Write Us

We are just a call away

[ LET’S TALK AI ]

X

Discover AI-

Powered Solutions

Get ready to explore cutting-edge AI technologies that can transform your workflow!

eToro is a huge deal in the investing world. Why? It’s the ultimate example of social investing.

The trading app is like a social experience. It lets millions of users copy seasoned traders in real-time and has even built a whole community around finance. It took something complicated and made it accessible. This creates a big takeaway for entrepreneurs. People want innovative trading platforms. Thus, the chance to build the “next eToro” is totally open!

eToro itself is massive, with over 3.5 million funded accounts. The app supports multiple assets and a super easy-to-use social interface. Now, the fintech rules are getting clearer, and a wave of new retail investors is entering the market. Business leaders are all racing to grab a piece of this trillion-dollar trading pie.

So, if you’re asking how much it costs to develop a stock trading app like eToro? You’ve come to the right place. This guide is going to break down the cost and tech stack knowledge you need to succeed.

We’ll look from a simple MVP-level social trading app to a fully regulated investment platform. We’ll also cover the development cost, highlight the must-have features, and will learn how teams like Techugo build these high-performance fintech ecosystems.

eToro is the gold standard for social investing.

Founded in 2007, eToro began as a small trading interface. Today, it’s a global ecosystem. Users can learn, trade, and connect there. The environment is both regulated and gamified.

eToro is a top name in investment technology. It has over 35 million registered users across more than 100 countries. As of early 2025, it has over 3.5 million funded accounts. This shows huge adoption by both new and experienced investors.

eToro offers multi-asset accessibility. Users can trade:

This keeps eToro on the cutting edge of digital finance.

The app holds good ratings despite intense competition. It scores about 4.1 stars on iOS and 3.8 stars on Google Play. Its user-friendly design and real-time trading have led to tens of millions of downloads. This makes eToro a clear market leader.

The CopyTrader™ feature really sets eToro apart. It’s a social-trading tool and lets users automatically copy the trades of top investors.

Other key features include:

It blends Wall Street complexity with a high level of social engagement.

eToro is constantly in the fintech news. It’s expanding its crypto trading under EU MiCA regulations. It also refines its compliance following U.S. SEC scrutiny. The company shows how to scale responsibly in a highly regulated market.

Simply put, eToro is the north star for any entrepreneur. It shows how to build a trading platform that combines financial empowerment with social connectivity.

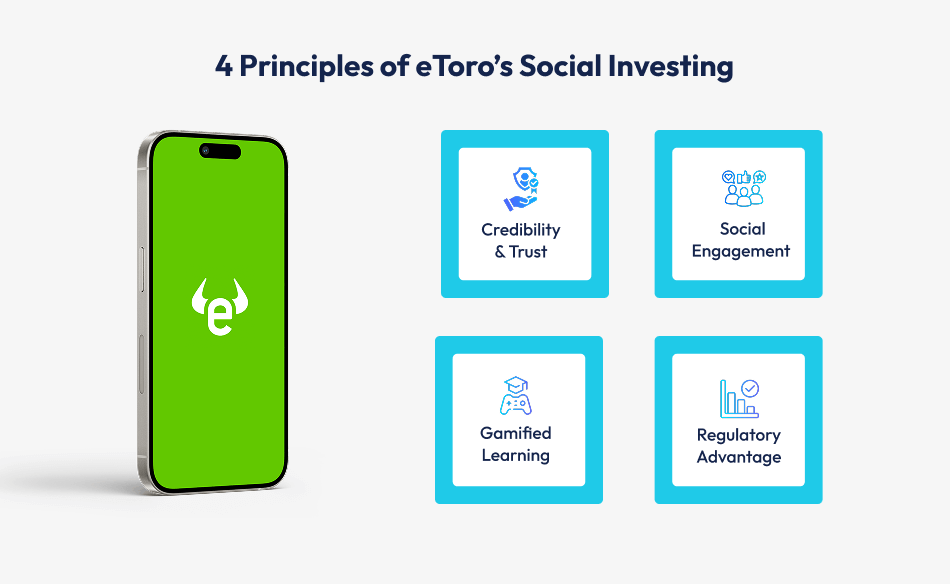

eToro’s success isn’t just about charts and trades. It’s built on credibility.

They ensure secure transactions and regulatory compliance. A transparent fee model also helps. This fosters user confidence and drives retention. Copy trading and community interactions are key. They make trading a collective experience. It’s not a lonely spreadsheet grind anymore.

Adding a social layer can multiply user stickiness by 3x.

eToro turned learning into earning. They use leaderboards and virtual portfolios. This is a masterclass in onboarding new traders.

eToro didn’t treat regulation as red tape. They used it as a trust-building tool. This allowed them to expand safely into new markets. Many competitors failed where eToro succeeded.

These four principles are your plan. The next step is getting the right partner.

Work with a fintech app development company like Techugo to create a powerful trading ecosystem.

Money moves faster now than ever before. The people who build the rails for that movement are shaping fintech’s future. Trading is no longer just for Wall Street elites. It’s a huge digital marketplace. This market is driven by Gen Z investors and real-time data.

eToro promotes engagement and empowerment. They transformed investing into a social experience. Today, eToro proves that financial technology is about connection as much as it is about capital.

Here’s the bigger picture:

This is why businesses are betting big on social trading platforms. These mobile apps connect finance with influence. Users trade assets, but they also trade ideas.

This is a perfect storm of opportunity for founders and enterprises. The market is booming thanks to tech. Regulatory clarity is growing. User demand is at an all-time high. Building a trading app like eToro isn’t just joining fintech. It’s about owning a share of the future of investing.

With a partner like Techugo, you get more than just an app. You get a platform engineered for compliance and user engagement. It’s built to thrive in a market that equally rewards innovation and trust.

Because the smartest trade you can make right now… is building the platform others will trade on.

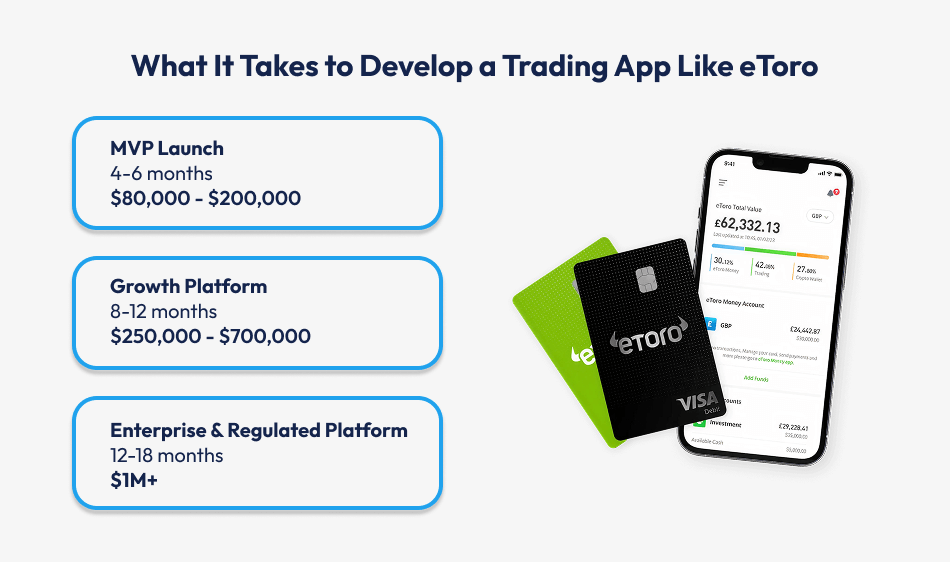

Every successful trading app starts as a smart MVP and scales into an enterprise-grade platform.

Here’s how the journey typically unfolds:

Timeline: 4-6 months

Ideal For: Startups & early-stage fintech ventures

Core Components:

Estimated Range: $80,000 – $200,000

Goal:

Timeline: 8-12 months

Ideal For: Funded startups & scaling fintech brands

Feature Enhancements:

Estimated Range: $250,000 – $700,000

Goal:

Timeline: 12-18 months

Ideal For: Established financial institutions & enterprise fintechs

Advanced Capabilities:

Estimated Range: $1M+

Goal:

| Category | Description | Impact on Cost |

| Feature Complexity | More features. More development hours. | High |

| Tech Stack Selection | Using advanced tools. Impacts infrastructure costs. | Medium-High |

| UI/UX Design Depth | Interactive dashboards. Real-time charts. Dark mode UIs raise design hours. | Medium |

| Regulatory Compliance | Licensed fintech apps must follow KYC/AML and PCI DSS frameworks. | High |

| Scalability Architecture | Building for global markets demands cloud microservices & API optimization. | Medium |

| Post-Launch Support | Maintenance Updates Cloud costs post-deployment | Low-Medium |

Find your definitive checklist of features to be engineered for performance and conversion.

Behind every seamless trade lies a meticulously engineered stack of technologies working in sync. The right tech stack determines the speed and security posture.

| Layer | Purpose | Tech Stack & Tools | Key Highlights |

| Frontend (User Interface) | Delivers a seamless and responsive trading experience across devices. | – React Native – Flutter – Swift (iOS) – Kotlin (Android) – Redux – Context API – WebSocket – GraphQL APIs – Chart.js – D3.js – Highcharts | – Cross-platform agility for faster launch – Real-time charts under 200ms latency – Premium native UI for high-speed trading |

| Backend (Trading Logic & Core) | Powers order execution Data management System performance | – Node.js – Python – PostgreSQL – MongoDB – Redis – RabbitMQ – Kafka – Microservice Architecture – REST – GraphQL APIs – AI and ML modules | – Modular microservices for scalability – 40% latency reduction with intelligent caching – Advanced AI-driven fraud detection |

| Infrastructure & DevOps | Ensures reliability Scalability 24/7 uptime | – AWS – Google Cloud – Microsoft Azure – Kubernetes – Docker – CDN – Jenkins – GitHub Actions – Elastic Stack – Grafana – Prometheus | – 99.98% uptime guarantee – Predictive monitoring and performance analytics – Auto-scaling for traffic surges |

| Market & Third-Party Integrations | Enhances app functionality through external ecosystem connectivity. | – Market Data Feeds

– Exchange APIs

– Payment Gateways

– CRM & Analytics

– Chat & Support

| – Modular integration architecture – Real-time pricing and trading capabilities – Scalable setup for future asset classes |

For any trading app to survive the scrutiny of global markets, compliance and cybersecurity must be built into its DNA.

| Focus area | Objective | Regulations | Compliance approach | Impact on cost |

| User Identity Verification | Prevent fraud and ensure user authenticity before account activation. | – KYC – AML – SEBI – FCA – CySEC Guidelines – PSD2 – MiFID II | – Integrated verification APIs

– Automated document validation with OCR & AI – Continuous risk profiling | Adds 10-15% to regulated trading app development cost. Depending on the region and the depth of compliance |

| Transaction & Payment Security | Safeguard user deposits and fund transfers. | – PCI DSS – PSD2 (Europe) – RBI Payment Compliance (India) | – Tokenized payment flows – AES-256 encryption – 3D Secure & biometric confirmation | Influences brokerage app development price. Ensures credibility with investors |

| Data Protection & Privacy | Comply with global privacy standards for user data handling. | – GDPR (Europe) – CCPA (US) – ISO 27001 – SOC 2 | – Encrypted data storage – Consent-driven data access – Regular vulnerability assessments | Slight increase in fintech app development cost. Ensures long-term scalability |

| Trading Authorization & Recordkeeping | Maintain transparent and auditable trade logs. | – MiFID II – SEC Regulations – ISO 22301 | – Immutable transaction records (blockchain-enabled) – Time-stamped audit trails – Admin dashboards for compliance reports | Moderate impact on trading platform development. Boosts platform reliability |

| Fraud Detection & Risk Mitigation | Detect suspicious activities and prevent insider trading or wash trades. | – Anti-Fraud Standards (ISO 37001) – SEC & FCA Monitoring Guidelines | – AI-driven anomaly detection – Continuous behavioral analytics – Transaction risk scoring models | Adds up to 5-7% in real-time trading app development, but reduces potential financial exposure |

| Disaster Recovery & Business Continuity | Ensure uptime and system integrity under stress conditions. | – ISO 22301 – ISO 27031 – Cloud Security Alliance Standards | – Multi-region cloud backups – Auto-failover systems – Disaster simulation testing | Minimal cost addition. High ROI in uptime and reliability |

When it comes to trading platforms, profitability is an architecture. Leading apps like eToro transform user activity into a sustainable revenue engine:

| Monetization Model | Revenue Stream Overview |

| Commissions | The platform earns from the bid-ask spread or trade execution fees. Even a 0.1% spread across high trading volumes scales rapidly. |

| Subscription Tiers | Offer premium memberships with advanced analytics. As well as lower fees or exclusive access to market insights. |

| Margin & Leveraged Products | Generate additional revenue through lending and leverage trading fees, popular among experienced traders. |

| Premium Social Features | Paid community access Mentorship programs Verified trader badges |

| Referral & Affiliate Programs | Expand the user base via influencers and referral partners. Reward them per funded account or trading volume. |

| Market Data Licensing | Sell anonymized, aggregated trading data to research firms or hedge funds. |

Convert even 10% of registered users into funded accounts. Your app begins generating exponential revenue within months. For example, a platform with 100K users and an average funded wallet of $500 could yield $2–3M in annualized trading spread income.

In fintech, every great opportunity comes wrapped in regulation, responsibility, and reputation risk.

Before launching your trading app, make sure you’ve ticked off every box below.

In a financial landscape where milliseconds determine millions, Techugo stands tall as a fintech app development leader, bridging innovation and scalability. With 10+ years of expertise and a robust global clientele, Techugo has architected cutting-edge financial management apps that power the new generation of digital investors.

Whether it’s designing a regulated trading ecosystem or integrating AI-driven analytics. Or maybe a social and peer-to-peer trading app. Techugo ensures every fintech product delivers security and speed.

Our fintech capabilities span:

The best proof of our impact lies in the success stories we’ve helped build. Powering financial transformation for both established giants and emerging innovators alike.

Bajaj Finserv Limited is one of India’s largest and most trusted financial conglomerates. They offer services across:

With a market capitalization exceeding $40 billion, Bajaj Finserv has become synonymous with India’s fintech revolution.

The challenge they faced before partnering with Techugo:

As Bajaj Finserv expanded its digital presence, it sought to modernize its legacy finance systems. Provide a seamless digital experience across its app ecosystem. The goal was to make financial services faster and accessible to all.

What Techugo offered:

Techugo built intelligent digital solutions that amplified customer engagement and operational efficiency. The collaboration included:

The impact:

Through its partnership with Techugo, Bajaj Finserv evolved from a traditional finance powerhouse to a fully digital-first fintech leader. Setting a benchmark for enterprise-grade innovation in the Indian financial sector.

Vidfin is India’s first video-based financial education platform. The platform blends finance with entertainment and technology. The platform offers investment tutorials to redefine how users understand money.

The challenge they faced before partnering with Techugo:

Vidfin wanted to build a subscription-based OTT platform exclusively for finance. With streaming capability and personalized recommendations. All while maintaining a premium user experience.

What Techugo offered:

Techugo engineered a full-stack fintech education ecosystem. Integrating high-end media tech with fintech functionality:

The outcome:

BookMyForex is India’s #1 foreign exchange and remittance marketplace. Founded in 2012, it’s the first-ever platform in India to provide:

With partnerships across leading banks like Yes Bank and Axis Bank, BookMyForex has become the most trusted name for currency exchange. It serves millions of travelers, students, and businesses.

The challenge they faced before partnering with Techugo:

The platform needed to enhance transaction speed. Ensure regulatory compliance. Deliver a mobile-first experience that could handle massive user traffic. All while integrating seamlessly with multiple banking APIs.

Solution built by Techugo

Techugo collaborated with BookMyForex to strengthen its digital infrastructure. Optimize user experience and boost conversion efficiency across mobile and web ecosystems.

Our solutions included:

The Impact:

The cost generally falls between $80,000 and $300,000+. A lean MVP starts lower, around $40,000–$65,000. This lets you validate your concept quickly. The final price changes based on key integrations and platform complexity. Partnering with a fintech expert like Techugo ensures you get maximum cost efficiency without sacrificing scalability or compliance.

You must blend social interaction with financial power. Key features are:

These features boost user engagement and trading success. Techugo integrates these best-in-class features while ensuring full financial compliance.

A full-featured trading app typically takes 5–7 months to develop. This depends on the project’s scope and technical complexity. You can launch a basic MVP in as little as 10–12 weeks to capture early market traction. The process includes:

Techugo uses agile development to ensure timely delivery and a high-performance backend.

The cost is influenced by several critical factors:

Techugo customizes every app for compliance and efficiency, making sure your investment is effective across all stages.

Yes, absolutely. Techugo specializes in social trading app development. We ensure your platform mirrors eToro’s successful social engagement model. We integrate AI analytics with secure APIs and regulatory frameworks. The result is an end-to-end trading ecosystem designed to outperform the market.

Yes, you do. Launching a trading app requires compliance with financial regulations. This depends on your target region. These regulations prevent fraud to protect users. Non-compliance can lead to heavy fines or platform suspension. Techugo’s fintech team assists with integrating essential KYC/AML protocols and secure data storage. Ensuring a smooth, legally sound launch.

A robust, modern tech foundation is essential for performance:

Yes. Techugo develops cross-platform trading ecosystems optimized for both mobile and web. Our goal is seamless accessibility. Traders can monitor markets and engage with peers across all devices without lag or security concerns. Techugo implements real-time synchronization and intuitive dashboards. This omnichannel approach maximizes user engagement and retention.

Maybe you’re envisioning a peer-to-peer investment ecosystem. Or a regulated trading app like eToro. Techugo transforms your concept into a high-performing, regulation-ready digital product.

From Bajaj Finserv’s digital evolution to BookMyForex’s forex revolution and Vidfin’s fintech education breakthrough, our expertise proves that we engineer financial ecosystems that engage and succeed.

Are you up to turn your trading vision into the next fintech success story?

Build your eToro-inspired trading platform to become faster and fully compliant.

Write Us

sales@techugo.comOr fill this form