Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

The world of online shopping in the Middle East is having a major moment.

Think of it like this. Forget those old-school trips to the store. The glitzy digital marketplaces in Dubai are going crazy with on-demand buying in Riyadh. This region is now the go-to place for incredible eCommerce apps.

These new shopping apps use clever tech. We’re talking about AI-powered tools and chatbots in the UAE. What do they do? They give you super personalized recommendations. They predict what you want to search for. They offer instant customer help. Basically, they make traditional retail feel really old.

Since everyone is glued to their phones, businesses are jumping on board. They’re working with top mobile app developers across the region. Their goal? To create sleek, innovative online shopping apps that can actually stand out.

If you’re a startup or enterprise planning for eCommerce mobile app development in the Middle East, these platforms are more than shopping destinations. They’re real-world case studies. Each app reflects how AI, UX, logistics, and regional behaviour come together to build scalable ecommerce products.

In this deep dive, we’ll look at the top eCommerce apps in Middle East and what it takes to build a stable, AI-ready retail platform that truly makes sales. You’ll also know the cost to develop an eCommerce app.

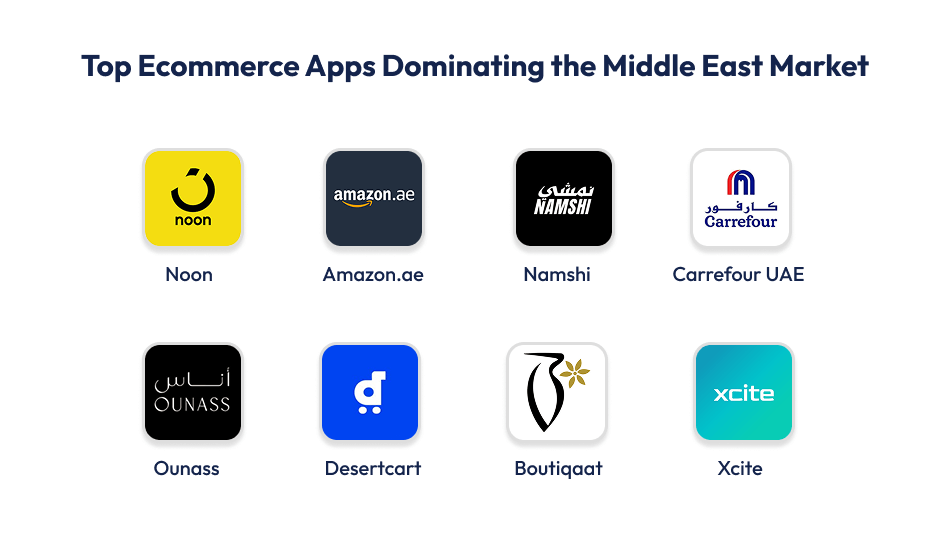

Meet the top 8 ecommerce players in the Middle East that are raising the standards of commercial operations in the region.

Noon was founded in 2016 by Mohamed Alabbar and backed by the Public Investment Fund (PIF) of Saudi Arabia. The platform officially launched in the UAE on 30 September 2017. In Saudi Arabia by December 2017. Headquarters span Dubai (UAE) and Riyadh (KSA), reflecting its pan-GCC focus.

App downloads: 10+ million

Registered users: 30+ million

Quarterly data (Q1 2024): Downloads rose from 79 K to 84 K and active users from 1.2 million to 1.5 million

Revenue: Estimated at over $2.5 billion in annual revenue as of 2025.

Features:

Mobile App Development Potential:

Noon is a strong reference point for ecommerce app development in the Middle East. Its success shows how Arabic-first UX, region-specific offers, and AI-powered personalization help scale a mobile shopping app across the GCC. For businesses planning mobile app development in UAE or Saudi Arabia, Noon highlights the need for a logistics-ready backend and modular architecture that can support millions of SKUs and high daily order volumes.

The platform launched in the UAE when Amazon.com, Inc. rebranded its acquisition of Souq.com and inaugurated Amazon.ae on 1 May 2019. The entry leveraged Amazon’s global infrastructure and Souq’s regional footprint. Together they established a strong foothold in the GCC ecommerce space.

While specific UAE-only download numbers are scarce, the iOS version lists 4.3 ratings. On Google Play, the global Amazon Shopping app has 500M+ downloads and a rating of 4.4.

Regionally, a 2021 estimate indicates Amazon commands 46% share of UAE online shoppers.

The launch in 2019 boasted over 30 million products available at launch.

Amazon.ae has invested in micro-fulfilment and logistics infrastructure to ramp speed and service levels in UAE. This is an indicator of aggressive investment rather than just incremental growth.

Features:

Mobile App Development Potential:

Amazon.ae demonstrates how global ecommerce platforms must localize mobile app development for Middle Eastern markets. Features like cash-on-delivery, AED pricing, and ultra-fast delivery depend on scalable cloud infrastructure and automation-led ecommerce app development. Startups building apps like Amazon.ae need strong API integrations, micro-fulfillment support, and AI-driven customer experience layers.

Namshi was founded in 2011 (or sometime between 2011-2012) in the UAE and across the GCC region. The platform focuses on fashion and lifestyle e-commerce, serving the GCC:

Namshi has achieved approximately 25 million app downloads, with around 4 million monthly active users.

Features:

Mobile App Development Potential:

Namshi offers valuable insights for fashion-focused ecommerce app development. Its mobile-first design, AI-based product recommendations, and BNPL integrations show how UX, fintech, and personalization directly impact conversions. For startups exploring mobile app development in the GCC, Namshi proves that performance optimization and visual discovery are critical for lifestyle ecommerce apps.

Carrefour first entered the UAE in 1995. Majid Al Futtaim operates the franchise here.

Majid Al Futtaim Retail launched a major digital presence in April 2020. This included the carrefouruae.com website and a mobile app. The goal was to take their huge in-store catalog online. This move fits the trend of “convenience commerce” in the Middle East. It combines Carrefour’s physical strength with an easy mobile experience.

In June 2024, Majid Al Futtaim confirmed its digital platforms were unified under the Carrefour brand. Their various online brands now serve over 15 million monthly online customers across the Middle East.

An online fulfillment center was opened in Al Garhoud, Dubai. This center was necessary due to the surge in demand during 2020. It spans 5,000 m². This location processes up to 3,000 orders daily. These orders cover both grocery delivery and non-food items. The platform boasts a massive product range with more than 500,000 food and non-food products.

Carrefour also boosted its payment system. A partnership with Checkout.com helped integrate their payment options. This supports their massive online customer base of more than 15 million monthly shoppers.

Gross Merchandise Value (GMV) grew to AED 2.7 million in a measured period. This is a design-agency case‐study figure rather than a full corporate disclosure.

Features:

Mobile App Development Potential:

Carrefour UAE reflects how omnichannel ecommerce apps are built at scale. Real-time inventory sync, AI-powered audience tracking, and one-click checkout highlight the importance of data-driven mobile app development. Businesses planning ecommerce app development in UAE can learn how to integrate physical stores, logistics systems, and digital platforms into one seamless mobile experience.

Ounass was launched on 15 December 2016 by Al Tayer Insignia LLC as an exclusively digital luxury e-commerce platform. Positioned as “the Middle East’s Definitive Home of Luxury”, the platform focuses on high-end fashion accessories and home-ware.

Users registered: 4+ million monthly active users

Rating on iOS app store: 4.7

The platform has recorded around US $32 million in online revenue (GMV) in 2024 for its UAE domain. It reported growth of 35% year-on-year in a 2024 press feature. An average order value of around US $550 and ultrafast delivery (average 89 minutes).

Features:

Mobile App Development Potential:

Ounass sets a benchmark for luxury ecommerce app development in the Middle East. Its focus on premium UI, hyper-fast delivery, and personalized shopping journeys shows how high-end mobile apps rely on performance stability and personalization engines. Brands targeting premium users must invest in refined UX, scalable infrastructure, and AI-driven recommendations.

Desertcart was founded in 2014 in the UAE by Rahul Swaminathan, with headquarters in Dubai. The catalogue size is estimated at over 100 million products across 100+ countries. Monthly visits to its UAE domain were cited at around 3.8 million. As of 2025 the “Pro” member count is over 30,000 subscribers.

In 2025, Desertcart reported having delivered over 1 million items in the region, representing 70% year-on-year growth.

Features:

Mobile App Development Potential:

Desertcart showcases the technical depth required for cross-border ecommerce app development. Managing international catalogs, customs workflows, and global logistics highlights the need for robust backend systems. For businesses building AI-powered ecommerce apps in the Middle East, Desertcart proves the value of scalable product management and automated order processing.

Boutiqaat was founded in 2015 and is headquartered in Kuwait with regional expansion in Dubai. The platform positions itself as a social-commerce hub for fashion products in the GCC. It offers virtual boutiques for celebrities and influencers to curate product selections for their followers.

App downloads: 2+ million

App rating: 4.6 rating with 55.8K ratings.

In a 2021 report, Boutiqaat was in funding talks to raise between US $100 m and US $150 m. The business is heavily influencer-driven. The model allows influencers to set up shops through Boutiqaat, which handles transactions and fulfilment.

Features:

Mobile App Development Potential:

Boutiqaat illustrates how social commerce is reshaping mobile app development in the GCC. Its influencer-led model blends content, community, and checkout into one flow. Startups building ecommerce apps can replicate this approach by integrating creator storefronts, social engagement features, and seamless in-app purchasing experiences.

Xcite is the electronics-retail brand of Alghanim Industries, positioned as a major multi-brand electronics and home appliances retailer in Kuwait. The brand launched its dedicated mobile app and e-commerce presence as part of its digital retail expansion.

On Google Play, the Xcite app shows 1M+ downloads.

According to a case study, Xcite serves a customer base exceeding 3.5 million users. Operating across over 10,000 products and 300+ global brands.

In its AI-CRM implementation, Xcite grew its CRM-driven revenue share from 8% to 25%. Achieved a 175% increase in average revenue per user. Highlighting the strong monetisation of its app and digital channel.

The product range spans more than 10,000 items across 16 categories. Reflecting a diversified electronics vertical rather than pure fashion/retail.

Features:

Mobile App Development Potential:

Xcite highlights how AI-driven CRM and personalization enhance ecommerce app performance. Its mobile app development strategy focuses on upselling, user segmentation, and omnichannel experiences. Electronics retailers planning ecommerce app development in the Middle East can learn how AI-powered customer journeys drive higher revenue per user.

AI is transforming ecommerce into a hyper-personalized retail experience.

Smart recommendation engines now anticipate what users might want before they even search. Adaptive pricing models dynamically adjust offers based on buyer intent and browsing patterns. Voice and image search features have made online shopping more fun!

Several leading apps with AI chatbot for shopping UAE have redefined customer engagement through intelligent conversational interfaces:

AI’s predictive muscle enables ecommerce brands to forecast demand, optimize inventory, and prevent out-of-stock situations. With real-time insights into user behavior, businesses can predict shopping peaks, automate reordering, and personalize promotional timing. Such data-backed agility is what separates AI-powered ecommerce apps in the Middle East from their traditional counterparts.

Behind these innovations stand top-tier mobile app development companies in Dubai. They craft AI-powered ecommerce apps that are high-performing. Firms like Techugo are pioneering this shift, delivering tailored solutions that combine:

By leveraging the expertise of a top ecommerce app development company, businesses can streamline operations. All while controlling the app development cost in UAE for maximum ROI.

Launching a digital retail platform across the Middle East? The app development cost in UAE becomes a decisive factor in aligning innovation with the budget strategy. Thus, the price tag is not just a figure! It’s a capital investment in long-term brand value.

| App Type | Key Inclusions | Estimated Cost |

| Basic Online Shopping App | Product listings Cart Payment gateway integration User login | $30,000 – $50,000 |

| Mid-Tier Ecommerce App | Real-time tracking Loyalty program Multi-vendor setup | $60,000 – $90,000 |

| AI-Powered Ecommerce App | AI chatbot Personalized recommendations Predictive analytics AR/VR features | $100,000 – $150,000+ |

Partnering with a mobile app development company in Dubai ensures not just cost efficiency but market-aligned product engineering. Companies like Techugo lead this transformation by combining AI and agile development to craft user-first ecommerce ecosystems.

How does Techugo stand out as a mobile app development company?

Q1. Which are the most popular ecommerce apps in the Middle East?

Some of the top-performing ecommerce apps with regional trust in the Middle East include:

Q2. How much does it cost to develop an e-commerce app in UAE?

The typical cost is between $30,000 and $150,000+. It all depends on how complex the app is. Factors like integrations and AI features drive the price. Apps with things like AI chatbots, real-time tracking, or multi-vendor support cost more. Development by a top Dubai company also places the cost at the higher end.

Q3. What technologies power AI based shopping apps in the Middle East?

Modern AI apps use a combination of powerful technologies:

Q4. How can a mobile app development company in Dubai help businesses scale online retail?

A local mobile app development company offers key advantages:

Q5. What features should I include in a modern ecommerce app?

A competitive ecommerce app should include:

The Middle East’s ecommerce market is projected to surpass $57B by 2026. This is fueled by the rapid rise of AI-powered ecommerce apps. As digital innovation defines the next retail revolution, now’s the time to lead. Not just follow.

Are you prepared to start with the ecommerce success journey? Partner with Techugo, your trusted app development company in Middle East, and turn innovation into impact.

Write Us

sales@techugo.comOr fill this form