Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Super apps bundle multiple everyday services into a single interface, and are taking the world by storm, like WeChat in China or Grab in Southeast Asia. Users can chat with friends, book rides, order food, pay bills, and even access banking, all in one place. This model provides immense value to both users as well as businesses.

The super app market is growing rapidly…from tens of billions today to hundreds of billions in the future. For example, industry estimates peg the global super app market at approximately $96.8 billion in 2024, with a robust annual growth rate of 28.2% projected until 2032.

Global super app market is expected to swell to over $706 billion by 2032, fueled by mobile internet access, e‑commerce, AI-powered super app features, and digital payments.

If you’re an investor, an enterprise, or any business, continue reading to explore benefits as well as market opportunities in super app development like Yassir.

Super apps have caught fire in Asia and are now spreading globally. Research shows super apps’ global market will reach $426 billion by 2030 (growing 28% per year), and may hit $706 billion by 2032. Key drivers include more smartphones, fast internet, and demand for one-stop convenience.

Modern consumers love all-in-one solutions. Instead of juggling a dozen apps, people spend hours each month inside a single super app. Like, in China 1.35 B+ people use WeChat every month because they enjoy the smooth experience of signing in once to access banking, shopping, mobility and more.

Advances in AI, blockchain and payments are fueling super apps, like, AI-driven personalisation, which keeps users engaged, while digital wallets and QR code payments make transactions frictionless. Super apps also frequently integrate financial services, unlocking massive new revenue from once-unbanked populations.

For companies and investors, super apps are appealing because they create ecosystems – one platform that captures and retains customers across many needs. Key benefits of super apps for businesses include:

A super app is a marketplace of mini-services, making it easier to attract users who can convert to paying customers. By offering one app for many needs, businesses cast a wider net. In effect, the platform tailors the experience to each user, driving more sign-ups.

When users can do everything in one app, they tend to stay longer. For example, users don’t need to “leave” the app to use a different service, so engagement soars and churn falls. This stickiness translates directly to higher lifetime value – the more services you offer in-app, the more people rely on it daily.

Building a super app often means developing a core platform that others (internal teams or partners) can plug into. This modular approach (with “mini-apps” or applets) lets small teams work independently, reducing complexity. It can speed up releases and lower development conflicts. Moreover, a well-architected super app loads only what’s needed on demand, improving performance and security.

Although a super app can be complex, it often becomes more cost-effective over time. You’re maintaining one central platform instead of many separate apps. This consolidation means a smaller total team and infrastructure, reducing long-term maintenance costs.

Perhaps most importantly, a super app creates many monetisation opportunities…

In short, opening your app to partners and users across services lets you collect fees in multiple ways.

Ankit Singh, COO, Techugo, says –

“Super apps’ all-in-one experience is its biggest USP, and it is “almost bound to succeed” as it meets daily needs in one place, which businesses can then capitalise on. If you plan strategically with an experienced development team, you can surely yield significant returns with super app development.”

Before investing in super app development like Yassir, this question often arises – How do super apps make money?

So, many super apps start with one anchor service, mostly with messaging or ride-hailing, to build an audience, then layer on additional services. So the super app business model can follow 2 paths:

Focus first on user growth and daily usage (e.g. WeChat started as a chat app), then gradually add monetisation (payments, games, advertising). This builds massive user loyalty first.

Start monetising early (e.g. fees, advertising) and ensure revenue from day one. Some apps use a mix – for example, Grab balances ride commissions with later rollouts of financial products.

Revenue sources: In practice, super apps make money in many familiar ways, but on a bigger scale:

Business models and revenue streams for super apps: these platforms “monetise easily” by charging transaction commissions, selling ads, and more (for example, WeChat charges businesses for ads and takes cuts from driver fares and restaurant orders).

One of the hottest recent examples is Yassir, a super app born in Algeria. Yassir was built from the ground up as an all-in-one platform for North and West Africa. It started with ride-hailing and expanded into food and grocery delivery (Yassir Express), and is now moving into payments and e-commerce.

Some highlights:

Yassir succeeded by zeroing in on local needs (serving Francophone Africa) and executing the super app model perfectly. It went from zero to a multi-service ecosystem with millions of users and has earned a reputation as “indispensable” for daily tasks.

The Middle East and North Africa (MENA) region is particularly ripe for super apps:

Large, growing user base. As of 2021 there were over 300 million mobile internet users in MENA, driven by young, urban populations. Smartphone adoption and 4G/5G infrastructure are surging.

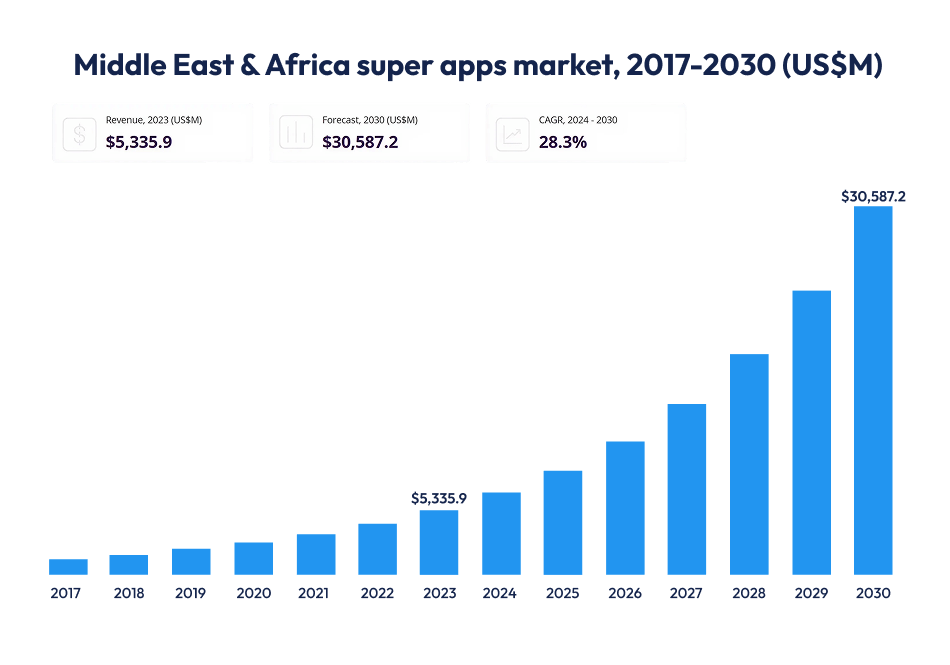

Projected growth. The Middle East & Africa super app market is still relatively small but growing fast. It was about $5.34 billion in 2023 and is expected to reach $30.6 billion by 2030 (roughly a 28% CAGR). The chart below illustrates this explosive rise.

Source: Grand View Research

Super app market projections for Middle East & Africa: from $5.34B in 2023 to over $30.6B by 2030 (CAGR 28%).

Despite high smartphone penetration (e.g. 99% in UAE, 95% in Saudi Arabia), the region currently has no single dominant super app. Most services are still siloed in separate apps. This fragmentation means savvy companies have a chance to consolidate many services. Local telecom operators (like e&, stc, Ooredoo) and startups are already exploring this. In fact, experts note that GCC telcos have broad digital footprints and could pioneer the region’s first true super apps.

Governments in the region are actively promoting digital economies. Initiatives like India’s UMANG app (20,000+ public services in one place) show how policy can back unified platforms. Consumers are accustomed to all-in-one digital experiences (for example, the widespread use of apps like Careem in the UAE and ride-hailing elsewhere).

All in all, MENA offers a “greenfield” super app market. Yassir’s success in North Africa is a proof point, but there’s still much room to grow (Yassir’s CEO himself says they’re “just scratching the surface”). For investors and entrepreneurs, this means huge untapped demand for – the Middle East’s digital future will likely include super apps that handle everything from mobility to payments under one roof.

Super apps represent a powerful trend in mobile technology. They offer convenience for users and multiple growth levers for businesses.

As seen with giants like WeChat and emerging stars like Yassir, the model can create huge engagement and revenue.

With the global market booming (especially in Asia and increasingly in MENA), investing in a super app now can position you at the forefront of the digital economy.

Techugo, being an experienced global mobile app development company with a strong delivery experience across the UAE, Dubai, Middle East and USA, helps businesses and investors turn super app development into profitable platforms.

Because super app development like Yassir is not just about stacking multiple features into one product. It’s about creating a flexible ecosystem that can scale, monetise, and adapt to user behaviour over time, and that’s where Techugo excels with its custom mobile app development services. Here’s how Techugo supports your super app journey:

Yes, it can be highly profitable once scaled. Major super apps have demonstrated huge revenues and improving profits. For example, Grab (ASEAN’s biggest super app) reported 48 million monthly users and a $136 million Adjusted EBITDA in Q3 2025 (its 15th straight quarter of profitability gains). Tencent (WeChat’s parent) saw revenues of $84.6 billion in 2023. In general, the diversified revenue streams (commissions, ads, fintech) mean that successful super apps often produce high returns. In emerging markets, even modest market share can translate into big profits because the user base and transaction volumes are so large. (Tip: focus first on user growth and engagement; profits usually follow after reach is built).

Simply put, super apps are the future of mobile ecosystems. They are a one-stop platform for users’ daily needs – which means they see far higher usage and loyalty compared to single-service apps. For businesses, owning a super app means controlling a larger slice of the customer’s life and wallet. Investors are excited because the market is enormous and growing fast (global CAGR 28%) and because the model allows cross-selling and network effects. If you build a good super app, you leverage every additional service to add value: users who come for ride-hailing might stay for food delivery, payments, e-commerce, etc. In uncertain times, a super app’s efficiency and ecosystem lock-in can make a company more resilient. Basically, you “achieve more doing less” by expanding an integrated platform instead of many standalone products.

Developing a full-featured super app is a significant investment, though costs vary by region, features and complexity. Industry estimates suggest a basic MVP (minimal viable product) super app can cost on the order of $30,000–$60,000, while a fully customised, multi-feature super app might range from $100,000 up to $250,000 or more. Factors like multi-language support, payment integration, and advanced AI features can push costs higher.

Yassir’s success boils down to smart execution and local focus. It started with the services people needed most (rides and deliveries) and did them well, quickly growing a captive audience. In Algeria, 60% of all on-demand bookings happen through Yassir – that’s dominance. It then leveraged this user base to expand into neighbouring countries and new services (e.g. Yassir Cash for payments).

Importantly, Yassir tailored its strategy to its market: in regions with low banking trust, it used everyday convenience to win users’ trust before introducing financial services. Strong funding ($193M raised) and partnerships (100k+ drivers and merchants onboard) have given Yassir the muscle to execute its vision. In short, Yassir combined an all-in-one platform with a deep understanding of its users – exactly what great super apps do.

Write Us

sales@techugo.comOr fill this form