Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Once, you had been sent abroad without money, searching for a bank that accepted your card without charging another random fee. And if you’ve ever handled payments in different currencies while working on your own, you know the stress. Simple tasks suddenly turn into talks about exchange rates, delays, and charges no one warned you about.

In those early days of global travel and online work, traditional banking just felt slow and confusing. That’s why Wise (formerly TransferWise) became such a big deal. It made sending money across borders feel quick and clear. No drama. No surprises. Just smooth transfers.

And now, more founders want to build something like this. But the real question pops up fast…what’s the cost to build a fintech app like Wise? Or in simple words, what goes into the TransferWise app development cost?

If you’re planning this, teaming up with a reliable fintech app development company becomes the first smart step. Let’s unpack the cost.

Before knowing the cost, let’s understand why you should invest in a fintech app development like Wise.

Today, approximately 70% of people all over the world use at least one digital financial service, and many people choose mobile banking over traditional bank visits. Therefore, results can be seen.

The fintech app development market globally is seeing exponential growth; it is now expected to go over $652.80 billion by 2030. This is a clear indication that a large audience is ready and already seeking fintech solutions or apps.

The global fintech market is growing rapidly, and fintech transaction volumes are increasing in regions like Asia, so if you build a money-transfer or cross-border payment app, the demand is real.

Companies using fintech tools report big gains: use of data-driven fintech reduces decision times and cuts operational costs.

This efficiency matters especially when scaling services or handling many users.

Fintech services often reach small businesses, freelancers or users underserved by traditional banks.

That opens new customer segments without having to fight over already saturated markets.

As per research, those small and medium enterprises (SMEs) that adopt fintech solutions innovate more, invest more in talent, as well as scale their operations. For startups or those businesses that are in the growing stage, can stand out by taking this advantage.

These 5 reasons make a compelling case for investing in fintech app development.

The estimated cost to build a fintech app like Wise starts from $15,000 and can go over $60,000, as there are many variables that affect the final pricing, like how complex your app is and the technology used. Plus, fintech app development cost is also influenced by the platform, hourly rates, and the features you want.

| App Type | Budget | Time Duration |

| Basic | $15,000–$30,000 | 2–4 months |

| Average | $31,000–$60,000 | 5–7 months |

| Complex | Above $60,000 | 9 months+ |

You can use this simple formula to estimate the total cost; this is just to help you get an idea, because the final budget will vary, depending on app complexity, the expertise of fintech app development company that you hire, and their location as well.

“Estimated Development Hours × Developer’s Hourly Rate = Total App Development Cost”

If you start with an MVP, the cost will be lower surely because it takes less time and fewer resources to build. On the other hand, if you get in touch with any experienced fintech app development company, you’ll definitely save time and ensure your app is secure, scalable, and ready for users.

We’re sure now that you’ve got a clear understanding of fintech app development cost, so let’s talk about the main features of fintech app like wise and their cost.

This is crucial to know as the cost of features can significantly impact the overall budget of fintech app development, but it depends on what features and how many features you want in your app.

| Feature Set | Typical Inclusions | Estimated Cost Range (USD) |

| Core / Basic Features | User registration & onboarding, basic money transfers, account management, simple UI/UX, basic currency conversion | $10,000 – $30,000 |

| Essential Fintech Features | Multi-currency support, real‑time exchange rate integration, transparent fees & exchange rates, send/receive international transfers, transaction history, basic security (login, basic encryption) | $15,000 – $40,000 |

| Advanced & Business‑Ready Features | Compliance & KYC/AML verification, payment gateway / banking API integration, advanced security (2‑factor auth, encryption), multi-currency wallets, admin panel, analytics & reporting tools, high scalability, support for debit card or virtual card integration | $30,000 – $100,000+ depending on scope and complexity |

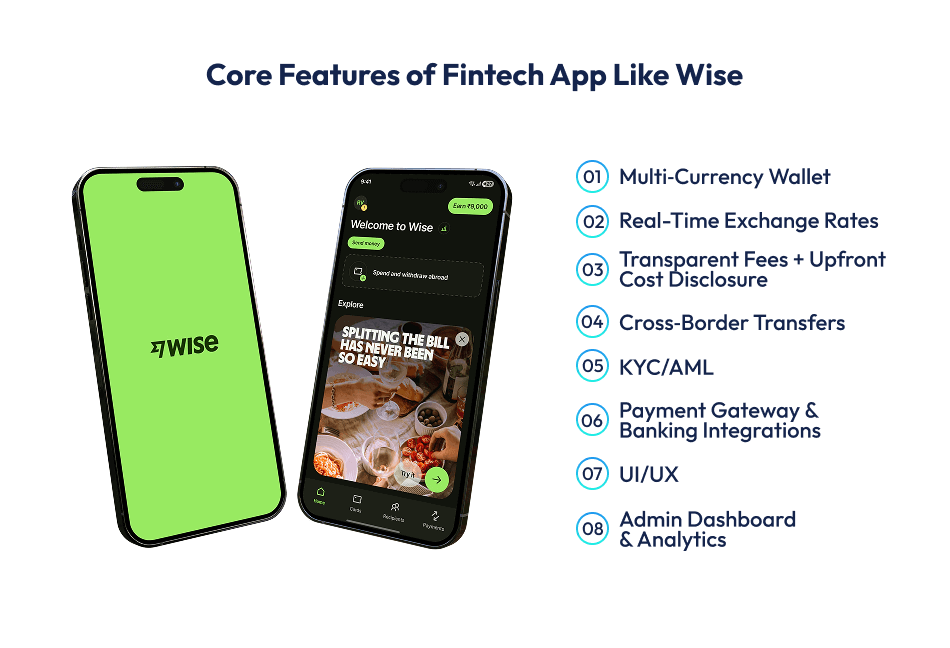

Here are the key features you should consider…and here’s what they do

Here are the key features you should consider…and here’s what they do

Your app should let users hold, convert, and manage several currencies. It should fetch live forex data so conversions use real market rates. That’s central to building trust.

No surprise charges. Users must see fees and exchange rates, right before confirming a transfer. This transparency is a big reason users trust apps like Wise over banks.

The app must support sending money across countries, to many currencies, and allow global transfers with minimal fees. It should also support receiving for multiple currencies or countries.

Before allowing transfers, the app should verify user identity per regulations…maybe with document upload or other verification methods. This step builds legitimacy and safety.

Your app will need integrations for real money movement (bank transfers, payment gateways or APIs). This is essential to handle real-world transactions and support multi-currency transfers.

Simple and clean design, like easy to navigate, intuitive steps for transfer, clear information display. All these things help users adopt quickly. A good UI/UX improves trust and usability.

If targeting business users or aiming for scale, having backend tools for admins to monitor transactions, fraud detection, reporting, analytics is key. This is part of Wise clone app development complexity.

👉What This Means for Your Budget & Planning

Always keep in mind that the final budget or cost to develop a fintech app will vary because it will depend on the number of features you want and their complexity level. Plus, the quality of design, compliance needs, integrations, as well as which region your developers are in…all these things will affect the cost, so there’s never a fixed cost.

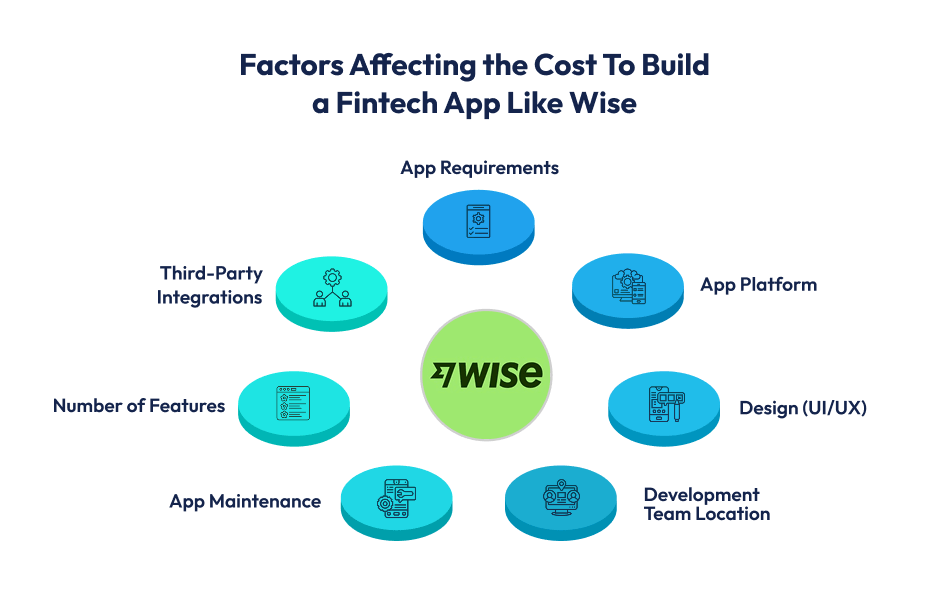

You might know that fintech app development is considered to be one of the most complicated as well as exciting projects, hence, this challenge and excitement come with a cost. In simple terms, there are multiple factors that affect the overall cost to build a fintech app like Wise, so it is crucial to know them in the initial stage so that you can plan your fintech app development budget wisely.

The app’s cost depends on what it can do. Features, security, complexity, and services all affect the fintech app development price. The more advanced the features, the higher the cost.

Decide if you want your app on iOS, Android, or both. Single-platform apps cost less, while cross-platform or multi-platform apps reach more users but are more expensive.

A good design matters. Fintech app development company teams focus on UI/UX to make apps easy to use and attractive. Better designs can slightly increase cost but improve user engagement.

Where your developers are based affects the price. Developers in different regions charge differently. Offshore teams may cost less than local teams but still deliver quality results.

Maintenance includes bug fixes, updates, server management, and compliance. Skipping this can harm security and user experience. Regular maintenance affects the overall fintech app development cost.

More features mean higher costs. Advanced features like payment processing, user authentication, real-time analytics, or multi-currency support increase your Wise clone app development cost.

Adding payment gateways, banking APIs, or security services takes extra time and resources. Complex integrations can raise costs. Using modern programming tools can make integration smoother and keep your fintech app development budget manageable.

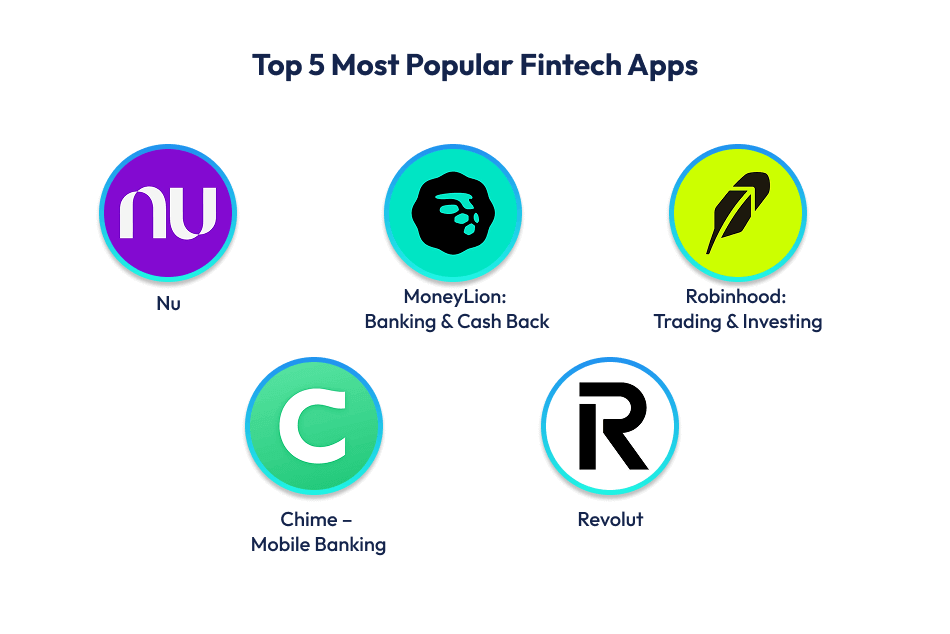

Now that you’ve got a clear idea of how much it costs to develop a fintech app like Wise, let’s zoom out a bit. Wise isn’t the only star in the global money-transfer and digital banking space. In fact, the fintech market is full of power-packed apps that have changed how people send, save, and manage their money.

So before you start building your own fintech product, it’s worth checking out what the top players are doing and those apps that users already trust and love.

Here are the top 5 most popular fintech apps like Wise that dominate the landscape and inspire most modern fintech app development projects:

Nubank is Brazil’s top fintech app. It offers instant transfers, spending insights, and reward points you can use to clear purchases. It’s a good example of how a Wise-like app can offer simple, real-time finance tools.

MoneyLion is a popular US fintech app that helps users borrow, save, and manage money in one place. It’s known for easy budgeting and quick loans, making it a strong alternative to fintech apps like Wise.

Robinhood lets people trade stocks, ETFs, and crypto with zero fees. Its simple design and commission-free model made it one of the biggest names in modern fintech app development.

Chime is a mobile-only bank with no hidden fees. Users can manage spending, save automatically, and access thousands of free ATMs. Many businesses study Chime when working with a mobile app development company in the USA.

Revolut app functions as a neobank and financial super-app which offers diverse services such as banking, currency exchange, investments, and budgeting tools to consumers and businesses, primarily in the UK and Europe.

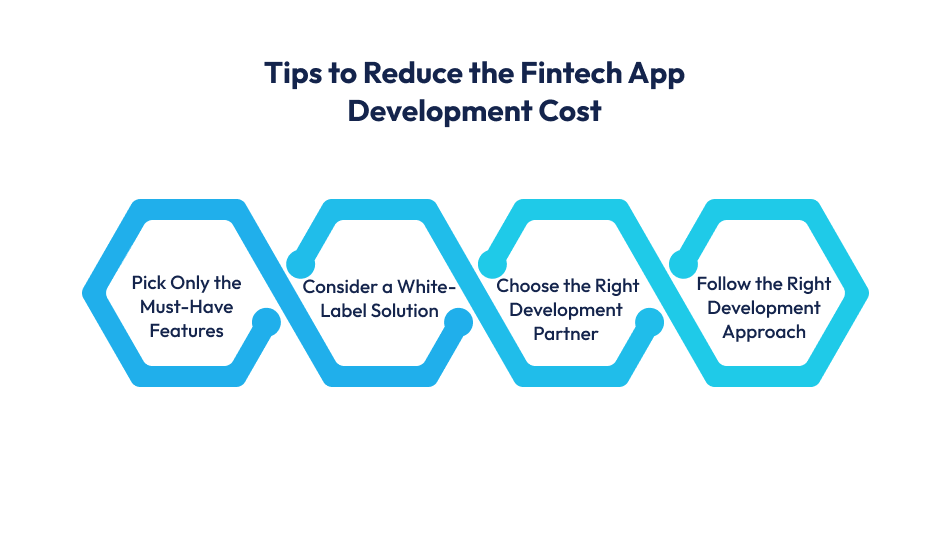

Now that you already know the cost to develop a fintech app like Wise, let’s talk about a few smart ways to keep your budget under control.

Every new feature adds extra time and cost. So start with the essential features—the ones users actually need in a money transfer app like Wise. Skip anything that doesn’t improve the experience. This keeps your first version simple, fast, and budget-friendly.

If you want to launch faster, you can use a white-label fintech platform. It already includes core banking, payments, and compliance tools. You simply customize the design and logic based on your business. This is one of the easiest ways to reduce fintech app development efforts and costs.

Working with an experienced fintech app development company can save you a lot of money long-term. They already understand banking workflows, security rules, APIs, and compliance standards. You can choose a cooperation model (fixed cost, dedicated team, or hourly) based on your budget.

Most fintech teams use Agile because it reduces risk, avoids delays, and supports continuous updates. A project manager who knows Agile or SCRUM ensures the product moves smoothly without wasting time or money.

Now that you know how to control the fintech app development cost, the next question is…who can actually build it the right way?

Because smart planning alone won’t help unless you work with a team that actually knows how to build apps like Wise the right way.

Someone has well said that – “Success is the sum of small efforts, repeated day in and day out”.

Techugo has spent over 10 years building products that actually work in the real world. Not just prototypes. Not just pretty screens. Real apps that function, scale with user growth, and meet strict security rules.

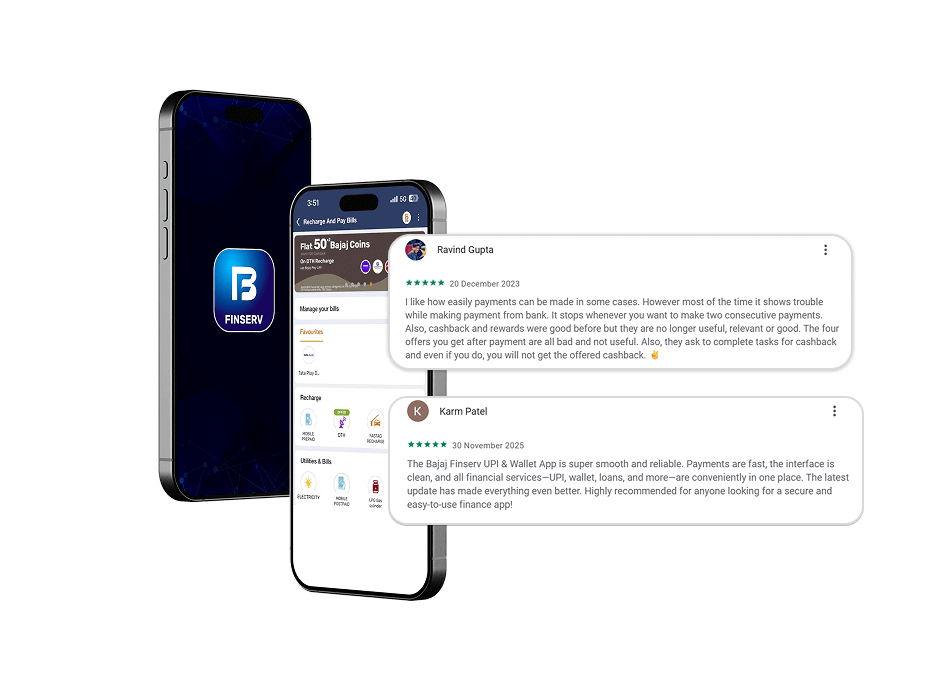

One example is the Bajaj Finserv App. Techugo led the digital shift for this Forbes Asia’s Fab 50 finance giant and helped modernize its financial services. The result? A faster, smoother, more digital experience for millions of users across India. It now has 100M+ downloads, and an average star rating of 4.8.

Over the years, our team has built 1400+ mobile apps, delivered 50+ AI solutions, and worked on 30+ large-scale Indian government projects. That kind of experience, plus our team’s hands-on understanding of compliance, payments, KYC, security, cloud, and mobile banking, makes us a reliable fintech app development company for any business planning to build a fintech app like Wise.

If you want a product that’s stable, secure, and built with long-term growth in mind, Techugo can help.

By availing our high-performing fintech app development services, you’ll get…

If you want a secure, scalable product that competes with global players, Techugo is the right partner that can help you build it step by step with full transparency in everything from strategy to deployment. You also have options to hire fintech developers who have years of experience in custom app development.

Fintech app development is expensive, obviously, as compared to other apps because they involve more than just simple screens; they need bank-level security, encrypted APIs, KYC/AML compliance, payment gateways, currency conversion tools, as well as a backend that can handle thousands of real transactions. All this extra tech and testing increases the overall fintech app development cost.

Yes, absolutely, in fact, that’s the smartest way to start with an MVP as it includes the core features (sign-up, wallet, basic transfers, and security), and once users start using it, you can gradually add advanced features like multi-currency transfers, investment tools, or analytics. This is a proven approach; it cuts your initial budget by almost 40–50%.

A simple version of a money transfer app takes around 3–4 months, a mid-level app takes 5–7 months, and a full-fledged or advanced fintech app like Wise can take 9 months easily or more, because of compliance, testing, and integrations. Fintech app development timelines are always longer as compared to normal apps because they have to align with KYC/AML compliance, regulations, and must pass strict security reviews, plus they need bank-level security, encrypted APIs, payment gateways, etc.

The cost to build a fintech app like Wise generally starts from $15,000 and can go above $60,000, depending on the features, security layers, compliance work, platform (iOS/Android), and the team you hire. If you want multi-currency transfers, payment gateways, fraud checks, and a smooth UI, the budget goes higher. A basic MVP will always cost less.

Yes, in most cases, it is cheaper to hire fintech developers from India, and this can reduce your development cost by 40–60% without compromising quality. Many global brands outsource to India because the talent pool is strong, experienced, and more affordable than in the US, UK, or UAE.

Write Us

sales@techugo.comOr fill this form