loyalty.

With BNPL adoption surging in the GCC, fraud risks also grow. Tabby uses AI-powered fraud detection to flag suspicious behavior instantly, keeping both merchants and customers safe.

Beyond consumers, merchants get AI dashboards showing which products are driving BNPL adoption, average basket values, and customer retention metrics. This helps businesses refine pricing, promotions, and product placements.

Of course, it’s not all smooth sailing. The BNPL wave in the GCC comes with its fair share of bumps. And Tabby? Well, it’s learning how to ride those waves smarter than most.

Buy Now Pay Later in GCC market is still fresh. Rules around consumer protection, interest-free models, and repayment policies aren’t fully fleshed out yet.

The biggest criticism of BNPL globally? People overspending because they don’t feel the pinch immediately.

Not every retailer in the GCC is tech-ready. Some still struggle with digital payment infrastructure.

Players like Tamara (Saudi Arabia) and Spotii (Dubai) are also fighting for space. The market is heating up.

Fake accounts, phishing, and non-repayments are all obvious when it comes to digital payments.

The GCC is shaping into a perfect testbed for BNPL growth. Rising youth population, digital-first shopping habits, and government-backed fintech reforms. It’s all clicking at the right time.

The days when BNPL was just another payment option are over. In the GCC, it’s turning into a mainstream financial tool, especially in the UAE and Saudi Arabia. With the rise of players like Tabby, BNPL is now part of everyday digital payments.

BNPL isn’t just about splitting payments anymore. With AI-powered BNPL solutions, companies like Tabby will predict customer behavior, reduce risks, and offer hyper-personalized financing. This means smoother approval processes and safer transactions.

For now, BNPL is mostly about shopping. But the BNPL future in the Middle East points to travel, healthcare, education, and even government services. Just think, you’re paying school fees or flight tickets in easy installments, directly through apps like Tabby.

Investors are pouring money into GCC FinTech startups. Tabby’s backers already include big regional and global names, showing that the BNPL model is no fad. In fact, Tabby investors in GCC see it as the cornerstone of digital finance here.

Tabby is moving fast to connect UAE, Saudi Arabia, and other GCC countries into one payment ecosystem. That is convenient as well as a signal that the GCC is becoming a hub for FinTech disruption in the Middle East.

Do you think that creating a BNPL app is only about splitting payments?

Then you’re not right.

“Developing a BNPL app is about trust, because money is personal. It’s about compliance, because one wrong move can shut doors in the GCC. And lastly, it’s about experience, because users won’t forgive clunky, confusing design.” – Ankit Singh, COO, Techugo

At Techugo, we’re not just another vendor. We’re a leading fintech app development company in UAE and across the Middle East that knows how to turn bold fintech ideas into scalable, secure, and loved products.

From AI-powered fraud checks to seamless merchant APIs, we build the kind of BNPL apps that actually work in real markets, not just pitch decks. Here are the must-have features for a Tabby-like BNPL app:

The cost to develop a BNPL app like Tabby depends on scope, features, and platform choice.

We are a leading FinTech app development company in Middle East. We don’t just build apps, we design FinTech BNPL solutions in GCC that scale with market needs.

Whether you’re a startup or an established brand, we’ll guide you through compliance, AI integration, and user experience design to make your BNPL app stand out.

BNPL or Buy Now Pay Later in GCC is a payment model where shoppers split payments into installments. No heavy interest, fast approvals, and it’s digital-first. Apps like Tabby make it easy in UAE, KSA, and beyond.

Tabby lets users shop now and pay later, just like in the UAE. Customers pick Tabby at checkout, pay a small upfront amount, and split the rest into installments. Merchants get paid instantly, and the system integrates with POS or online platforms.

Very safe. Tabby uses AI fraud detection in payments, encryption, and strict compliance with GCC regulations. AI ensures users and merchants are both protected.

Absolutely. AI-driven fintech apps like Tabby use machine learning for risk assessment, fraud detection, personalized limits, and consumer insights.

BNPL adoption in UAE and KSA is rising fast. Experts predict it will expand to healthcare, travel, and education. Apps like Tabby will lead the way, backed by AI and strong fintech infrastructure.

The Tabby payment solution in UAE works online and offline. Users select Tabby at checkout, pay part of the amount upfront, and schedule the rest in easy installments. No interest, clear terms, and AI-driven security make it safe and convenient.

The BNPL revolution in the GCC is here. Consumers want flexibility. Merchants want growth. And Tabby is showing how to bridge both.

From UAE to Saudi Arabia, Tabby Buy Now Pay Later in UAE is redefining digital payments. With AI, smart risk checks, and seamless user experience, this app is a revolution.

And if you’re dreaming of a BNPL app like Tabby, Techugo, a top fintech app development company in UAE and Middle East, can help you build a similar or better app with AI integration, and capture a thriving market.

The future is digital, fast, and flexible.

And AI-powered fintech apps are a major part of the future. Get yours built by Techugo, a reliable fintech app development company in UAE and stay ahead in the GCC market. Don’t just watch it, be a part.

Write Us

sales@techugo.comOr fill this form