2 Jun 2023

Encompass Mortgage Software: A Reliable Solution for Borrowers and Lenders!

Shivani Singh

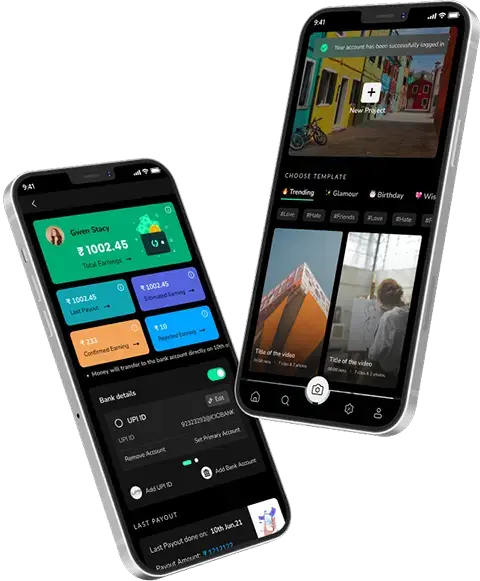

About the fintech industry, we only know that it lets us manage money transfers, deposits, and online payments with some taps and clicks on our smartphones and streamline how we perform these activities conventionally.

However, that’s not the only mesmerizing thing about fintech because tools like Encompass mortgage software have come to maximize our reliance on digital solutions offered by the industry.

If you’re in the loan business, you’re probably familiar with the Encompass banking software. Well, this guide is elaborated on the same.

So, let’s jump directly into this and learn why Encompass mortgage software integration is suitable for your business needs and how you can build it with the assistance of a top mobile app development company in USA.

What is Encompass Mortgage Software?

Encompass is the most recognized loan origination system in the fintech industry, providing lenders of every size with access to derive and close more loans in less time worldwide. It offers tremendous borrower experience using intelligent automation and AI technology.

Also, it has next-generation data security and built-in compliance paperless document management that ensures protection to lenders and borrowers. Through Encompass, the loan officer and underwriter can track loan applications and utilize automation for loan underwriting tasks within seconds.

What’s more interesting is that the digital solution can let users archive all loan files and track the closed ones. Even it gets easier for firms to audit existing loans, send automated emails to stakeholders, and consider the compliance management system. That’s not it, but other features like loan appraisal, document management, refinancing, risk management, third-party documentation, and an integrated pricing engine make it a reliable solution for lenders and borrowers.

Business Benefits of Investing in Encompass Mortgage Software

Now, let’s take a ride into the dynamic benefits this software category provides to businesses of all sizes.

- Ancillary servicing and accounting system integration

- Delivery models such as onshore, near-shore, best shore

- Enhanced system optimization and performance

- Decreased data entry and increased automation

- Personalized end-user and system administrator training

- Multi-tier governance model with senior leadership commitment

- Automation in delivery to investors

- Scale & agility with the right team of developers

- Cost Optimization & Effectiveness

- Better operational efficiencies through processes streamlining

- Enhanced compliance and quality assurance

That’s not it!

There are many more benefits of investing or building your own encompass mortgage software; connect with a leading mobile app development company to get a complete insight into the same.

How to Develop the Encompass Mortgage Software?

To initiate the development of encompassing mortgage software, you should consider these essential steps;

1. Generate your Software Idea

You must move to the next step if you already have decided to create an encompass mortgage software with a handful of good techniques that will make it a hit and help you gain the competitive edge.

2. Conduct Market Analysis

Once you have a software idea, it’s time to move forward and conduct a market analysis to uncover what the audience wants and needs. For that, ensure to learn about your competitors on these criteria while creating a spreadsheet that tracks:

- Feature set

- Monetization scheme

- Last Updated

- Ratings and Reviews

- Downloads

3. Determine Software Features

This stage lets you decide on the core features of the software based on the market analysis you did earlier. You can have everything on paper and add more modifications to it to breathe some life into it. For Encompass loan software, here is a list of all features that you should consider instead of the basic ones:

- Document Management

- Internal Audit Features

- Custom Workflows

- Integrated Pricing Engines

- Loan Tracking

- Risk Management Functionality

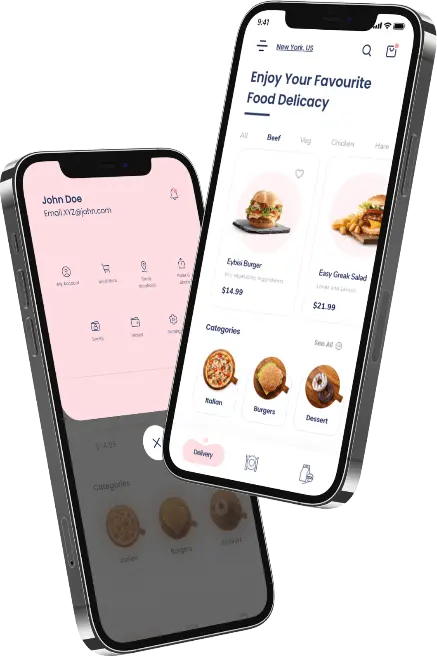

4. Create Design Mockups

Design mockups will let you understand how your software will look to users. It must be interactive and intuitive; for that, a rough sketch can prove to be a perfect match. Start with the central section, and then move towards the navigations within your software. Ensure that the navigation feels intuitive and natural, bringing you closer to your targeted audience.

5. Prepare Software Design

Now the design mockups are ready, create your software just like you imagined while connecting with the UI/UX team. The right team of tech experts will bring everything in front, so connect with them and customize your software just like you want.

6. Design Marketing Plan

To let your software attract your end users, you must adopt a marketing plan. Building a landing page for your audience, a press release, emailing the pre-launch, and documenting your journey are exciting ways to let your audience know more about your software and market your products and services.

Also Read – Content Marketing: A Remarkable Lead Generation Theory

7. Build Software

You can now bring your software idea to life while connecting with the best app development company today. The right developers ensure support & maintenance even after the software is live for a specific period. So, ensure to find a company that is experienced and provides exciting services for your robust builds.

How can Techugo help you build your Encompass Mortgage Software?

If you are thinking about how we can help you develop your robust encompass mortgage software, this section is a must-read. Not only we can develop a customized product for you, but also let you boost your business productivity while integrating the enhanced automation. Here are various benefits you can achieve while considering our services and association.

1. AI-Powered Technology

We create robust solutions using AI technology that lets mortgage lenders seamlessly manage the operation. For decision-making, problem-solving, and market prediction like challenges, all you need is the integration of this robust tech into your Encompass mortgage software.

Also Read – How does an Artificial Intelligence App add Great Potential to your Business?

2. Cloud-based Software

Even our top-notch developers can build a cloud-based system that allows mortgage lenders to run loan origination worldwide, thus improving efficiency like never before.

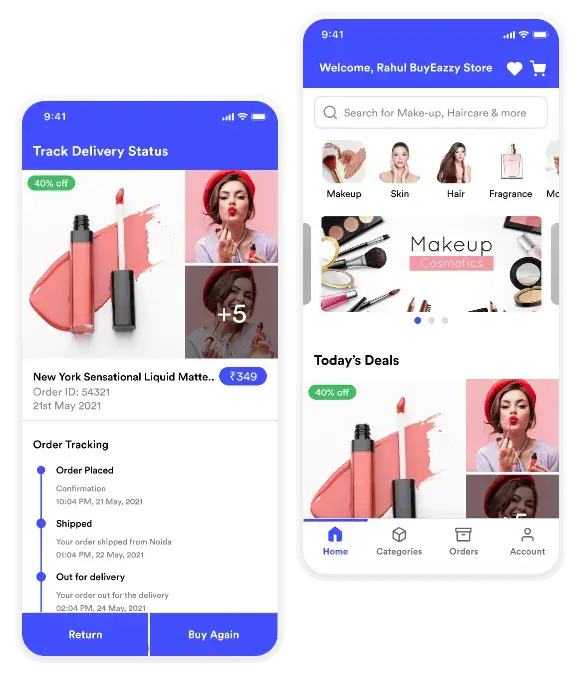

3. Platform Customization

To let you meet your business-specific needs and requirements, we customize your app and contribute our effort for improved performance management, seamless digital collaboration, and document management.

How much does it Cost to Develop Encompass Mortgage Software?

It’s not easy to tell you the Encompass mortgage software cost as it depends on various factors. Therefore, one needs to figure out the factors to find the cost of developing an app or software. Such as:

1. Type of Software Project

From new software development, software modification, software integration, and web development, you need to choose the best one that fits your business goals. As you want to create your own Encompass banking software, new software development would be a better approach for you.

2. Size of Software Project

What will be the size of your software project, small, medium, large, and enterprise? You need to decide on this, too, according to your business requirements, goals, and objectives. Ensure that different project roles consume different time intervals to provide you with a robust build.

3. Development Team Size

While a small project requires one or more developers, a mid-sized project requires project managers and the complex one needs a whole team of developers, QA specialists, and a project manager. So, choose your development team wisely according to your budget and organizational goals because it will also impact the Encompass software cost.

Let’s Build your Encompass Mortgage Software!

Now that you have grasped a lot about the Encompass mortgage software, it’s time to build the one while associating with the right app development company like Techugo.

Not just we help you with our expertise but also in some more unique ways through which you can facilitate your growth in the market.

So, what are you waiting for?

Book a consultation today and get started with an innovative plan.

FAQs:

How does the Encompass mortgage software work?

Encompass loan software is here to streamline a loan’s application, operation, and closing stages. Using a centralized platform, it manages everything from gathering application information to finalizing the loan. For every aspect of the loan origination process, you can trust Encompass mortgage software.

Is the Encompass loan software compliant with laws and regulations?

Yes, the Encompass mortgage software complies with privacy laws and regulations. Even the integration of AI technology within the software ensures privacy and data security.

How does Encompass loan software help a business?

Not only the features within the software let businesses achieve enhanced visibility, efficient origination process, improved security, and compliance, but also various other benefits.

Is it possible to integrate the Encompass mortgage software with third-party systems?

Yes, it is!

Accounting software, credit reporting agencies, pricing engines, title companies, document management systems, compliance management software, e-signature solutions, and servicing platforms are various third-party systems that can seamlessly integrate the Encompass mortgage software. However, depending on the requirements of the business, the integration can vary.

What kind of AI technologies do you integrate into the Encompass software mortgage?

Techugo, a leading fintech app development company, can integrate AI technology in different ways into the Encompass banking software, such as predictive analysis, natural language processing, and machine learning.

Does AI enhance the way loan originates in Encompass mortgage software?

Yes, AI improves loan origination by automating manual processes, minimizing errors, and analyzing data for better decision-making.

Get in touch.

Write Us

sales@techugo.comOr fill this form