Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Did this ever happen that you abandoned your online shopping cart because the payment process felt too complicated or untrustworthy?

If yes, you’re not alone.

A seamless payment experience is the backbone of e-commerce. The choice of payment gateway can make or break customer trust. Kuwait’s e-commerce sector is projected to witness steady growth. Driven by high smartphone penetration and rising demand for online shopping. Plus, heightening the adoption of digital wallets.

Businesses, thus, need more than just an attractive app! They need secure, fast, and localized payment solutions that align with customer preferences.

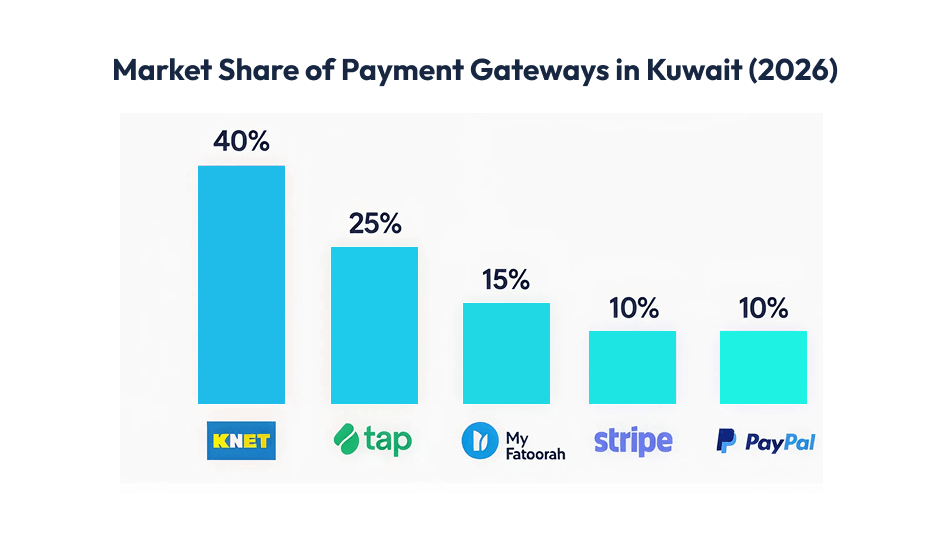

From KNET, Tap Payments, and MyFatoorah to international players like Stripe and PayPal, the payment gateway landscape in Kuwait offers businesses multiple options. But choosing the right one and integrating it smoothly into your iOS or Android app requires careful planning. Plus, the right development expertise.

This blog will walk you through:

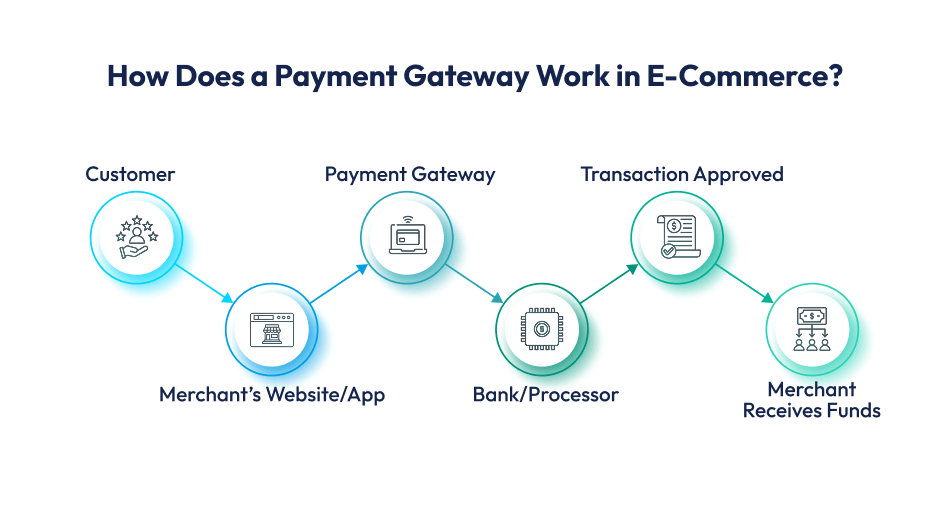

Imagine you’re browsing an online electronics store based in Kuwait.

You add a sleek Bluetooth speaker, proceed to checkout, and enter your details. But when you click “Pay”, you’re asked to fill in a dozen fields. Wait while security checks happen. And finally, your payment fails. Frustration sets in, you close your laptop, and never return to that store.

That short experience reflects how critical payment gateways are to the e-commerce journey.

A payment gateway is the technology and service that handles online transactions. It authorizes, processes, and ensures the security of payments. It’s the bridge between your customers, your app or website, and your bank or payment processor.

Kuwait’s e-commerce market is growing fast.

Go through some stats to see why payment gateways are especially important there:

These numbers suggest that more people are shopping online. More payments are happening digitally.

So customers are definitely expecting frictionless payment experiences.

Even with all this growth, many e-commerce stores in Kuwait and the wider GCC face similar UX pitfalls:

So, if your checkout flow is slow, doesn’t support local payment options, you’re likely losing a large portion of potential sales.

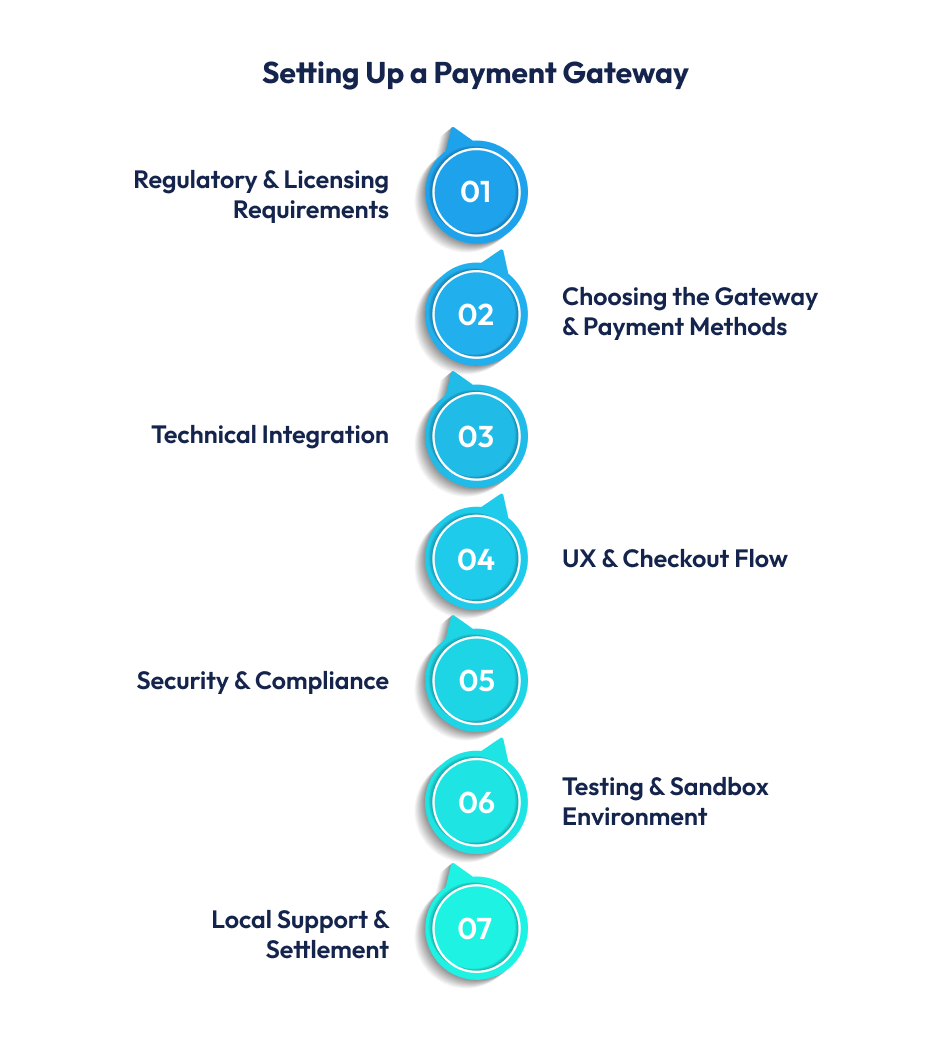

Integrating a payment gateway in Kuwait involves regulatory steps, local expectations, and choosing between local vs international providers.

Want to learn more? Here’s a deep dive into integrating payment gateways in Kuwait.

Deliveroo Kuwait added KNET as a payment option via a partnership with NBK (National Bank of Kuwait). Enabling customers to pay with KNET-enabled debit or prepaid cards. This local integration helped Deliveroo appeal to customers who prefer local payment solutions.

Businesses using Tap’s checkout SDK can enable Apple Pay automatically when supported in Kuwait. This means that if the merchant uses Tap and Kuwait is one of the supported countries. Apple Pay gets enabled via the SDK without extra steps.

Tap introduced “Deema”, the BNPL service in Kuwait that merchants can integrate to offer installment payments. This helps boost average order values. Customers who cannot pay fully immediately have more flexible payment options.

Without formal legal documentation, some gateways refuse to onboard a business or impose stricter conditions. Many small/home-based shops in forums mention difficulty getting gateways like Tap or KNET without licenses.

Users are often wary of redirected payment pages, unclear fees, or questions about how data is handled. Local branding (like KNET) helps, as does having secure, familiar checkout screens.

Mistakes in callback/webhook configuration. Improper handling of transaction states. Mis-managing currency/locale differences. These can cause errors or rejected payments.

New rules (e.g., from the Central Bank) may require stronger AML/KYC, security features, or reporting. Gateways and merchants must monitor changes and ensure compliance.

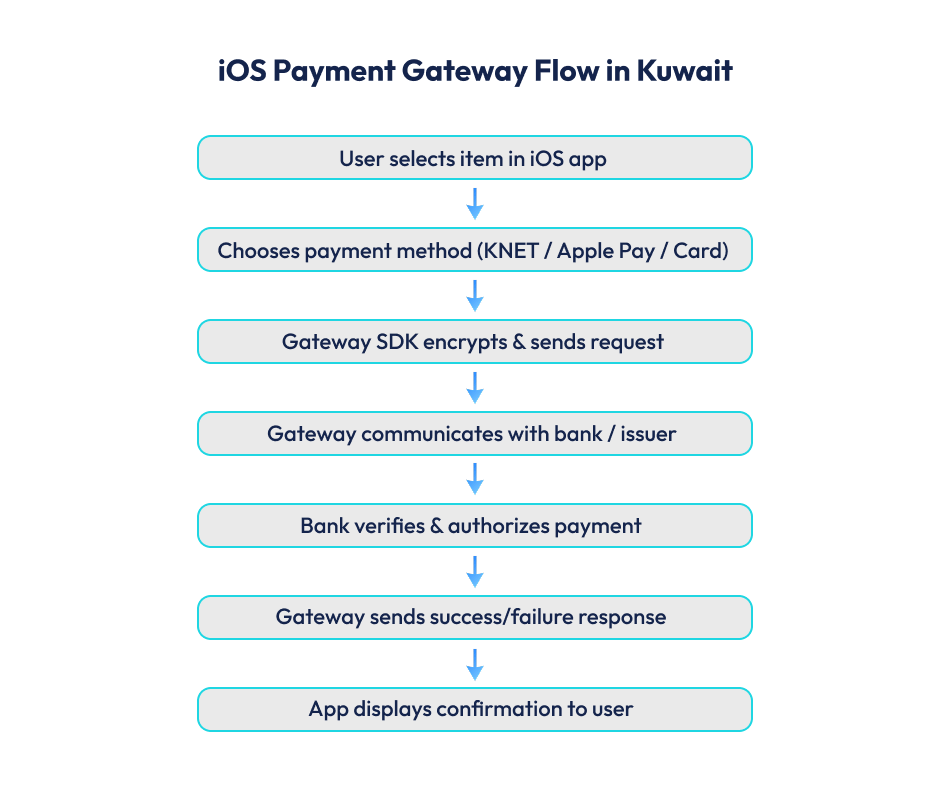

If you’re building for iOS, you’ll need SDKs. Sometimes extra work for mobile-friendly UIs, ensuring in-app purchase flows are smooth, approvals from Apple (if using Apple Pay), etc.

To build a payment gateway integration that’s reliable and future-proof in Kuwait, aim for:

Kuwait’s e-commerce and digital payments landscape is well served by both local and regional gateway providers. Below are some of the most prominent payment gateways operating in Kuwait today, and what makes them strong. Use this as a guide when choosing for your mobile app.

| Gateway | Key Features | Limitations |

| KNET | – Very widely used in Kuwait; trusted brand. – Supports debit (and sometimes credit/prepaid) cards issued by member banks. – Tightly integrated with Kuwaiti banks and central banking infrastructure – Good for payments in KWD without currency conversion issues. – Offers secure, PCI-DSS compliant processing. Risk management and encryption are built in. | – Only works in Kuwait (for KWD and local bank cards), which is fine for domestic sales. But limiting it if you plan to cross-border or global customers. – Some features like recurring billing, advanced auth/capture may not be supported (depending on the integration). – Redirect-based flows may affect user experience slightly compared to fully embedded/native flows. – Onboarding and compliance (bank account, license) can be stricter. |

| Tap Payments | – Licensed by the Central Bank of Kuwait as an Electronic Payment Service Provider. Ensures regulatory compliance locally. – Offers a wide range of payment methods – Local support & faster payouts for Kuwaiti merchants. – Useful if you want to cover both local & cross-border customers with a single integration. – Also provides POS terminals (in-store or on the go) powered by KNET for offline / in-store scenarios. | – Transaction fees may be higher than purely local debit card gateways, depending on the mix of payment methods. – Some features (like Apple Pay or alternative payments) may require additional setup or approvals. – For some merchants (especially smaller ones), licensing or bank/merchant documentation requirements can make the onboarding slower. |

| MyFatoorah | – Another Kuwaiti gateway/provider with strong regional reach, supporting many payment methods and multiple countries in the Middle East. – Offers detailed reporting and analytics, mobile-friendly checkout. Good for e-commerce sites wanting transparency & ease of use. – Recognized by the Central Bank of Kuwait (as Large e-Payment Service Provider). – Supports international cards & cross-border payments, useful if you want to sell beyond Kuwait. | – Costs may be on the higher side for certain transaction types (especially international cards). – Some merchants report more requirements in documentation/licensing. – The checkout flow and integration might require handling multiple payment options, currency conversion, etc., which adds complexity. |

| UPayments | – Local Kuwaiti payment gateway, licensed by Central Bank as a Large e-Payment Service Provider. Offers robust APIs and plugins for popular e-commerce platforms. – Competitive pricing on KNET transactions (very low %/transaction) with plans for different merchant sizes. – Offers a sandbox/test environment. Good for developer testing. – Variety of features like payment links, POS, etc. | – As with many local providers, certain high-volume or enterprise features may require custom negotiation. – Limited international reach compared to MyFatoorah/Tap if you want outside-Kuwait customers. – Some merchants might find support/documentation less mature depending on the payment method or scenario. |

| Hesabe | – Positioned for local businesses. Includes familiar payment methods like KNET + credit/debit cards. – Supports payment via POS, payment links & dashboard for tracking. – Provides localized customer experience & support. | – Fees for cards + fixed extra amounts (e.g. per card transaction) may be steeper vs pure debit-card gateways. – International transaction support/currencies might be more limited or costlier. – Onboarding/licensing requirements can be a barrier for small/unlicensed businesses. |

| Global Gateways (e.g. PayPal, 2Checkout, Apple Pay) | – Useful when you want to accept international customers, offer alternative payment methods (wallets etc.), and gain brand recognition. – PayPal is globally trusted. 2Checkout supports many payment methods and currencies. – Apple Pay integration adds convenience for iOS users where supported. – Some gateways may allow for simplified “payment link” style transactions for small setups. | – Currency conversion fees, cross-border transmitter fees, and lower acceptance of KWD or local payment methods can reduce margins. – May have policies/regulation constraints (e.g. business license requirements) in Kuwait. – For local users, local methods like KNET tend to have better trust/tracking. – UX may degrade if redirecting outside of local trusted flows. |

Now the real question might be,

How to choose among these gateways?

These are a few deciding factors to help pick what works best for your business or app:

When it comes to mobile commerce in Kuwait, iOS apps dominate the premium user segment. With iPhone penetration in Kuwait being one of the highest in the GCC, businesses cannot afford to overlook how well their payment gateway integrates into iOS applications. A seamless iOS checkout can directly boost conversions, while a clunky one can drive customers away.

Techugo, as a top mobile app development company since 2014, believes that the right payment gateway is the backbone of trust in your e-commerce journey. Having partnered with businesses across Kuwait and beyond, our team ensures that every integration aligns with your business goals.

Learn how we help businesses choose the right gateway for robust app development:

Techugo integrates PCI-DSS-compliant gateways with advanced encryption. Tokenization and 3D Secure to safeguard your users’ data and transactions.

Whether it’s KNET for local trust or multi-currency support for global expansion. We ensure your app covers both domestic and international audiences.

From one-click checkouts to Apple Pay integration for iOS apps. We focus on minimizing friction so your customers never abandon their carts.

Also Read – Learn the iOS App Development Process

Our developers leverage the best SDKs and APIs to implement Stripe or others to ensure smooth, scalable integration tailored to iOS and Android.

We guide businesses toward gateways that offer quick settlement cycles. Helping you manage cash flow efficiently and reinvest in scaling your e-commerce platform.

When we build e-commerce apps meant to scale over 3-5 years in Kuwait, we focus on:

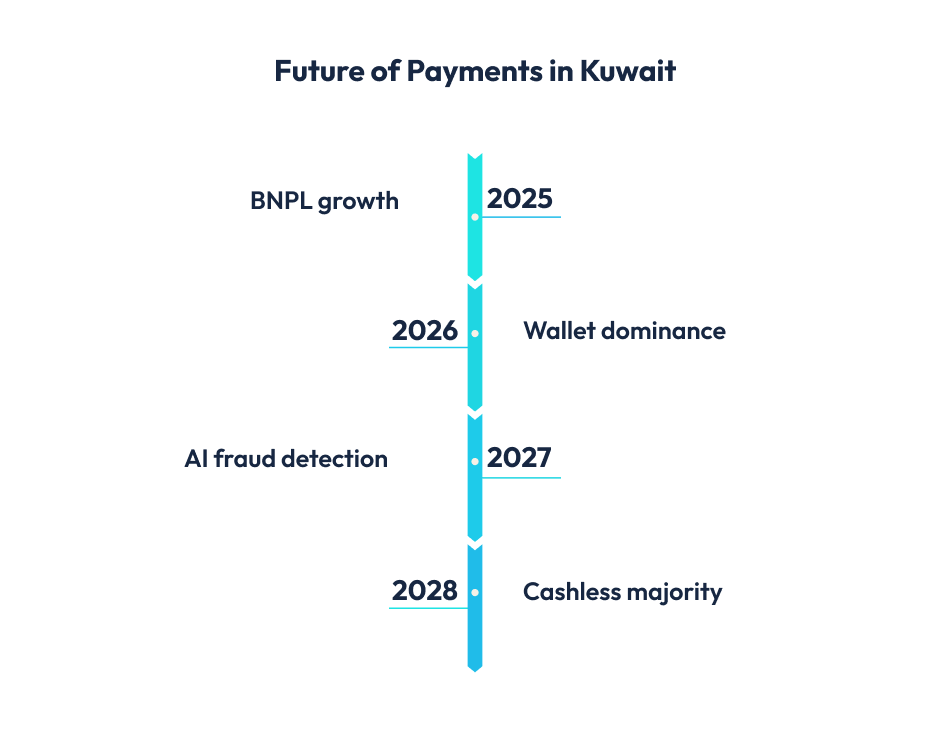

Kuwait is in the midst of a payments revolution. As e-commerce grows, consumer habits are shifting. Regulators are stepping up, and new technologies are pushing for more convenience. If you’re building or planning an app, it’s worth knowing what’s coming next in payment gateways.

Future of Payments in Kuwait

Timeline infographic showing:

Key trends to watch:

BNPL is becoming one of the fastest-growing payment methods in Kuwait, driven by younger consumers seeking flexibility.

The Central Bank of Kuwait (CBK) has recognized this trend. Its updated regulations for electronic payments include provisions to supervise BNPL services, ensuring consumer protections and controls are in place.

The CBK has rolled out stronger rules for e-payment providers (including payment gateways, e-money institutions, etc.). Focusing on:

For example, regulations now require tighter control on card transactions via websites when there is no OTP, setting daily limits and requiring customers to be able to adjust these limits via their bank’s digital channels.

Contactless payment adoption is very high in Kuwait. Visa reported tokenization penetration around 92% by December 2024, among the highest in the GCC. Contactless/card-tap or “pay via wallet” features are becoming expected rather than nice-to-have.

Google Pay has been introduced with Mastercard. Local banks are activating support for Google Wallet. This shows that mobile wallet / NFC payment options are becoming more mainstream.

Roughly 24% of transactions are still done in cash in Kuwait. So gateways and app developers need to offer hybrid options or ensure convincing incentives for customers to go digital.

CBK is enhancing payment systems (e.g. continuous improvements in the Automated Settlement System, governance for e-payment licensing, regulatory instructions) to make the payment backbone more robust.

More fintechs are being licensed, and more payment-solution providers are being registered. Innovation is being encouraged, but under stricter oversight.

80% of people in Kuwait trust digital payments, and many expect to use them even more over the next year. Security features like OTP, tokenization, and strong authentication will become more of a requirement than an option.

The cost to integrate a payment gateway in Kuwait depends on the provider and your app’s requirements. Generally:

The most widely used payment gateway in Kuwait is KNET, trusted by almost all local shoppers for secure transactions.

Yes. Apple Pay is supported in Kuwait through banks and licensed gateways like Tap and MyFatoorah, making it easy for iOS app users to pay securely.

For iOS apps, Tap Payments, MyFatoorah, and KNET are popular as they support Apple Pay integration and comply with Kuwait’s Central Bank rules.

Yes. Gateways like Stripe and PayPal can be used, but for maximum adoption, businesses must also integrate local options like KNET.

Payment gateways are the backbone of Kuwait’s e-commerce growth. Enabling secure, seamless, and trusted transactions. From KNET to Apple Pay and BNPL solutions, businesses that integrate the right gateway into their apps gain a clear competitive edge.

Techugo’s expertise in robust app development and payment integration helps you deliver checkout experiences that win customer trust and drive long-term growth.

Write Us

sales@techugo.comOr fill this form