Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Over the last few years, the software market in Saudi Arabia has moved from a support function to a growth engine. Businesses, government bodies, as well as enterprises – all are investing heavily in technology to grow quickly, to advance their operations, and to stay competitive as well.

That’s why the IT market in Saudi Arabia is growing at a pace that nobody was expecting, and this demand has mainly surged due to the digital transformation in Saudi Arabia and Vision 2030. That’s the main reason why Riyadh is emerging as a hub for AI tech software development companies in Saudi Arabia.

To understand where this growth is heading, let’s first look at the current size of the software development market in Saudi Arabia. And also understand how businesses can take advantage of this expanding market.

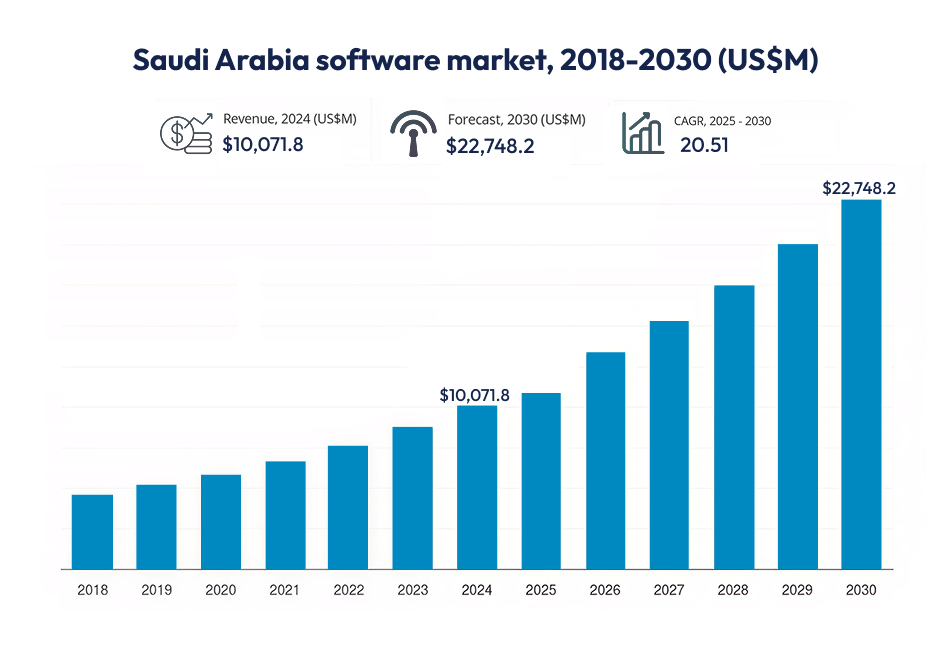

Source: Grand View Research

Businesses from various industries are investing largely in digital systems to support daily operations as well as growth in long-term. This has made software a core part of the wider IT market in Saudi Arabia, rather than just a support function.

As per Grand View Research, the Saudi Arabia software market has generated USD 10,071.8 million in revenue in 2024 and it is expected to reach USD 22,748.2 million by 2030.

Today, the software development market in Saudi Arabia includes

For example, Saudi Aramco recently upgraded its digital platforms to manage operations and data more efficiently. STC (Saudi Telecom Company) has also recently launched new cloud-based solutions. Their motive was to support businesses across the country to show how enterprises are quickly adopting modern software.

Private companies in Saudi are also moving away from manual processes, leaving traditional systems, and starting to adopt modern software so that they can improve efficiency, productivity, and decision-making.

So the demand for software development in Saudi Arabia is not just coming from government-backed organisations, but also from both private companies. Because everybody is planning for long-term…not short-term trends.

With continued digital transformation in Saudi Arabia and increasing technology investment, the market is expanding at a consistent pace, and this growth is setting the foundation for a much larger and more mature software ecosystem in the coming years.

Let’s see the major factors driving this growth…

So many companies and government bodies are actively replacing old systems and adding modern digital tools to update themselves, to be competitive in the market, to improve efficiency, and to make quick decisions. So, yes, digital transformation in Saudi Arabia is happening in both real businesses as well as public services.

It can be said that digital transformation in Saudi Arabia is not limited to any one specific service or industry. Every industry and service in KSA is undergoing digital transformation, with the main focus being to modernise their existing processes and operations and provide better services by using various types of software, AI tools, and technologies…and this justifies the rapid growth of the software market in Saudi Arabia.

As everyone knows, Saudi Arabia’s Vision 2030 is a major force behind the country’s digital transformation and software market growth; that’s why technology and software are the core of this plan to achieve goals.

These initiatives or this much focus on tech-led development under Vision 2030 is one of the big reasons why the software development market in Saudi Arabia is growing rapidly and attracting global attention.

Not just the government but private sectors are also putting funds into modern IT infrastructure and innovative software solutions, and increasing growth in Saudi Arabia’s software market.

If you know, STC has invested heavily in cloud platforms and enterprise software solutions. Similarly, venture funds and private investors are also supporting startups started around AI, fintech, and healthcare tech.

Investment is increasing, creating a market for software development companies to thrive and succeed in. This is undoubtedly why Riyadh is becoming a hub for AI tech software development companies in Saudi Arabia.

There are some of the world’s most ambitious smart city projects being built in Saudi, and software is at the heart of them. To efficiently manage transportation, energy, healthcare, and public services efficiently, NEOM and smart districts in Riyadh are using advanced platforms.

Since these projects rely on strong digital infrastructure, so, there is a good need for cloud systems, IoT networks, and real-time data platforms, and this increases the demand for enterprise software, AI solutions, and apps that can support large populations and complex operations.

As Saudi Arabia is investing in smart cities and robust infrastructure, it is not only modernising urban life but also fueling the software development market in Saudi Arabia; both local and global software companies have a huge opportunity to grow.

As Saudi businesses expand and modernise, the need for enterprise software is rising rapidly. Companies across finance, healthcare, retail, and logistics are adopting platforms that help manage operations, improve efficiency, and support decision-making.

For example, Saudi Aramco and STC have implemented large-scale enterprise solutions to streamline workflows and integrate data across departments. Even smaller enterprises are moving to cloud-based tools and SaaS platforms to stay competitive.

This growing demand is a major driver for the software development market in Saudi Arabia, encouraging investment in custom solutions, AI integration, and scalable digital systems.

AI is already solving real problems, hence, businesses are obviously using AI software development to automate tasks, analyse huge amounts of data, and make decisions smartly and quickly. Like banks are using AI to detect fraud instantly. Doctors use AI to predict patient needs and improve care. These solutions don’t just save time; they reduce errors and make work more meaningful. The rise of enterprise AI solutions shows that companies are ready to invest in smarter software that actually helps people do their jobs better.

A big challenge Saudi organisations face is that many off‑the‑shelf AI models don’t understand Arabic dialects or cultural subtleties, hence, they demand for locally trained AI models and custom development, not just plug‑and‑play AI. This is why companies aren’t just using global AI platforms; they want AI that speaks their language literally and figuratively.

Most Saudi firms are not adopting AI for “innovation’s sake.” They’re applying AI to very specific operational pain points like – invoice reconciliation, predictive maintenance in factories, and optimising last‑mile delivery…not just generative content bots.

Especially in finance and healthcare sectors, leaders demand AI systems that can explain their decisions (not just predict), and demand for custom AI development with strong governance and auditing features…this is a nuance that is rarely captured.

Moving to the cloud is, of course, about saving space on servers but it is also about flexibility, speed, and collaboration. Companies can access their systems from anywhere, scale as they grow, as well as integrate different tools without headaches. In Saudi Arabia, there are huge opportunities for cloud software development, especially for businesses that want scalable solutions without overcomplicating IT.

There are many organisations that can not shift everything to the public cloud due to compliance and data residency requirements, instead, they can adopt hybrid cloud, which is a mix of on‑premises + cloud services. This increases demand not just for cloud software, but orchestration platforms, secure connectivity layers, and integration services.

CFOs in Saudi firms are reluctant to budget for traditional IT with unpredictable upgrade and support costs. SaaS paired with cloud infrastructure gives predictable OPEX spend…not just tech flexibility. Financial predictability is a real, practical driver.

Software-as-a-Service (SaaS) is changing how companies pay for and use software. Instead of buying expensive licenses or managing servers, they can subscribe to tools that work immediately and update automatically.

From project management apps to enterprise-grade HR and finance systems, SaaS helps businesses of all sizes focus on growth instead of IT headaches. In Saudi Arabia, SaaS adoption is growing fast because it’s practical, cost-effective, and easy to scale.

Many SaaS tools used in the West lack support for key local requirements such as Zakat/GCC tax reporting, Arabic UI, Hijri calendar workflows, and region‑specific financial standards. This has birthed demand for region‑aware SaaS companies, not just global players.

Saudi enterprises are not buying SaaS apps for stand‑alone use. They want them integrated with ERP, HR systems, payment gateways, and legacy databases. Custom connectors, middleware, and integration layers matter more than the SaaS tools themselves.

Due to risk policies in sectors like energy and banking, vendors with ISO/IEC 27001, SOC 2, or local Saudi data compliance win over cheaper competitors.

Building software in Saudi Arabia is not about following a rigid development checklist. It’s about making the right strategic decisions early, especially in a fast-growing and regulation-driven market.

Businesses should approach software development with the following priorities in mind:

Choose a partner who understands Saudi regulations, data compliance, Arabic-first users, and Vision 2030 objectives. Local market understanding matters as much as technical capability.

Software should solve real operational or growth challenges. Clear goals—such as efficiency, automation, customer experience, or AI-driven insights—must come before technology discussions.

Software for the Saudi market should support Arabic interfaces, regional workflows, government system integrations, and sector-specific compliance requirements. One-size-fits-all tools often fall short here.

As the Saudi Arabia software market expands, systems must be flexible enough to support cloud adoption, AI integration, and business growth without costly rework.

Businesses should ensure new software can integrate smoothly with existing ERP systems, cloud platforms, payment gateways, and legacy tools.

Successful software is not a one-time build. Continuous updates, security, optimisation, and performance improvements require a long-term technology partnership.

Many Saudi businesses are facing a familiar problem, i.e., systems don’t talk to each other, traditional tools slow teams down, and off-the-shelf software feels restrictive. Plus, most importantly, finding the right tech partner often takes longer than expected. This is why, in 2026, Saudi businesses are seriously looking for long-term technology partners…not just to build software, but to fix what’s not working.

In reality, businesses want software that fits their processes, respects local regulations, scales with growth, and actually gets adopted by their teams…easily. They want a partner who understands the pace of change in Saudi Arabia and doesn’t disappear after delivery.

That’s where Techugo, as an experienced software development company in Saudi Arabia, comes in and supports. Working since 2015, businesses in Saudi Arabia partner with Techugo because its team listens first, and focuses on understanding real pain points, whether that’s integrating systems, adopting AI responsibly, or moving safely to the cloud. Saudi businesses partner with Techugo for because they need –

More importantly, Techugo works as a long-term technology partner. A partner that supports growth, adapts as needs grow, and helps teams feel confident about the software they use every day.

In a quickly growing software market like Saudi Arabia, that kind of trust and clarity matters more than ever. Are you ready? If yes, partner with Techugo, your trusted partner in custom software development in Saudi Arabia.

Saudi Arabia’s software demand is coming mainly from government, healthcare, fintech, retail, logistics, and most importantly from real estate industry because these sectors are under pressure to adopt AI and digital transformation to modernise their operations and processes, to stay compliant, and grow safely. Off-the-shelf tools often fail here, that’s why many businesses in Saudi Arabia, no matter what their industry or service is, turning to custom software development in Saudi Arabia.

Every entrepreneur, every business, every organisation is running towards achieving the goal for Vision 2030 as this plan is pushing every sector to adopt AI and automation and to make decisions that are backed by data. For businesses, this means they need new AI tools, custom software and mobile applications, cloud and SAAS-based solutions. As a result, the software development market in Saudi Arabia is growing around long-term platforms, not short-term tools.

Most of the businesses in Saudi want to hire international software development companies or they outsource custom mobile app developers in Saudi Arabia on a contract basis, as these companies offer you a team that possesses years of regional experience, skills, and knowledge of Saudi culture and business market. Local compliance matters, but so do scalability, AI expertise, and delivery maturity. The right custom software development company providing software development services in Saudi Arabia must understand Saudi regulations, Vision 2030 goals, and global tech standards as well…not just one of them. So the short answer is – it depends on the company’s past experiences in similar projects, portfolio, team and its expertise, reviews and ratings on different platforms.

Costs vary based on complexity, AI integration, and security needs. On average, a simple software or MVP starts around SAR 30-75K, a mid-level custom system ranges between SAR 75-200K, and large/enterprise solutions can go upto 700K or more. Many businesses struggle with hidden costs later, which is why clear architecture planning matters more than the initial quote.

Off-the-shelf tools break when businesses scale, and Saudi enterprises need software that fits local workflows, Arabic-first users, integrations with government systems, as well as future AI upgrades, which is most important. Custom software offers control, security, and long-term ROI…key reasons driving enterprise software adoption across Saudi Arabia.

Saudi startups now have access to funding, cloud infrastructure, as well as AI-ready platforms, but the challenge is speed and focus. If startups and SMEs take software development services in Saudi Arabia, they can build and launch their software quickly, which is aligned with Vision 2030 and avoid tech debt. The future of software development in Saudi Arabia is massive and full of benefits, and the software market is expected to reach USD 22,748 million by 2030.

Write Us

sales@techugo.comOr fill this form