Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

Most finance executives believe that sending invoices on time is crucial to boosting cash flow. However, manual billing procedures are time-consuming, error-prone, and inefficient. This is where automated billing systems and electronic invoicing solutions can help. By automating the billing process, companies can streamline their workflows, reduce the risk of mistakes, and speed up invoice distribution. An automated bill management solution or an e-invoicing system is the key to achieving this.

The increasing use of remote work and real-time financial transactions has made billing more difficult. There are various reasons for this, including the possibility of using outdated software or being restricted to tools that do not solve the issues of your finance team.

These fintech software solutions can be integrated into your company’s environment and assist you in growing your business by automating as much as 50% of manual accounting and financial operations, regardless of the company’s size. This blog will discuss everything related to billing automation software development and what factors to consider when choosing one.

As your business grows, billing becomes more complex. The old-fashioned manual billing method does not provide the flexibility needed in today’s highly competitive market.

Although it’s tempting to think manual billing is a good idea, it’s labor-intensive and time-consuming. When you bill manually, you’ll have to manage payments, ensuring compliance with Generally Accepted Accounting Principles (GAAP), notably ASC 606, and ensuring that all information is correct. As your customer numbers increase, manually generated invoices are prone to errors and can cause problems such as:

However, how prevalent are these problems? A few studies show that data entry errors can be as high as 5 per 1000 entries, and there are significant discrepancies due to both numeric and non-numerical errors.

With little manual input, an automated billing system can automate the billing process, such as gathering, reviewing, creating, and distributing invoices. It can be tailored to meet customers’ needs and could provide a self-service portal to facilitate simple invoice payments.

Automated billing systems for B2B sales can be compared to the digital assistants of busy executives. Using traditional invoice management methods is similar to manually managing appointments and jobs. With an automated billing system, it’s as if you have a reliable assistant who effectively schedules appointments, coordinates meetings, and reminds executives of tasks to be completed. In the same way, the automated billing system manages invoice creation as well as delivery and reminders. It frees up time while ensuring accuracy during the billing process, just as an experienced digital assistant can simplify the work of a busy executive.

“According to an analysis done by Mastercard, 76% of companies say that the pandemic is pushing businesses to upgrade their digital infrastructure. Find out what’s changed in finance following the pandemic.”

Automated billing software helps companies save time, minimize errors, and speed up the process of collecting payments by automating billing workflows. These software solutions provide a complete bill-paying solution that eliminates the requirement to utilize several solutions to track and measure customer usage.

Automated billing begins by collecting details about customers. This information is crucial to ensure the bill is timely, accurate, and adapted to each individual’s preferences. This information can also be used to create comprehensive customer profiles.

The customer profile can contain the customer’s payment preferences, details on delivery and contact, and any pertinent information regarding billing or subscription (such as the user’s preferred prices). By accumulating this information upfront, the billing system can ensure the following:

The method you use to create your customers’ profiles will determine the type of billing system you use. For instance, most software providers provide templates and forms (such as spreadsheets) that your team can utilize to enter customer information.

Some companies incorporate their solutions into the most popular Customer Relationship Management (CRM) and enterprise resource planning (ERP) systems, automatically pulling in customer data already gathered by these platforms.

Billing automation software automatically creates and distributes invoices according to your company’s billing period (monthly, quarterly, or milestone-based, for instance). Some billing systems permit advanced usage-based, tiered, prorated, and combined billing. These systems can be configured with flexible templates and engines.

Based on your billing software’s integrations, you can accept payment from various sources, including cardholders with credit or debit cards, ACH banking transfers, and wireless payments. This gives you more opportunities to generate revenue and gives your customers various payment options based on their preferences.

When customers make their payments, they are assigned by the system to each payment to the correlating invoice for precise tracking. By the billing system you’re using, you may then be able to use dashboards for reporting that give you real-time information about your business’s performance and economics for every customer segment. When you’ve gathered this data, you can enhance your profit by:

Everything likely went as planned; you’ve gathered your customers’ information and invoices, processed payments, and now collect any unpaid or late fees. If you’re having difficulty managing the dunning process independently, we suggest using an appropriate collection tool to locate and retrieve these invoices, ensuring a seamless payment experience.

Billing software’s primary purpose is to generate and send invoices to customers. It aids companies in managing their client accounts, tracking payments, and automating the billing process to ensure the correct amount is charged.

Custom-designed billing software offers customized features such as multilingual software for invoicing and time tracking, offering greater flexibility for companies with unique financial management needs. It is a great way to ensure that the funds are handled effectively.

However, the accounting program is a more complete system that handles all financial information. It aids in managing financials, income, spending, and taxes. Accounting software evaluates the company’s financial picture, while billing software focuses on payment processing.

Businesses can handle payment processing using various billing software, including cloud and desktop applications. Each billing function has distinctive features that meet the requirements of different companies.

Utility billing software is designed to serve the service-based telecommunication, water, electricity, and water industries. It uses a tiered pricing model, determines charges depending on usage, and produces bills with extensive descriptions. Utility providers rely heavily on this software, which works well with smart meters and can be tracked in real time.

Point of Sale (POS) compatible billing software aids retailers in managing consumer transactions. This kind of software offers retailers a complete solution, as it can be used for reporting on retail sales, inventory management, and multiple payments.

Due to the growth of mobile commerce, businesses can now conduct the billing process, thanks to the mobile-friendly billing application. It is ideally suited for companies that heavily use mobile transactions. It’s appropriate since it offers real-time push notifications, recurring invoicing, and the ability to pay via mobile devices.

Telecom providers use this software to process invoices for value-added voice and data services. It automatically records call details, tracks service usage, and handles payments, ensuring correct and timely billing.

This software is specifically designed for businesses that use a subscription-based model. It can be a kind of streaming or a SaaS provider. In this instance, payments can be seamless, as the system manages prorated fees, subscription renewals, and periodic invoicing. Analytics to improve customer retention, payment reminders, and automated invoice generation are well-known.

It is perfect for small and medium-sized enterprises since it concentrates on creating, sending, and tracking invoices. It generates invoices promptly, monitors how payments are being processed, and informs the user when due payments are not made. Many applications also incorporate accounting programs to ensure more efficient financial management.

This program, specifically developed for healthcare, simplifies the process of processing insurance claims, billing patients, and tracking payments. It offers detailed billing information for providers and patients and ensures compliance with health regulations.

Large companies often require software to manage complicated accounting systems, multi-currency transactions, and international activities. Automated billing software development provides advanced functions like dynamic pricing, complete analytics, and CRM and ERP system integration.

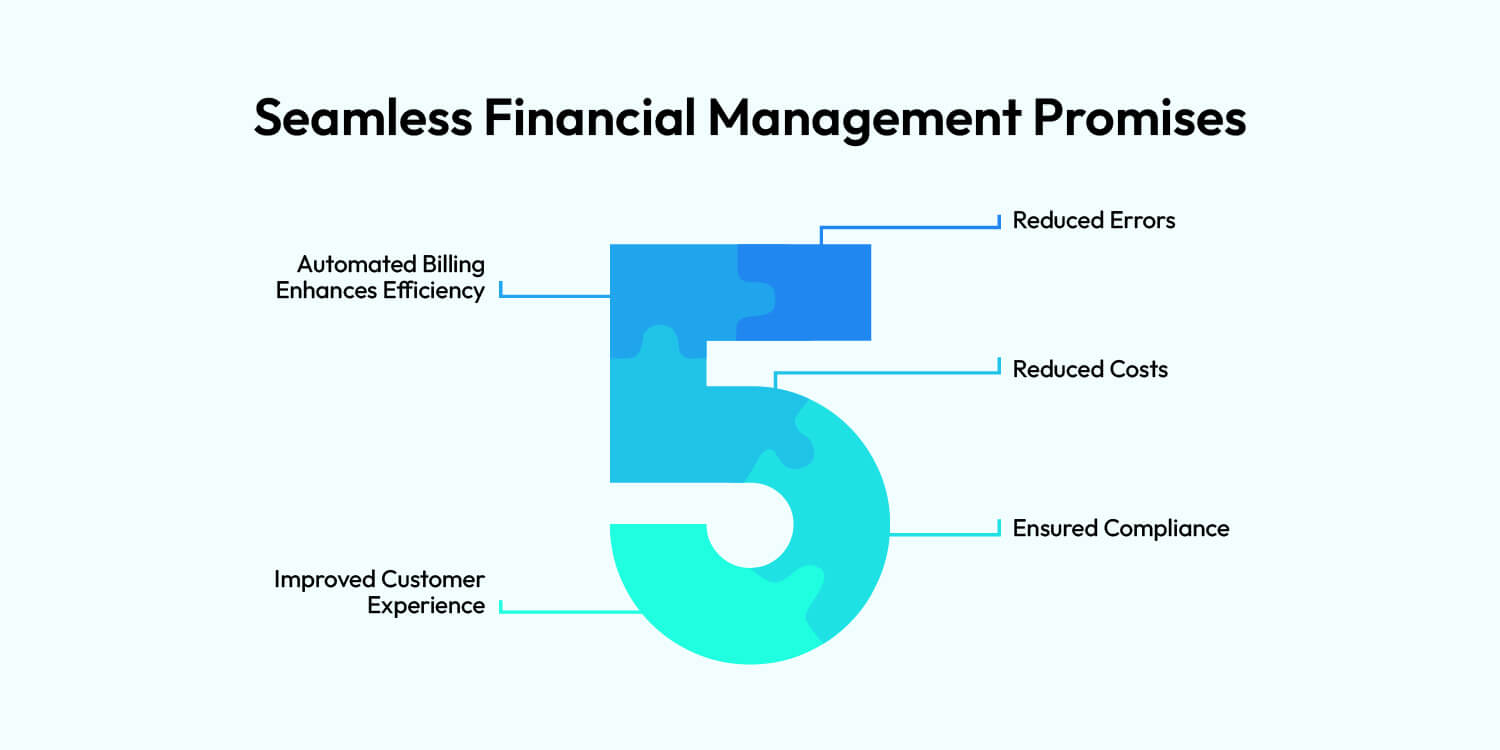

Automated billing software helps eliminate the weaknesses of manual billing systems by reducing processes while reducing errors and improving the overall efficiency of business operations. Here’s how it works around the shortcomings of traditional billing practices:

Billing software automates time-consuming tasks, such as invoicing, recurring billing, and real-time payment tracking. This helps businesses reduce time and use the resources to complete larger projects.

As companies grow, automated billing software can expand quickly to accommodate complex billing systems and higher invoicing volumes. It can also adapt to the demands of companies that offer a range of products or services and price plans that differ from manual processes.

Companies could be provided with the ability to access real-time financial data through automated bill management software, including payment status, past-due invoices, and even revenue, making them better choices to ensure a smooth cash flow.

Your employees are also human. Even the most experienced employees can make mistakes occasionally. According to research conducted by Verapay, 80% of executives in the C-suite at large corporations have lost money because of miscommunication, which can lead to invoicing disputes.

These mistakes can lead to a sloppy billing process that requires continuous fact-checking. Overcharging or undercharging customers could confuse and damage their trust in the company.

On the other hand, automated billing systems carefully study the data and pricing strategies to generate 100% accurate invoices. Customers who receive error-free invoices will likely get reimbursed faster. Automated billing systems monitor cash flows into and out and can change information in real time. Thus, business leaders can access the most current information, evaluate their financial health, and make informed decisions.

All SaaS companies face churn issues, whether voluntary (when customers cancel an account themselves) or involuntary (when they want to pay but cannot). Research has shown that 40% of subscription companies have experienced increased involuntary churn. The inability to verify cards automatically (56%) or allow customers to pay (45%) using an expired card is among the leading factors that cause payments to fail. Businesses are losing potential customers and have the chance to boost their revenues drastically.

Automated payment systems play an essential part in preventing involuntary churn. They notify customers automatically of the upcoming payment or due date to increase the likelihood of successful payment. One of the benefits of this feature is that you do not need to check your accounts manually for failed transactions, retry failed payments, or keep track of any of these actions.

Automated systems provide an online repository of all billing data, making accessing, organizing, and retrieving data simple. This helps eliminate the mess of paper records and speeds up compliance reporting, audits, and reconciliations.

Manual systems are often unable to meet the requirements of specific industries and tax requirements. Billing software ensures the calculations are accurate and minimizes the risk of penalties by including tax regulations and compliance guidelines in its processes.

Many businesses that use subscriptions want to expand beyond the domestic market and develop newer, more advanced, or emerging markets worldwide.

Business leaders must consider various payment alternatives’ risks, regulations, and expenses. However complex, there’s no reason not to comply with GAAP principles, especially those of the ASC 606 Revenue Standard, which causes the majority of businesses to be in trouble.

A sound automated billing system can take care of a range of legal requirements. It recognizes the revenue promptly and keeps your business in compliance in complicated areas like taxes and data security for your customers. If you don’t follow the rules correctly, the financial consequences of not following the rules could cost your business.

As your business expands in complexity, your in-house billing system becomes confusing and cumbersome. This means you must schedule work hours to ensure things are working. Research suggests that business owners looking to replace billing solutions employ 45% of their engineering team to handle billing, and 34% agree that their current system is challenging to keep up with.

However, an automated billing system can transform the once-slow process into a swift and scalable automated process. Imagine what you could achieve if they applied 80% of their billing efforts to support business operations at a higher level. Businesses spend up to 11 hours each month making payments that could be better spent on a strategy.

The best billing software will help you support your employees by reducing the need to constantly check facts and removing the need for constant fact-checking to streamline and automate the manual process. These advantages will allow the marketing and sales teams to concentrate on activities that increase revenue, improving sales efficiency.

Automated solutions guarantee prompt and accurate billing by automating the generation and delivery of invoices. Most solutions provide customers with self-service sites to review and manage invoices, enhancing transparency and customer satisfaction.

B2B buyer journeys have grown lengthier and complex, with more stakeholders involved in the decision-making process. They are accountable for a more thorough analysis of

There are no simple formulas, and each buyer must be treated differently. Traditional billing systems have found it challenging to create creative pricing strategies. 76% know their business has been losing money because they work with accounts manually.

However, automated billing systems can efficiently manage even the most complicated billing processes and prevent human error. For instance, when a user upgrades from a basic plan to a premium package, the automated system automatically calculates the cost, collects the payment, and adjusts the amount due in real time.

With automated billing software development, companies can improve their operational efficiency, remove the limitations of manual systems, and provide clients and staff with a seamless billing experience.

Leveraging off-the-shelf software for billing can be an efficient solution. However, it is not reliable enough. There are many benefits of automated billing software development:

In most cases, the software developed is designed to scale, allowing it to adapt to your company’s needs. However, if your needs evolve or your business expands, you’ll require customized software with more features, increased users, and additional integrations.

To prevent data leaks and breaches, constructing custom billing software can allow you to take the security measures your company requires. A customized software solution compliant with industry rules and regulations can prevent security concerns and ensure compliance with data protection laws, such as GDPR and HIPAA.

Every business has specific requirements that are not met with a random program. This is why creating custom invoice software is useful; you can set your billing software requirements and select the features you want to add. This way, you can ensure the software aligns with your business needs and increases efficiency.

With custom-built billing software you can integrate, you will not have problems with other systems your company uses. Whether they’re customer relationship management (CRM) systems, ERP (ERP) systems, or accounting software doesn’t matter. This integration will ensure consistency in data flow and help reduce manual data entry.

Customizing software can be more expensive initially but will cost less over the long term. You will not need to pay monthly fees and spend cash to modify the software to suit your needs.

A billing system based on business requirements has various features specific to each company. Here are a few of the standard functions:

Integrating different payment gateways, including credit and debit cards, digital wallets, bank transfers, and more, gives your customers payment options. This broadens your customer base and simplifies payment collection.

Set up automatic reminders to notify customers about due dates. This will help you collect payments more quickly, improve cash flow, and lower the chance of bad credit.

Integrating CRM software into your billing system will provide an accurate single source for all customer data, contact information, purchase history, and payment status—and help improve coordination between your finance and sales teams.

A robust automated billing software program automatically creates invoices using precise calculations and professionally designed templates. This prevents duplicate entries and reduces the need for manual intervention, ensuring that invoices are issued immediately.

Analytics tools built into the software provide real-time insight into revenue patterns, such as late payments and customer behavior. These insights can help users make better decisions about pricing and product options.

If a business operates in several locations, the software will automatically handle different taxes, currencies, and regulations for compliance. This can eliminate many administrative burdens.

The billing system software should be flexible and straightforward to expand. When you add new product lines, expand into new markets, or cater to various prices, your system must be able to adapt without costly overhauls.

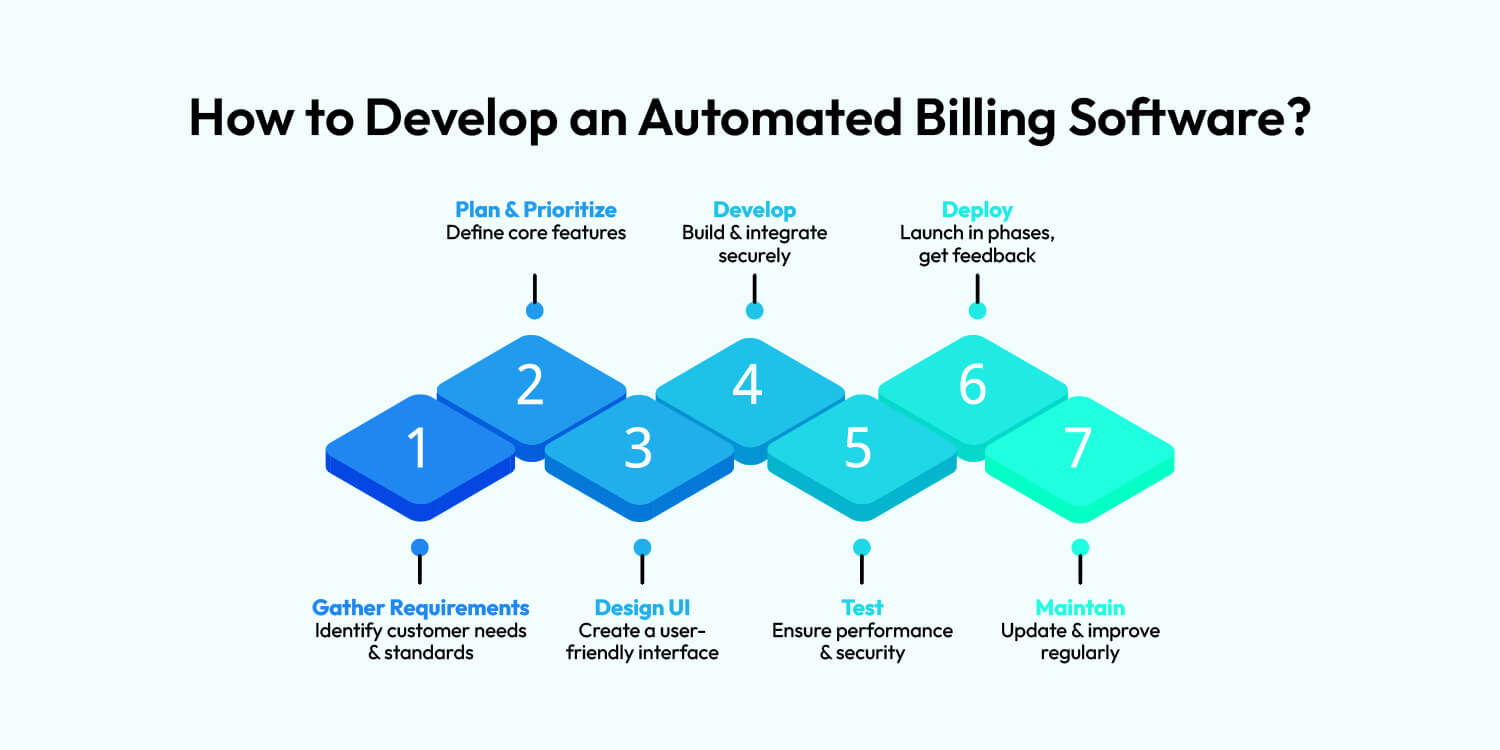

The process of billing software development in Middle East usually requires a well-planned method to ensure stability and scaling. This is a step-by-step guide to the development process:

Find out your customer’s specific requirements. Study competitors to learn about industry standards, compliance requirements, and customer expectations.

The core features should be defined according to your company’s goals and customer needs. For this phase of your automated invoice development, it is essential to concentrate on features like integrating payment gateways with computerized invoices and reporting tools that satisfy immediate needs and allow for scalability.

Develop intuitive interfaces that enhance the user experience. The clean, mobile-responsive design allows for accessibility across all devices, making it more straightforward for companies and their customers to use the platform.

Choose a tech stack that is scalable and provides security. At this point in the automated billing software development, ensuring seamless integration with existing systems, including CRMs, accounting software, and payment gateways, is crucial.

Conduct a thorough test to detect issues and ensure the software works flawlessly in various situations. We suggest testing for security, performance, and compliance to reduce risk.

The software will be launched in phases, beginning with a trial program. Get feedback from users to improve the billing app’s automated design process before a complete launch.

Ask your fintech app development company to update the software regularly to add new features, correct bugs, and ensure compatibility with the latest technology and laws.

While the development process defines the steps required to develop efficient and effective automated billing software, it’s crucial to comprehend how each stage affects the overall development cost. Furthermore, aspects like the complexity of features, the selection of a technology stack, and the degree of customization needed will significantly impact the budget.

Transitioning to a new billing system can be challenging for your employees and customers. To ensure the transition is easy and seamless, here are some suggestions you should consider.

Take advantage of the chance to review and modify your payment terms using the automated billing system. For example, if your current process was based on mailing invoices with net 30 terms for payment, think about changing it to reflect the effectiveness of the new paperless process, which allows customers to get bills immediately and conveniently pay the fee online.

Inform customers about the forthcoming switch to a new billing system to prevent confusion and suspicion, especially after numerous phishing attacks. Send an email devoted to the issue or add a note on the final invoice before the change to assure customers and highlight the new system’s advantages.

Many automated billing management software platforms provide online platforms that allow customers to pay bills using various methods, from electronic checks to major credit cards. It is essential to determine your customers’ preferences and set up your billing system to efficiently accommodate their preferred payment methods.

Suppose you want to create an online platform for invoicing and bill software to suit your business. In that case, you have two options: use an existing software program or hire a mobile app development company in UAE to develop a custom solution for your business.

Learn about the functions of trusted billing and invoicing software with basic billing features built into the software. Alongside the primary aspects of building billing software, it is possible to integrate it with other services like ERP platforms, eCommerce CRM, ERP, and many more. These solutions can eliminate the requirement for the setup process to be completed before or for training your employees with 24/7 support and user-friendly and intuitive interfaces. However, a pre-built invoicing software solution isn’t suitable for those who require more practical features that you could modify.

For example, off-the-shelf subscription billing software applications are ineffective if you have many clients you manage differently or need an advanced application with departmental fees, charges, or discounts.

By partnering with a mobile app development company in Saudi Arabia, you can create custom billing software to meet your company’s needs. The primary purpose is to manage and automate the financial aspects of specific business needs, such as making invoices and receiving payments.

Customized billing systems, tools for managing crises, and software can solve your company’s issues and challenges. The program’s ability to be customized to fit your company’s requirements provides beneficial advantages.

They include full system integration with all existing services, high scalability, custom analytics, and non-linear processes. When choosing the best invoice software option, consider your company’s objectives and the work required to implement your current system. Select custom software development services over packaged invoicing systems if your company is growing faster than the current applications and must be designed to meet your needs.

Regarding your company’s financial health, you only have to worry about efficiency. A well-designed automated billing system allows you to be paid more quickly, reduce billing errors, and boost cash flow—the vitality of your business.

Ensuring you have successful automated billing software is a huge factor. Here are a few key aspects to look out for when choosing your billing software that is automated:

Billing involves making regular invoices for the customer based on the pricing plan they’ve selected, the usage they will be using during the billing period, and any applicable discounts.

These are the most important aspects of billing that your platform should support:

When a buyer buys an offer, the automated billing platform automatically creates a new subscription for that person that identifies what was purchased by whom, at what amount, and for what length of time.

This section will describe the features required for establishing subscriptions and managing accounts throughout the customer’s lifetime:

Swiftly changing pricing strategies is vital for the growth of subscription-based models. Many businesses fail to compete in the marketplace because their billing systems cannot offer prices that satisfy customers’ needs.

Your billing system’s automated process should be able to shift between various kinds of pricing models, for example:

Your billing system must offer discounts or free trials, coupons, and promotions to help your business attract more customers. After these deals expire, your billing system will notify customers that the trial period has ended and they can move on to paid subscriptions.

Every business requires a payment method. This article outlines the most critical aspects of the automated billing system you should be equipped with to ensure a simple payment process.

Your billing system should allow you to access your subscription reports and metrics in real time.

A few critical metrics to be considered include:

You’ll need a comprehensive summary of your company’s performance. These subscription metrics are essential to ensuring your company’s financial health; you must know them.

Custom-designed billing software is the ideal solution for your business’s invoices. Numerous companies, including large multinationals and small-to-medium-sized enterprises, use it extensively. These new technologies could improve billing accuracy and control their financial operations. The right choice of a development team is among the most critical factors in the success of your venture when you’re thinking of setting up your own. It is essential to partner with an expert and skilled mobile app development company in UAE like Techugo that knows about Fintech software development and the required expertise. So hurry up! Get in touch with us now!

Write Us

sales@techugo.comOr fill this form