15 Apr 2022

Updated on January 12th, 2023

iKhokha’s Lower Transaction Rates are a Boon for SMEs of South Africa!

Surbhi Bhatia

The modern world can be divided into two phases: before and after Fintech, and we can’t deny the fact that it has been a game-changer for the finance industry.

Initially, the primary aim behind introducing fintech was to provide efficient financial services and add convenience to businesses and consumers’ lives.

Undoubtedly, COVID-19 has been a massive turning point for industries, and the finance industry is no exception. The year 2021 presented numerous uncertainties that pressed businesses to adopt technologies for coping with the same.

And, GUESS WHAT?

Technologies played tremendous roles and perfectly fitted like the missing piece of the puzzle for the fintech domain.

For instance, you ask?

One of the leading fintech businesses introduced innovative payment solutions for SMEs in South Africa.

Are you intrigued to know what precisely the startup offers? Then, continue reading for more!

iKhokha is Offering Merchants with Automated Tariffing Fee Structure!

If yes, you would understand how the current wave of automation is impacting businesses immensely. In fact, the integration of fintech app development into businesses is no longer an advantage but a necessity that would push the growth of its mechanisms.

iKhokha, a dynamic team in South Africa, is serving businesses precisely the convenience they are looking for!

The fact is not hidden that running a business requires truckloads of investments and can be an expensive deal.

Therefore, don’t you think it would be a great relief if expenses were eliminated? Or if tasks and activities could be automated?

Be it dealing with inventory, paying rent for the physical space, or whatnot, small businesses are always leveraged with surprise expenses or costs. One of the most popular reasons behind higher expenses is the additional transaction rates.

What is it?

If you’re planning to go ahead with a startup, you must know about ‘hidden costs.’ Often, it is a fee paid by the business owner due to high transaction rates.

What’s more? It is mandatory to pay when anyone transacts a higher amount using their credit or debit card. Thus, most merchants prefer recording their sales in cash to eliminate paying monthly fees due to high transaction rates.

In a nutshell, poor payment schemes and wrong card machines may lead to getting stuck in a loophole of paying more for selling more.

But isn’t this world going cashless?

Indeed, that is true! However, businesses can’t entirely cut down on card payments since it has become essential to cater to consumer needs. So, what would you do?

Fortunately, iKhokha backed up small businesses of South Africa by introducing dynamic tariffing with the amalgamation of automation.

How does Dynamic Tariffing Work?

The concept is pretty simple: More Sales, Lesser Fee!

Yes, you’ve read that right! iKhokha’s transaction processes are built so that users don’t have to spend additional time emphasizing transaction rates. Instead, monthly transactions are reviewed by iKhokha, which automatically sets the limit as per the sales bracket.

Interesting, isn’t it?

Need more convincing on leveraging fintech into your business? Then, here’s more for you to know and bust the dilemma of making a choice.

The Role of Fintech in Shaping the Business World

Easily Accessible

Fintech is everywhere and can be used by anyone. It is a technology that is easily accessible at users’ fingertips, no matter if they have used financial services before or not.

Notably, continents like Africa are highly benefitting from fintech services, as providers like Tala are introducing opportunities that can tremendously help people manage their money.

Cost-Effective

Unlike traditional financial mechanisms, fintech is cost-effective as they provide solutions at a lower cost. For instance, activities are automated; therefore, it eliminates the need to hire additional human resources for the same.

Today, you’ll come across stock trading applications that charge zero commission!

Accelerates Small Businesses

It is not very challenging for large businesses to get their hands on the latest technology or financial tools. But, how would small businesses manage to keep up with the market trends?

Fast forward to today, it has become efficient for small businesses and even sole entrepreneurs to take advantage of fintech seamlessly.

A Safer Approach

While some people have the opinion that fintech services are not reliable, it is not true! In fact, traditional banking institutions can be at risk in terms of security issues due to their lack of adoption of new technology.

Fortunately, fintech companies ensure that customer detail and every transaction is protected. From location-based information to every transaction, fintech companies are playing an immense role in keeping the data secure.

Fintech Potential is Likely to Drive the Future!

Fintech has opened the door to truckloads of opportunities for businesses, and organizations are taking its advantage at its best!

The icing on the cake is the possibility to leverage technologies like blockchain, artificial intelligence, etc.

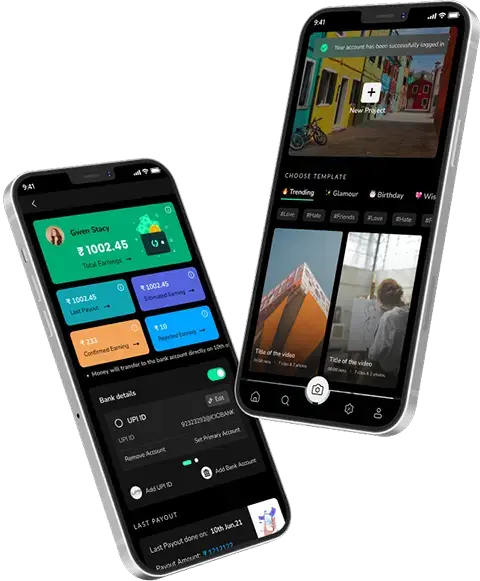

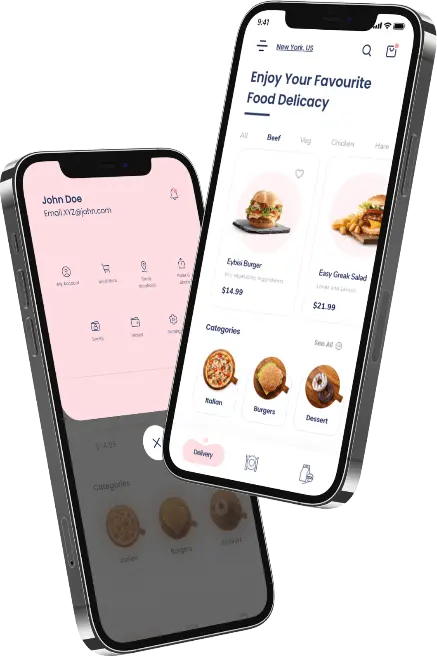

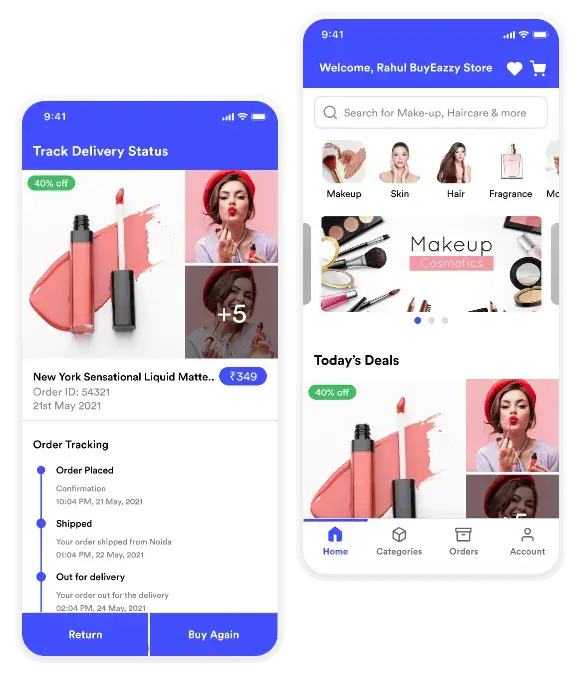

So, how about the idea of fintech app development?

Luckily, we are all ears! Techugo- a leading mobile app development company in South Africa, is waiting for you to spill your flawless app ideas, so we can work on the same to turn the vision into reality.

How about consultation over a cup of coffee?

Get in touch.

Write Us

sales@techugo.comOr fill this form